Market Briefing For Thursday, Jan. 24

Shifts in production 'and' investment going forward, may inextricably be moving away from China; almost regardless of how 'good' a 'trade deal' may be negotiated between Beijing and Washington. There is rising awareness, I think years beyond our early warnings about 'Intellectual Property theft', that may restrain not so much production alone; but enhance investment in 'free' world areas. And there's the brewing revelations about 'Confucius Centers' at major universities, that may have censored 'academic free speech' on all topics the Chinese Government didn't like, like Taiwan or the Dali Lama. As it appears less so from the $4 million grant to Stanford; more so to the Univ. of Maryland, which is refusing essentially an audit of their Center's funding.

I actually suspect President Xi of China is aware of this 'influence education' issue; as well as the slowing economy (hence more unemployed coming as they trim the military's size); and need to stop corruption. He recognized this indirectly with his unprecedented introspective speech yesterday I noted, as it was about 'shortcomings' and corruption 'within' the Chinese Communist Party. That was what I'll call a top-down sort of 'drain the swamp' message, with (as sayings go lately) Chinese characteristics.

As they 'drain the rice paddies', the winds from the Gobi Desert have tended to blow towards India for production; and towards the EU (even Israel) with respect to technology development. (Ironically, even China has tried making technology investments in Israel, and has been rebuffed in some cases.) I'm thinking one reason (besides security issues such as with their 'ports', might relate to concern about IP theft, and no way does the country that invented the Quad-core chip for Intel, or much of today's cyber-security technology, in any way want this compromised by invited the dragon into their lair. Is this all paranoia? Some of it is over-the-top and that's what Trump and Xi must together get a handle on, before it gets out-of-control.

Daily action - was pretty dramatic, in terms of the expected up-down-up pattern; and correlated with Oil, though that was more coincidental. No new developments with regard to China; although the sensitivity is clear.

The longer the market can work sideways in our rebound target 'congestion' zone in the S&P 2600's, the better chances are for a pop to at least slightly higher highs on a China Deal; and that would be a safer spot to fade market recovery. Although if it rotates down, led by weakening FANG's; so be it. On a short term basis it got pretty overbought; it's just that everybody gravitated to our view about the S&P 2600 area; hence it's not so easy to break it. And although there's a case to be made for higher prices, you don't really have a monetary backdrop that supports any sort of Fed 'subsidy' in-essence.

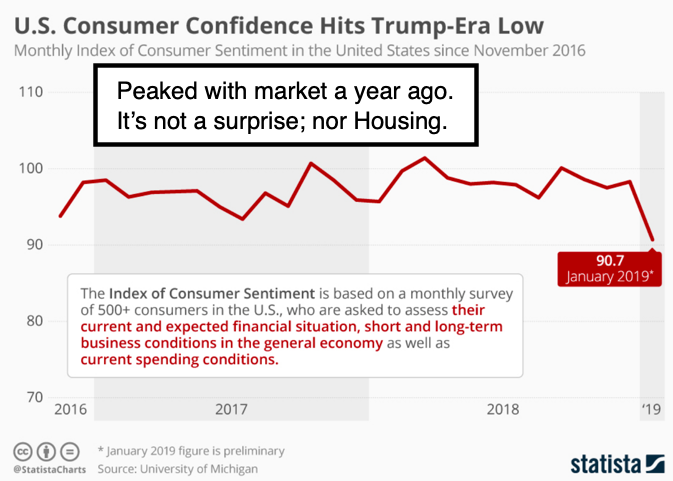

Also, the longer tensions in Washington delay an end to the Shutdown; the more it risks a heavier impact both on sentiment; on GDP, and on outcomes of a political nature. It's really something the overwhelming majority of likely all Americans would like to see ended quickly. The 'State of Disarray' is just unacceptable. To hear that the White House is 'drafting' (OMB) requests to Departments to ask what happens if this extends into March, is posturing I suspect, and a part of the President's nature of dealing. It's bluster and this is not something to be taken lightly; nor can we endure this into March.