Market Model Review - Monday, Oct. 18

The onset of earnings season appears to have energized the bulls as the S&P 500 finished the week closer to all-time highs than the recent lows. To be sure, the major indices remain entrenched in a trading range. But with some good news on the economic front (Core PPI was reported below consensus and retail sales came in well above expectations), COVID cases continuing to trend lower, and big bank earnings suggesting the economy is doing just fine, thank you, it can be argued that the correction may be nearing an end. However, rising rates and oil prices may provide the bears with a counter. We shall see who comes out on top this week.

Now let's get the new week started with a review the "state of the market" from a modeling perspective...

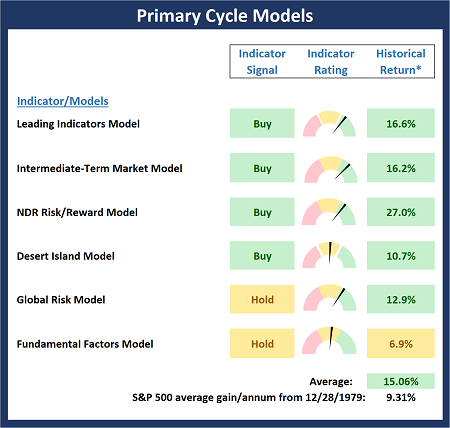

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

The Primary Cycle Board sports modest improvement once again this week as the Leading Indicators and Intermediate-Term Market models upticked a bit, pushing the hypothetical historical return of the S&P 500 when the indicators are in their current modes up to 15.06% from 12.08%. Bottom Line: Our big-picture market models tell me to continue to favor the bulls.

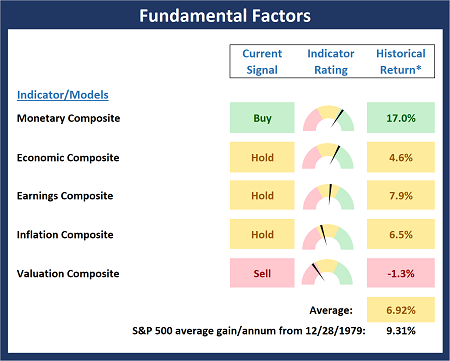

The Fundamental Backdrop

Next, we review the market's fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There was no change to the Fundamental Board this week. My take is the board reminds us that while the bulls remain in control, this is not a low-risk environment. The bottom line is there are "issues" with several models such as valuations.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market's trend.

Current Take: Trend Models

A couple of the Trend Board components flip-flopped from last week as the Short-Term Channel System moved from buy to hold while the Intermediate-Term Trend Model upticked to positive from neutral. Bottom Line: The board indicates the bulls are gaining ground on their opponents.

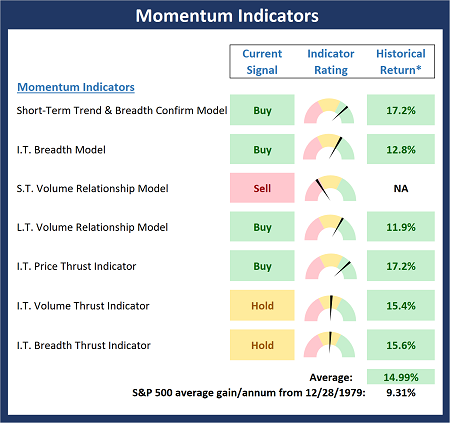

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any "oomph" behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

The Momentum Board saw marked improvement this week as the Short-Term Trend & Breadth model moved to a buy signal and two of the Thrust indicators moved up from the negative zone. Bottom Line: The board suggests the bulls have a chance to take control.

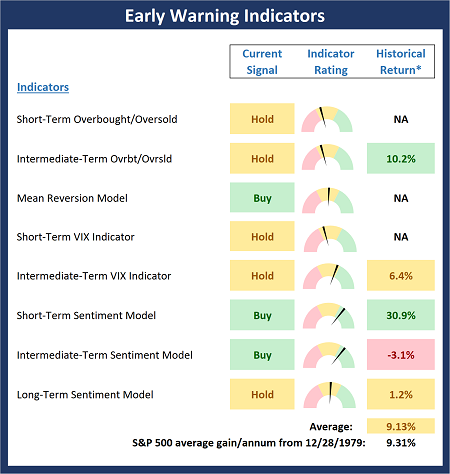

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

Last week we noted the Early Warning Board suggested the bulls had the edge from a near-term perspective, which proved to be a valuable hint about the week ahead. But with the oversold condition now abating, the board has become more neutral.

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should ...

more