Market Briefing For Tuesday, May 19

Overcompensation by the Fed for being an economic backstop helped, but that's pretty much already known (as well as their warnings of problems ahead, which is being discounted by markets), while clearly vaccine news, along with new therapeutics (we had both Monday Morning) has been my focus as 'key' to this market for actually several months at this point.

This goes beyond my saying that 'wherever the S&P is at when good news hits, it will soar', although that's what it did. You had an important revelation that the Moderna (MRNA) vaccine was triggering 'as high or higher' antibody levels in the 45 initial subjects (not merely a group of 8 that some media suggests as they try to tone-down the significance of this legitimate vaccine prospect at least as it stands now), and they they will do 'directly' to Phase III (that's as important as anything because it expedites probable progress now).

(Good vaccine reports, always question thrusts by this or most biotech's.)

The good news is across multiple vaccine candidates, multiple products as I wrote about last week (and the weekend report mentioning Moderna first incidentally), and importantly therapeutic treatments that I anticipate really arriving on the scene by the middle of 'this' Summer; not simple later-on.

It might be any of several clinical manifestations of 'cocktails' involving just plasma-derived antibodies; or other combinations (Solerna is one also now proclaiming a useful intervention for symptomatic but not yet-hospitalized patients). Combine all this and again you see why we allowed for set-backs from extended price levels (still do periodically) but are unwilling to fade or short this market (have not at all), because of our optimism that we'd get a key news item that confirms my belief that we were (and are) closer to the first of probably several viable vaccines that will provide sufficient immunity for 'life' to move toward a variation of normal, but hopefully with prudence.

That latter is relevant, because (as you saw today), airlines and cruise ship stocks ran-up right away, 'as if' everybody's going to start flying. Actually.. a surprise .. yes they are, but not immediately.

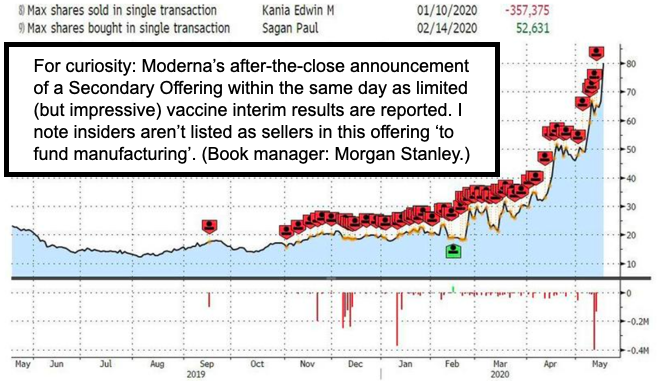

After the close Moderna announced a fairly large approximately 1.5 Billion Dollar Secondary Offering; so that should temporarily be dilutive. I ponder if that's a more effective way to develop, as opposed to capital from partners or the Government. And since several larger manufacturers are working on projects with them (Merck (MRK) and Astra Zeneca (AZN) included), I don't see reason for this, but again that management has their reasons (and I won't belittle that at all, since they have this vaccine, despite success and high salaries already achieved). This and the antibody speculative stocks generally are all either in-play, overpriced or already down; it's a tough area to trade.

In-sum: great accomplishment and the market responded as felt it would if a vaccine (or soon enough a therapeutic drug or cocktail is affirmed), and it becomes a renewed upside, subject to partial correction now (and insider profit-taking?), but not extremely overpriced as so many of the hedge guys contend, although that's hard to say as the idea was that vaccines are not intended to be huge profit-centers. Well this one just become one, for those already in. Doesn't mean it can't go higher, but feels like a cashing-out, but many of the insiders in biotech are infamously famous for doing just that.

Also.. rallies by the collections of airlines, hotels, cruise ships, oils and so on, that advanced today, well it tells you not just that the market pulls a rally out of thin air (that was what they said about the Fed Chairman and it applies more to the helicopter money than the stock market today) ... it tells you that the market is both aspirational and anticipates what we all want, a relief from the chaos that is Covid-19.

So many (as I noted last week) 'value stocks' were under-performing S&P, that just lifting Oils and Banks a bit could ignite a move. That's been core to my argument last week, that there's correction risk, but not collapse or any of the myriad of arguments related to actual economics. That already was 'in' the market, and represented by the forecast 'crash of 2020' earlier.

Bottom-line: the entire move off the March 'Inger Bottom' lows was both an automatic rally first of all, and then anticipation of partial recovery. Yes I agree with Chairman Powell that it will take 'time' for recovery. What a large part of the skeptics miss is: a bulk of stocks actually topped maybe as early as Spring of 2018, when we called for a rotational correction, and while the average stock came back somewhat, and the S&P rebounded as forecast for 2019 (from the Christmas low preceding), most smaller stocks are not priced for perfection.

Of course the super-cap stocks are the one extended and priced for not mere per, but a return to global growth. Hence: bifurcated market. I think this broad assumption that this is merely short-covering or wishful thinking, I disagree. It was a market waiting for good news and hanging-out in the 50-200 Daily Moving Average trading range. That does not mean it's not going to do much more (for now) than what I suggested weeks ago; a push toward S&P 3000, maybe 3100, but not much more for now.

All this came on-the-heels of the Fed Chairman's comments, and 'if' this is as suspected available later 'this' year (as my optimistic stance suggested), then we're not getting ahead of ourselves thinking the 3rd and 4th Quarter can reflect recovery. And that minimizes the duration of 'struggling', but of course the big Bears have been betting against America, probably without the realization that they were or are. Stocks are expensive but valuations are 'not' as extreme as some of the money managers suggested last week and as I discussed already, the super-caps were the only expensive ones.

Speaking of the Fed: Chairman Powell and Tresasury Secretary Mnuchin will be testifying tomorrow as to 'why' so little of the small business funds approved in March have yet to be allocated or spent. Might be interesting.

Market, down early due to numerous secondaries after-the-close, and as a concern about another 'Covid wave' in China, perhaps dampening demand for Oil, which has been picking-up.