Market Briefing For Thursday, Jan. 30

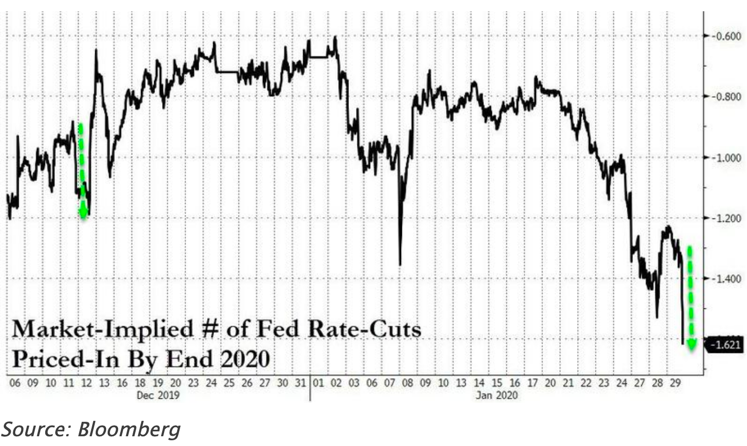

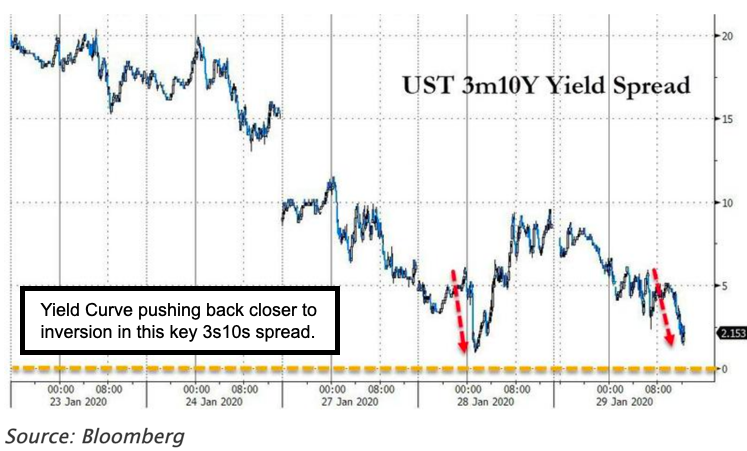

Beating around the bush with candor - after the dovish Fed statement, Chairman Powell tried not to be backed into a corner about 'reserve levels', liquidity injections, or their plan to start bringing things into balance later in the year (perhaps from April forward, though that may be optimistic).

Clearly the Fed wants to make it all seem 'administrative' in general, vs. a hands-on series of moves by the Open Market Committee, but again that is probably wishful thinking. The most one can draw out of it is generally, or as suspected, a Fed trying to remain accommodative, not rock the rate boat excessively, and probably not retreat as they already would have we think desired (they said so too, and now just say fewer interventions while ready to do so depending on conditions).

This was a very carefully balanced commentary with a focus on 2% rates of inflation; not 'near' as they said before, but 'to' the 2% level. Well even that requires growth which continues elusive with more unknowns related to the Chinese epidemic, and the lack of their contribution and timing of a recovery, fairly unknown, and the Chairman was clear about that while he emphasized that about 85% of the U.S. economy is unrelated to trade (I'd not question that because its always been 70% or more).

(Virus cases have increased by about 50% since this graphic.)

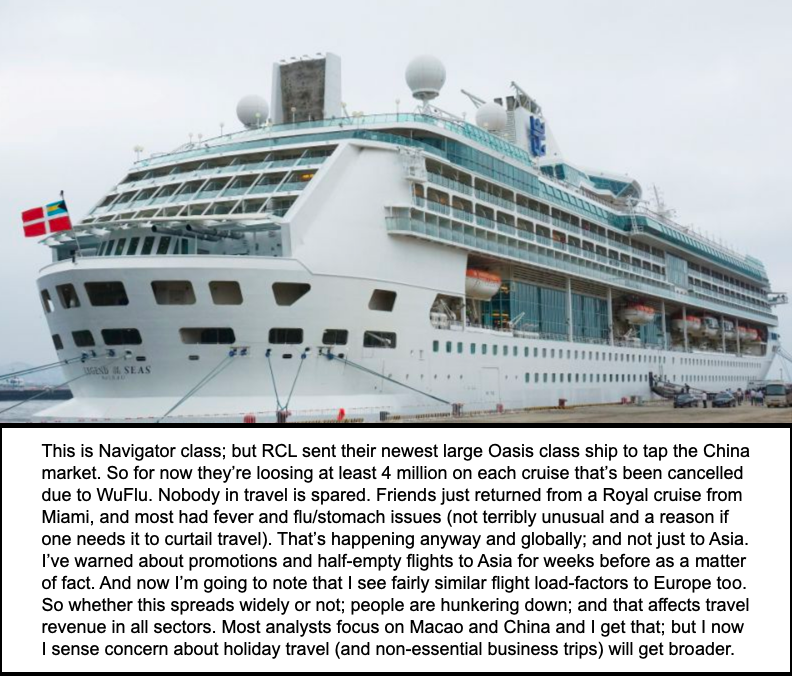

If earnings are taking center-stage in the market, for now, that's benign in a sense, given how the major Indexes and key stocks already are. In that respect there's more prospect for accidents than victorious romps, as we look forward to February trading, a time-frame I've thought particularly vulnerable, and additionally sensitive (in either direction) to WuFlu news.

In-sum: we believed (and still do) that the market, or at least the S&P, is fairly exhausted with regard to upside activity, after a moderate rebound in stock more mundane than the momentum leaders, as 2020 began.

So yes despite the short-term 'rock & roll' related to the viral scare (and it matters for sure), and even rebounds should it miraculously be contained faster than most responsible folks believe likely.. despite all that.. we see the S&P nearer-term prospects pointing to at least a 'sag' yet-ahead.

Turnover is amazing, so the different reactions to Facebook and Tesla sort of reflect that today, although Apple remains the market key. There's little doubt that this is stretched, and it's because the market is dominated by ETF and 'passive' approaches that you even have the Indexes holding as well as they are.

Overall S&P bounced off the minimal retrenchment levels as we envision more downside as we move into February. We doubt earnings will really hold markets, so Facebook is defensive for a few reasons, while Tesla ran lots of short-sellers, that's for sure. The market is acting spiky.