Markets Follow...They Do Not Lead

“Davidson” submits:

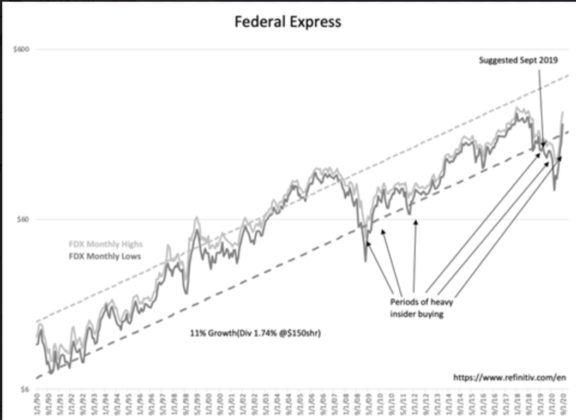

It never gets old when the classic investment assumptions are so thoroughly debunked by reports such as this one on Federal Express (FDX). In the middle of the COVID-19 FDX prices had declined below $90shr on dire forecasts of economic value destruction of this company which is central to the functioning of the US economy. Only now with FDX priced at $255shr, nearly 300% higher than its March 2020 lows, does Wall Street suddenly realize after its 1Q21 Earnings Report that management has weathered a difficult period successfully. As an example of Wall Street following not leading, FDX is one of many well-managed companies that standout.

Markets follow. THEY DO NOT LEAD!!

In my experience, the better approach is to identify well-managed companies and buy them when priced at historical discounts to management’s historical financial performance and sell them when priced at historical extremes. It is an approach that works over longer-terms often taking holding periods of several years. This is using a Value Investor approach when adding investment positions and a Momentum Investor approach when removing positions. The Value Investor approach does not explicitly state the importance of understanding the quality of the management team in assessing the historical financial record but doing this well is the ‘secret sauce’.

FedEx soars as analysts back near-term story after earnings topper

About: FedEx Corporation (FDX)|

“We believe the company is well-positioned for a multi-year run of strong earnings growth,” he adds.

Also on Wall Street: Cowen hikes its price target to $290.

Shares of FedEx are up 9.27% premarket to $259.50.”

(Click on image to enlarge)

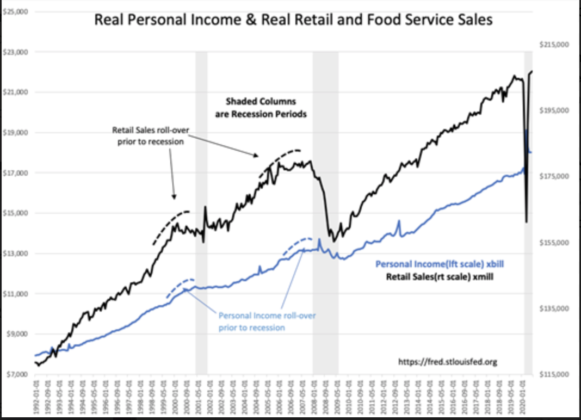

Retail Sales reported this morning reached an all-time high. Several indicators have been early at reflecting rapid recovery from the COVID19 shutdown with Retail Sales being one. Market commentary persists in its disbelief of economic progress stressing negatives which the data cannot justify. This has always led to the types of surprises presented by FDX and higher equity prices.

The markets represent a dysfunctional view of current activity in my perspective. Perhaps 3doz issues are favored by the bulk of investors on continued COVID-19 issues, while the pace of economic activity favors all other issues. Investors should continue to focus on well-managed companies priced at discounts to historical financial metrics. Insider buying by these management teams provides useful guides as to which issues deserve attention.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests ...

more