Market Leadership Shifts As Growth Gap Widens (Plexus Corp)

The Broad Market Index was down 0.77% last week and 72% of stocks outperformed the index. It was a light week for financial statement updates from the third quarter with only 61 companies reporting; lifting the update to 91% complete. These are mostly companies with fiscal years ended September (annual financial statements have a later filing deadline). Still to be seen is the larger population of companies with fiscal quarters ended October and they (mostly retailers) will report financial statements in the next two weeks.

Evidence is accumulating that we are in a growth leadership shift as industrial companies record improvements and technology companies record declines in growth. The growth gap between industrial (and commodity) companies and technology companies has widened to the largest ever.

The virus has exaggerated both sector trends and pushed many companies into insolvency. Emergency cost-cutting responses are very frequent now and especially among stressed companies. By sharply reducing costs and capital expenditures these stressed companies are adding to the economic and labor force weakness.

Higher Market Volatility Awaits

The effect of this leadership shift with companies in crisis mode is overall reduced capacity both existing and planned. Those decisions also extend the time required to recover capacity so that when demand recovers with capacity reduced, commodity prices will move up. Keep in mind, it is very early in the cycle trough and shares are broadly extended now. Historically, cycle troughs are associated with higher market volatility. Stay tuned as there will be plenty of future opportunities to identify the stronger companies.

Risk-Taking As Asset Values Increase

Meanwhile, there has been a substantial increase in risk-taking as the huge increase in asset values (and the associated decrease in interest rates to new historical lows) has pushed back bad memories. Sales of houses and autos are high and rising. These trends are now unusually extended and both greatly exaggerated by the virus.

There is plenty of uncertainly both short term (post-vaccine recovery) and long term (reversal of 30 years of money stimulus) that will make markets very volatile as we trace out the current downtrend.

Keep a healthy cash position and avoid the weak companies that will not survive the downturn. Premium share prices are more common in this group now. Review your portfolio holdings; sell falling growth companies particularly those with weak financial condition and search for companies like Plexus Corp exhibiting a fundamental buy pattern.

How to Spot a Winner!

A quality buy pattern requires:

- Higher sales growth

- Low & rising gross margin

- High & rising cash flow growth

- High & flat to falling SG&A and interest costs

- Falling inventories & receivables turnover

Plexus Corp $74.020 Buy This Rich Company Getting Better

Plexus Corp. (Nasdaq: PLXS) has been an exceptionally profitable company with a persistently high cash return on total capital of 15.8% on average over the past 21 years. Over the long term the shares of Plexus Corp have advanced by 3% relative to the broad market index.

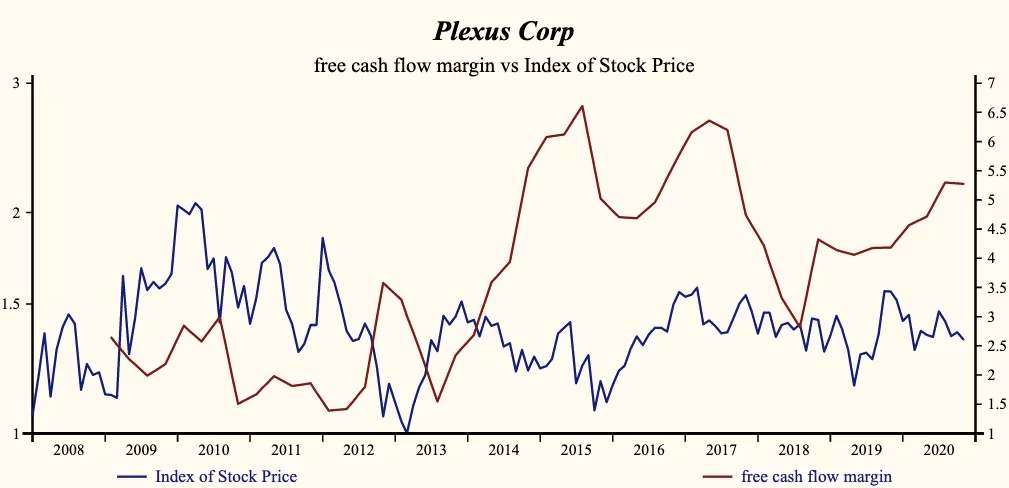

The shares have been highly correlated with trends in Growth Factors. A dominant factor in the Growth group is the free cash flow margin which has been highly correlated with the share price with a one-quarter lead.

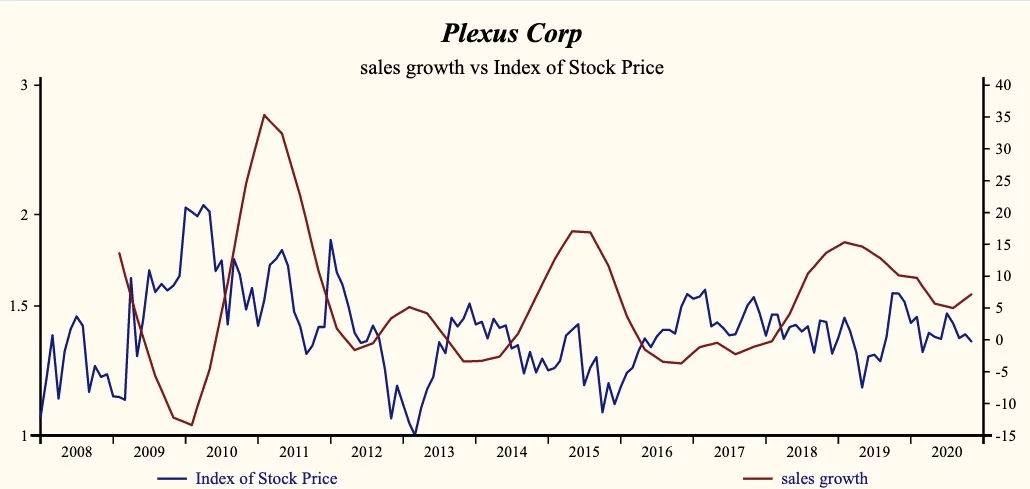

Currently, sales growth is 7.1% which is higher than the long-term record average and higher than last quarter. Receivable turnover has remained steady reflecting a strong quality of sales.

Superior Quality Growth Trend

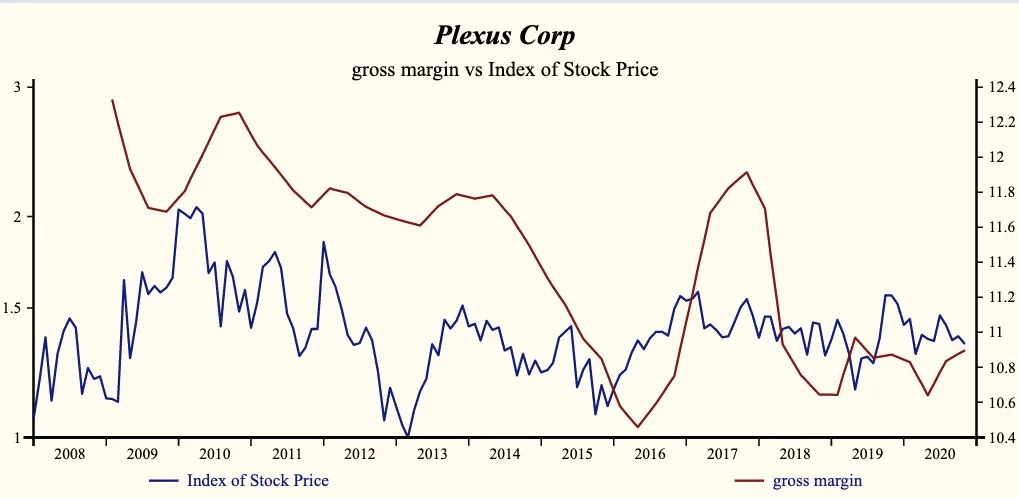

The company is recording a low and rising gross profit margin. Inventory turnover has stabilized over the past 3 quarters which indicates that products are not sitting on the shelf. Sales, General & Administrative (SG&A) expenses are low in the record of the company and falling. SG&A expenses are falling at a more rapid rate than the gross margin producing a rising profit margin or (EBITDA margin). Free cash flow growth mildly down ticked last quarter but remains around its highest level since 2017.

More recently, the shares of Plexus Corp have advanced by 6% since the most recent May 2019 low. The shares are trading at upper-end of the volatility range in an 18-month rising relative share price trend.

Despite the extended share price, this provides a good opportunity to buy the shares of this evidently accelerating company.

Disclaimer: This article is not an investment recommendation, Please see our disclaimer - Get our 10 ...

more