Market Briefing For Wednesday, June 13

The Status Quo Is Over - or so it seems; whether in geopolitics (with by the way an indirect message conveyed to Iran by virtual of the historic and much debated Singapore deal with North Korea), or in the Trade realm.

A multiplicity of issues confronting the world just now have barely moved the markets; which has been shuffling around amidst the preamble to the Summit; the fallout from Quebec's G7 gathering; and shouting matches so beyond-the-pale, that I suspect might have contributed to Larry Kudlow's heart attack.

Last night I said 'shame' on Peter Navarro for the terminology he used in reference to Canadian Prime Minister Trudeau (even Trump in this case was respectful by comparison); and at least he apologized for that today. Knowing Larry Kudlow has worked on both sides of the aisle and on Wall Street, with an internationalist tone by the way, I suspected his stress may have been pushed over the edge by Navarrow who is more isolationist in the opinion of many; and certainly less polished in his phraseology.

Now that everyone tries to ascertain where 'Kim Jung Un's head' really is, we can move on to the Fed Meeting or maybe reconciliation with Canada. A lot of political capital was spent both unwinding our trading relationships (in hopes they actually don't unwind); and on motivating North Korea quite frankly to realize they had a choice of 'peace or war', not more intimidation such as they practiced (and bamboozled) through many Administrations of both political parties for decades.

Trump got him in a room (or the reverse if you believe it was more setting a 'floor' that sustains the Kim dynasty.. with his sister in the wings..) with a legitimacy they never had before). I don't believe President Trump has an ulterior motive with North Korea; and really view his reference within a key speech in Singapore to introducing 'commerce' as part of the solution.

The naysayers will point to Trump's iPad displaying condos and hotels that could be built on beaches in the North; and why not. Just to survive, North Korea has gradually allowed some 'commerce', but nothing like China's as they stick closely to failed Stalinist-era economic designs. Trump knows of course real estate, and Kim did walk through a hotel-CASINO on his very surprising (to the gamblers and guests) walking tour the night before. So I don't find it odd at all that Kim would see the virtues of 'commerce' as the solution to a lot of problems. Making jokes about building a 'Trump Tower' in Pyongyang is cute; but the reality is that's just fine and the Trump group should not be criticized if (years from now) one actually materializes.

Shorter-term a lot more has to materialize, starting with a schedule for the efforts to denuclearize the Korean Peninsula, with many variables. Sure, Trump is quite the character, and he might be played by Kim here, but we really are finally doing 'something' and whether it's financial reform, peace in Asia, and coming efforts to fix the Iranian mess; it's more than what has transpired in the past. Again, a business-like approach too many disdain.

Bottom line: the Summit was a superficial success; with the outcome still a long process that we'll monitor of course. However it is as we suspected (just from North Korean TV covering it 'live', which is unprecedented, you just knew it would be hailed as successful), and can now 'sort of' move off the front-burner as far the stock market is concerned (barring surprises).

On Canada, while too many are apologists, and the language was foul; it's true that our allies have become too accustomed to putting tariffs on some of our products, while comparable exports of theirs aren't taxed. This has to change, and continues being worked-on. Navarro might not be the guy to handle relations with anyone after his display on the weekend however.

And meanwhile Larry Kudlow thankfully is recovering; hopefully fully.

The Antitrust guys aren't recovering; so lets hope they don't try to 'stay' the long contested, and now-approved (unconditionally at that) huge merger of AT&T (T) with Time Warner (TWX). If not blocked it will close by the 20th. I need not remind members that I avoided new purchases of AT&T near 40 and in the very low 30's had singled-out AT&T in several comments as a decent (relatively safe compared to others) investment. I mentioned it at the Las Vegas Money show and video interview there as well. Yes it's a couple points higher; but as the 'arb' boys lean on it, it's again attractive.

My point was primarily related to the low multiple and (hopefully retained in the present competitive era of cannibalizing DirecTV satellite business) by it's sibling DirecTVNOW streaming service, in-order to capture share in the forward-looking content-distribution realm, also known as 'OTT', or internet 'over-the-top' broadcasting. The 'vertically integrated' merger with TWX will enhance their presence; and might even evolve the face of CNN one day.

Conclusion: AT&T moved up a couple points in the wake of my favorable recent mentions; and now will retreat, due to the 'arbitrage' aspects of the deal of course (that's why it's down in after-market trade and Time Warner is up a few points). Let's see where AT&T 'settles.'

My primary 'view' is the affording of a higher multiple as the combined new AT&T becomes viewed as a 'media' or more a technology company, rather than priced as a 'telecom', which would over the next few years perhaps warrant a higher multiple. I said I'd like it, merger approved or not; but for sure better with approval. If they have to cut the dividend in the process of the evolution; so be it (I hope not). However if that happens and it shakes out, that would be another buying opportunity; but let's deal with it should it actually occur. Otherwise it's simply a hold and buy on weakness. I think it has been a good example of how I feel about some core holdings; liked it a lot back in the wake of the 'Epic Debacle' a decade ago; not at 40; and again in the high 20's or low 30's. I tend to get less enthusiastic as a stock gets more expensive; which seems to be a good discipline while holding.

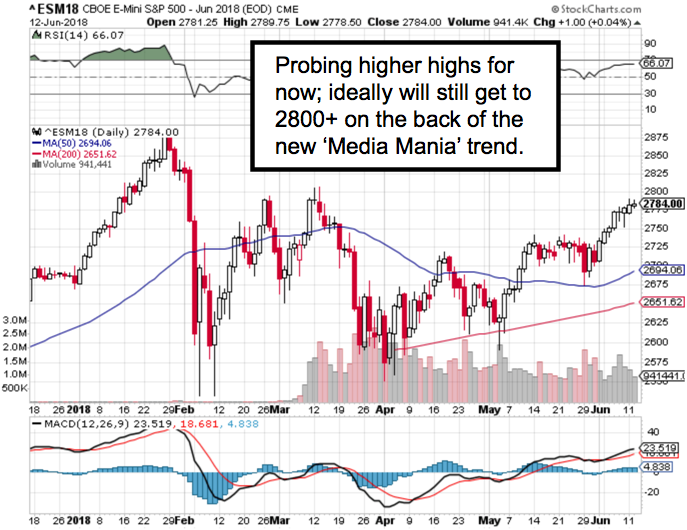

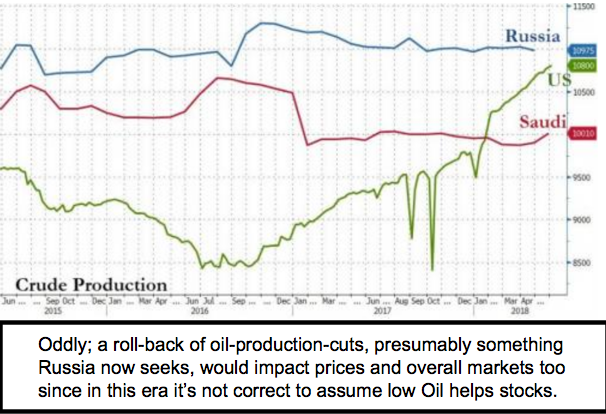

In sum: S&P now awaits an FOMC rate decision Wednesday. Expect a Quarter-Point rate 'hike' ideally; even if a lot of folks believe it's unjustified. Remain nimble and flexible, not getting excited about all the talk of a 'media-based' rush to incredible heights. For sure you'll see more consolidations and mergers in the field (starting with Comcast / Disney / FOX efforts presumably); but that won't levitate overall broad markets too much. It does excite Wall Street, because it very simply means new 'deals' coming (hence investment banking / legal business). The one outsider for now is CBS because of the wrangling with the Redstone family, which has kept full control away from Viacom. While I don't see traditional media as a glamorous target like the old days, it still matters. And CBS 'All Access' is, in my view, a stop-gap approach trying to get more revenues than contract negotiations with OTT distributors have offered so far.

Stay tuned for a potentially wild ride Wednesday but again don't assume a conclusion in the direction of the initial response to Fed action.