Market Briefing For Thursday, Dec. 17

A waiting game . . . is what the Fed is engaged in for now, and apparently for the next few months, based on the Chairman's reflections that I'll comment on a bit more. Clearly failure of Congress to come-together with a 'relief' package would prompt even more (desperate?) action on the part of the Fed.

As it is, they continue printing money, and essentially contribute to 'real' rates being negative at this point, which while not in-itself endearing to bankers, for sure means companies (like our AT&T (T) with it's heavy debt they're whittling off from the Time Warner acquisition) don't have much worry in terms of carrying costs of their debt.

That allows expectations of keeping the stock market more or less in a 'warm' situation, so you can get shakeouts, or even a correction, but no catastrophe, of course barring an exogenous event, or so-called 'Black Swan', swooping-in to disrupt the dynamics. The grand-scale cyber-attack was a potential terribly disruptive event, but either 'they' have control of it, or are minimizing what has been shared with the public, because so far it's not really influencing markets.

As I noted yesterday, an excess liquidity case is an explanation for the driving of equities higher in the near-term, and that doesn't change just because lots of traders are alert for a decline, or even coveting the prospect of shorting.

In our view they continue fighting the Fed, even as a shakeout is due but we'd prefer listening to the 'messages of the market', which haven't reinforced odds of significant decline. That's been in-part by virtue of internal corrections, with a host of smaller stocks never really recovering to the Summer highs, working off their 'then' extended levels, or now encountering some year-end tax selling too. Some of these will probably do fairly well in January, after such pressures tend to abate.

Notably, while one can argue it's been time to take profits in the 'super-caps', as I like to call the grand-dames of this market, some will continue doing well as unfortunately they often are beneficiaries of the pandemic environment that isn't dissipating, but at the moment is still on the ascent.

It's really cruel to optimistic people that the case levels rise as vaccine hopes prevail (or at least the 'campaign' to convince Americans how worthy they are, and we don't have all the answers on that front, but remain a bit leery for now) .. but that is the situation, as that tech leadership associated with this persists.

And again that (barring shockers), this counters a bearish view. It's not really that simple, though if one means the managers who denied the rally from the March lows (Inger Bottom) for months, well yes, some of them indeed have been putting money to work belatedly, trying to improve a summary of their results for the year or perhaps the 4th Quarter. And typically in the leaders in the expensive categories. Part of why I suspect some of this shifts in 2021.

Executive Summary:

- A risk is this market is the 'presumption' that vaccines are the cavalry, as every political and health agency is saying so, and we hope so but wary.

- Part of the wariness is because some of that is 'priced-into' the market, so stocks might be a bit vulnerable 'if' they perceive it's not so smooth.

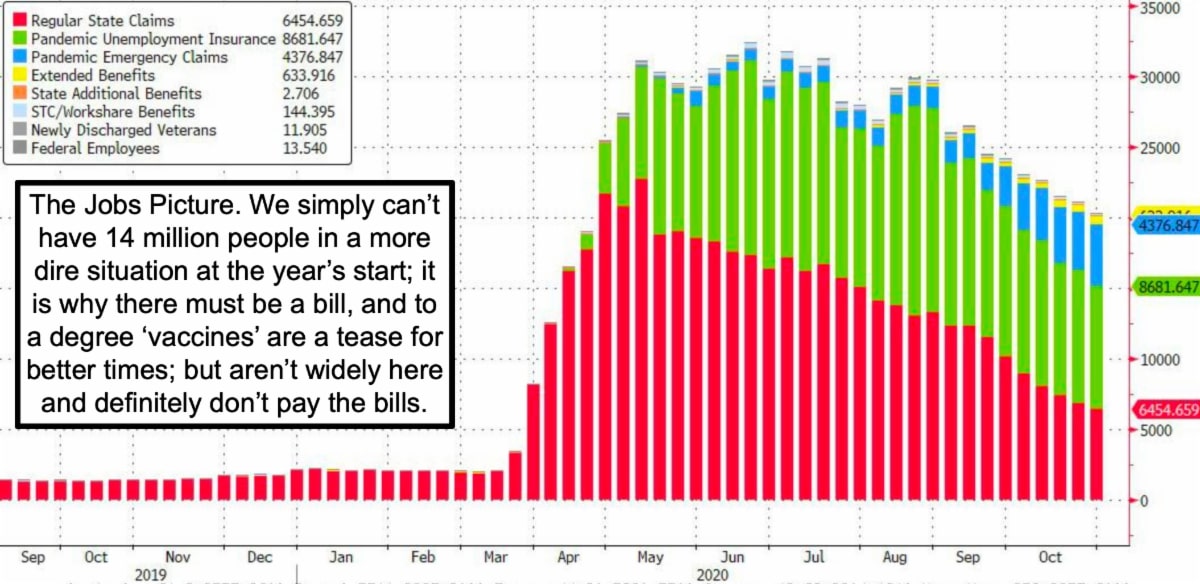

- Toughest part of the pandemic is now and the very near-term, although at the same time we must have the 'relief' bill and effective vaccines.

- An intraday shakeout (muted by the Fed comments) reminds us of what is a focused market on the super-caps, and the ability to shake 'if' they trip.

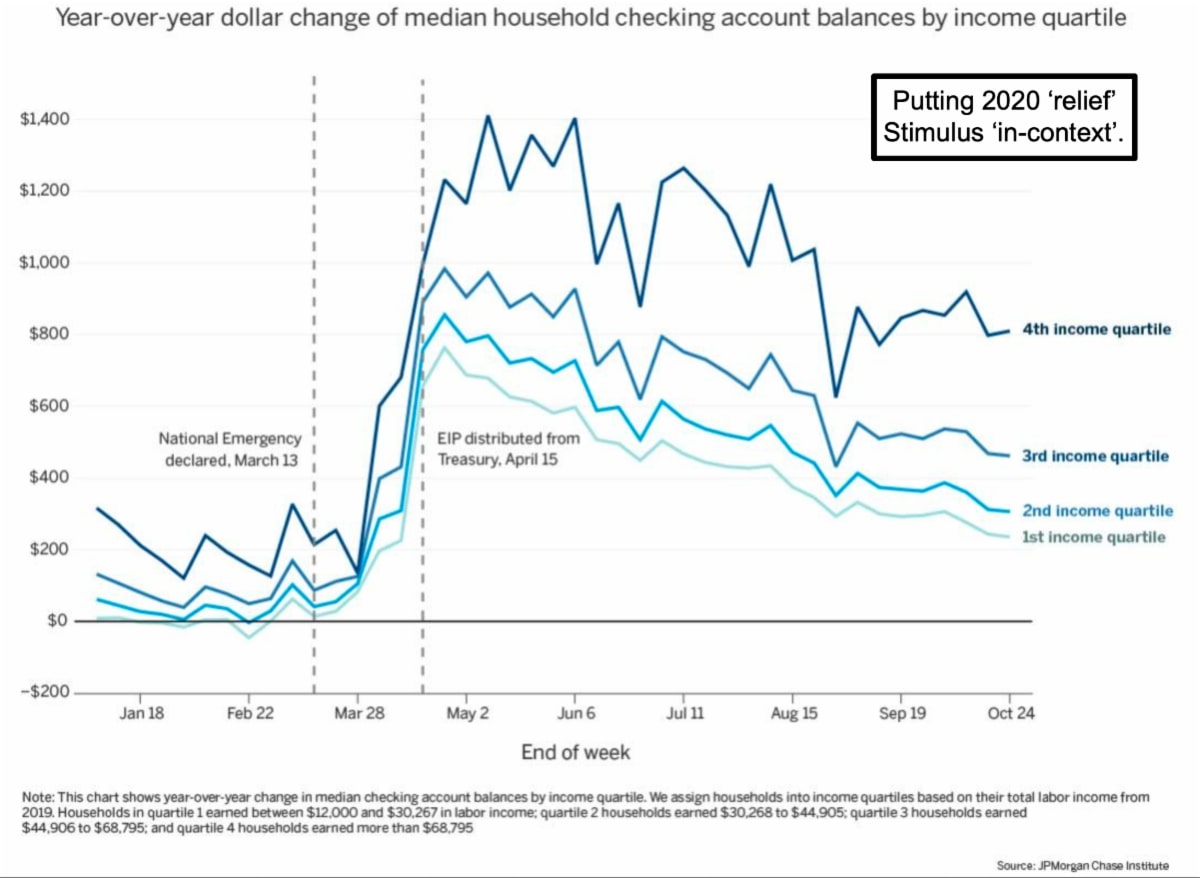

- Congress is not exactly in a 'best of times / worst of times' moment, and I disagree that the wealthy are so happy (most are being charitable or they should be, and definitely not traveling excessively).

- Surplus cash among those who can is going into remodeling even more so than new homes, as they can easily refinance if needed at low rates.

- Chairman Jay Powell showed a heart few have before, and that's great at the moment, but is problematic if the Fed stays easy too long, but that's a concern down the road, it is not a problem for the moment.

- Opposite actually, as this financial environment reminds us that we're still in 'work at home' mode, and will be for several months.

- Expect President-elect Biden to extend an olive branch to China, not for a reversal of standing-up for US trade needs, but to avert a terrible spiral of tension, even though there's no disagreement they don't deserve rewards for the way they have reacted particularly with regard to human rights.

- Possibly as a sign of troubled global issues under the next Administration, Tunisia's Prime Minister said he respects Morocco's choice to recognize the Jewish state but that Tunisia is not considering doing the same, if the Biden team does not deviate from current trends, they may shift later.

- Meanwhile, Jared Kushner will lead a U.S. and Israeli team to Morocco next week, so if there will be any surprises or at least initiated dialogue on this topic, it might happen 'off-stage' during the trip to Casablanca.

- For sure it would be fitting to cap one of the best series of deals of the Trump era by expanding the movement toward Middle East and North African peace and stability, and not foment trouble-makers.

- Even CNN's Jake Tapper gave kudos to President Trump (and team) for their herculean efforts that brought-about this historic regional shift.

- On COVID, numerous new tests are on the horizon, the Australian one is an antigen test, and will be fairly typical of several coming to market.

- Progress from Sorrento's (Scilex), suggest they continue to get ducks lined-up for main testing and trial events, so we await 'more quacking'.

- AT&T has sold Crunchyroll (anime) to Sony, and taking bids on DirecTV, doing so with both whittles down debt, as contended all along.

- Notably, the FBI has signed with AT&T's 'FirstAlert' system, which will be moving to 5G, and is essentially an endorsement of AT&T's system.

- As we contended from the middle-upper 20's, AT&T's dividend is solid, and they will do well with HBO Max, today ROKU today Amazon Fire carrying HBO Max, so customers will be able to see it Christmas Day (it will be the 4k / Dolby Atmos 'Wonder Woman 1984' noted before).

- So far HBO Max joins Apple TV+ as the only streaming services without adding extra charges for 4k and Dolby Atmos (both free or inexpensive for certain customers, especially AT&T wireless 'Unlimited Elite' users).

- Interesting year coming, with Tesla (TSLA) joining the S&P next week and Ford bring the EV Mustang to market now (469 HP and 0-60 in 3 seconds).

- Oh yes, Pfizer (PFE) has had some issues with its vaccine, one hospital has determined (and now the FDA concurs) that they can get extra doses out of each vile ... which also suggests there's much left to learn about it,

- Finally, Massachusetts regulators filed a complaint against Robinhood, the trading firm (not in Sherwood Forest), saying it aggressively lures inexperienced investors, partially by not qualifying trading in options or on margin (they pledged to better inform 'clients' of a rather loose situation).

- Robinhood has impressive stats, but many amateurs are benefiting from inflated markets. Too often the government takes action after they have been burned.

P.S. The market: 'sort of' on-hold hoping for the 900 Billion relief bill. With it, the likelihood of a second round of airline subsidies has gone up as well.

Strains on the healthcare system . . not to mention varying strains of COVID in the mix, has stimulated more debate about whether (or when) to take these vaccines (perhaps sorting-out which seems least riskiest not just protective).

At the same time the entire combination will keep the demand for 'testing' for exposure or condition relative to COVID (Sars-Cov-2 of course), going about as long as it seems the Fed is committed to keeping interest rates low.

That's slightly cynical but emphasizes a mixed backdrop of uncertain duration, for which the answer isn't entirely clear. It's clear the Fed hopes to see upticks in inflation, for the same reason many (all of us really) are hoping to emerge, in a favorable way from this pandemic.

After all the stock market has been anticipating economic revival rather than a double-dip recession, regardless of whether there's a bit of both going on just now for that matter. While volatility in Fed policy would shake markets, any big disappointment with the rollout of vaccines, could also shake expectations for an early commencement of what I've called the coming 'Roaring 20's' boom.

On COVID, as you know there have been concerns about some severe effects of the vaccines, beyond what is typically soreness at the injection site, or light fever for a day or two (a number of 103 fevers in the UK are not 'light' fevers).

The New York Times, noted a US health worker inoculated this week suffered an anaphylactic reaction (an allergic reaction that prompts a person’s immune system to release all sorts of harmful chemicals) to the Pfizer vaccines. That's disheartening and similar to two other cases in Britain last week.

The Times article didn’t mention cytokine storms, but an over-active immune system is a bad sign, and what typically has landed people in an ICU. This is why (where a patient can take it) steroids have been helpful, but more directly Sorrento's 5656 drug would suppress that, while an antibody therapeutic like their STI-2020 would bypass the immune system, hence encouraging our own muscles to create antibodies instead.

I am sure this different approach is not well understood, and to this moment it is common for the media to talk about 'huge doses', low availability, and delay of seeking treatment, because antibodies have to be given early-in-disease. It is true based on what's available now from Regeneron (REGN) or Lilly (LLY), but not with regard to what's presumed forthcoming from Sorrento (SRNE), followed later by 'lite' versions from the first two and maybe something from Inovio next year.

My take on Fed Chairman Powell's remarks were worrisome, not encouraging as some economists are interpreting it. I think Chairman Powell linked overall progress to inflation, and interest rates to Fed purchases.. not precisely clear, but suggesting uncertainty on the Fed's belief they can control any of this.

On COVID, as you know there have been concerns about some severe effects of the vaccines, beyond what is typically soreness at the injection site, or light fever for a day or two (a number of 103 fevers in the UK are not 'light' fevers).

The New York Times, noted a US health worker inoculated this week suffered an anaphylactic reaction (an allergic reaction that prompts a person’s immune system to release all sorts of harmful chemicals) to the Pfizer vaccines. That's disheartening and similar to two other cases in Britain last week.

The Times article didn’t mention cytokine storms, but an over-active immune system is a bad sign, and what typically has landed people in an ICU. This is why (where a patient can take it) steroids have been helpfut, but more directly Sorrento's 5656 drug would suppress that, while an antibody therapeutic like their STI-2020 would bypass the immune system, hence encouraging our own muscles to create antibodies instead.

I am sure this different approach is not well understood, and to this moment it is common for the media to talk about 'huge doses', low availability, and delay of seeking treatment, because antibodies have to be given early-in-disease. It is true based on what's available now from Regeneron or Lilly, but not with regard to what's presumed forthcoming from Sorrento, followed later by 'lite' versions from the first two and maybe something from Inovio (INO) next year.

That allows expectations of keeping the stock market more or less in a 'warm' situation, so you can get shakeouts, or even a correction, but no catastrophe, of course barring an exogenous event, or so-called 'Black Swan', swooping-in to disrupt the dynamics. The grand-scale cyber-attack was a potential terribly disruptive event, but either 'they' have control of it, or are minimizing what has been shared with the public, because so far it's not really influencing markets.

As I noted yesterday, an excess liquidity case is an explanation for the driving of equities higher in the near-term, and that doesn't change just because lots of traders are alert for a decline, or even coveting the prospect of shorting.

In-sum: the Fed pondering taking the punchbowl away is postponed, and just the bears are expecting some preemptive action by the Fed sooner. I almost wish they could do that, because it would mean a vibrant recovery was here.

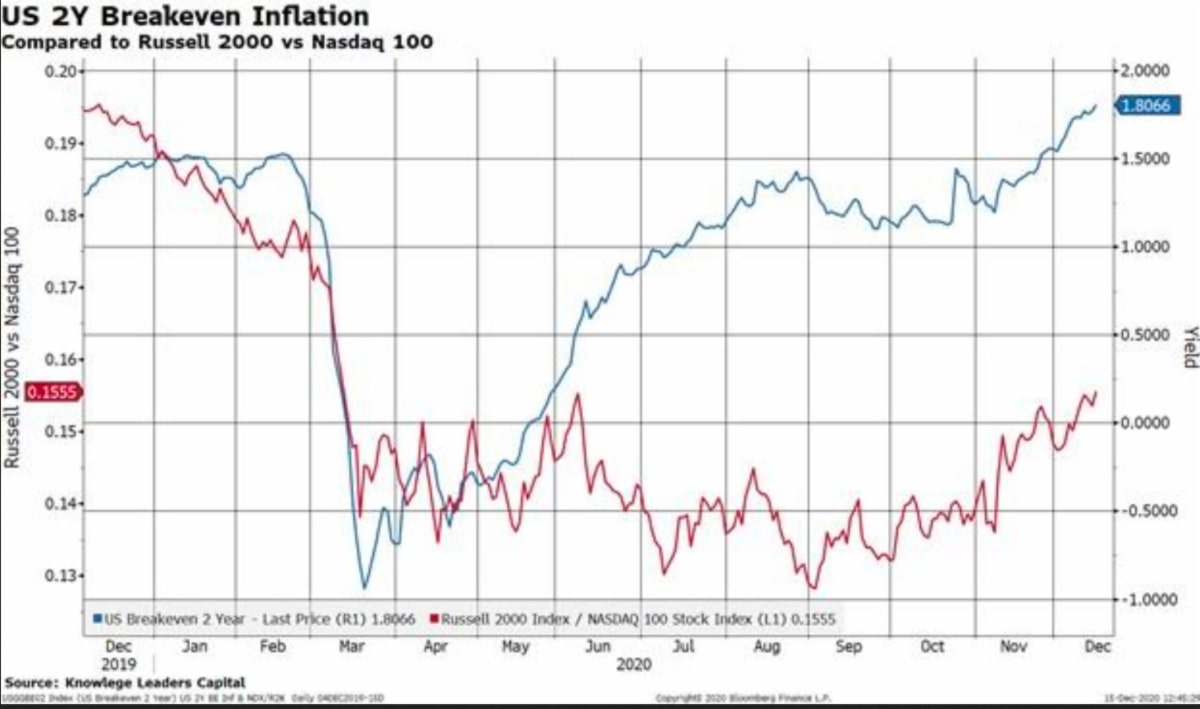

The uptick in inflation expectations isn't really going to help momentum stocks but would be a time when smaller stocks would be doing better. Also, the Fed desire is also a way to anticipate diminished buying power for citizens, given a majority don't really desire higher inflation-driven prices.

They have inflation in a sense now, in financial asset prices (Senior Indexes), and that includes housing, which in some parts of the country is making first time buyers struggle to find an affordable home, but willing to, given low rates (and young families are buying more house than they need because they sort of figure.. if they contemplate the future and don't expect to move.. that by the time they'd shop for a future home, mortgage interest rates won't be so low).

Bottom-line: the dynamics of an economic re-acceleration matter, and it may be troubling as many investors won't grasp an environment where small-caps might be outperforming the 'super-caps' handsomely, with speculation strong at times next year, while the stocks that prospered this year, pullback.