Market Briefing For Thursday, Apr. 22

'Sell in May and go away' - is an old Wall Street saying. It reflects seasonals of course, as money tends to dry-up as you approach Summer. That does not deny the ability of an ensuing Summer rally, but does happen to coincide this time with our idea of Spring culling-out during the prior exuberance, and rocky behavior in April and May as well. Today's rebound was anticipated.

Should later behavior press big stocks sufficiently lower (not these minor blips in some, amidst signs of things amiss at the same time for some companies), it might well be that a purge (especially 'if' it's in late May) might be the next or decent buying opportunity for intermediate traders. So stay tuned for that.

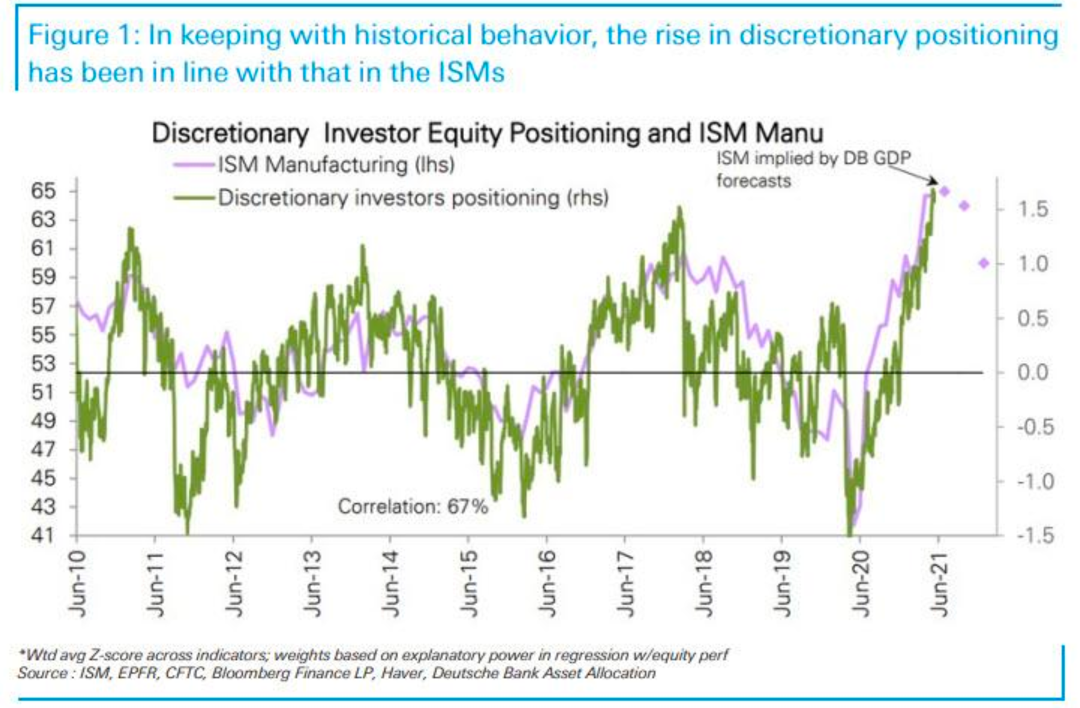

Generally money managers and analysts still have the same optimism for the economy, growth and the impact of fiscal stimulus (infrastructure included). At the same time a handful (myself included) have pointed to weakness recently in more speculative sectors of the market.

But we've noted how tricky this market is, with a lot of internal correction that's pretty obvious going on. That's true in small stocks, but most visible in FANG types and others that previously benefited from the 'stay home' economics. I won't delve into it tonight, but COVID is not cooperating with all the politicians behaving 'as if' we were clear of major problems relating to the pandemic.

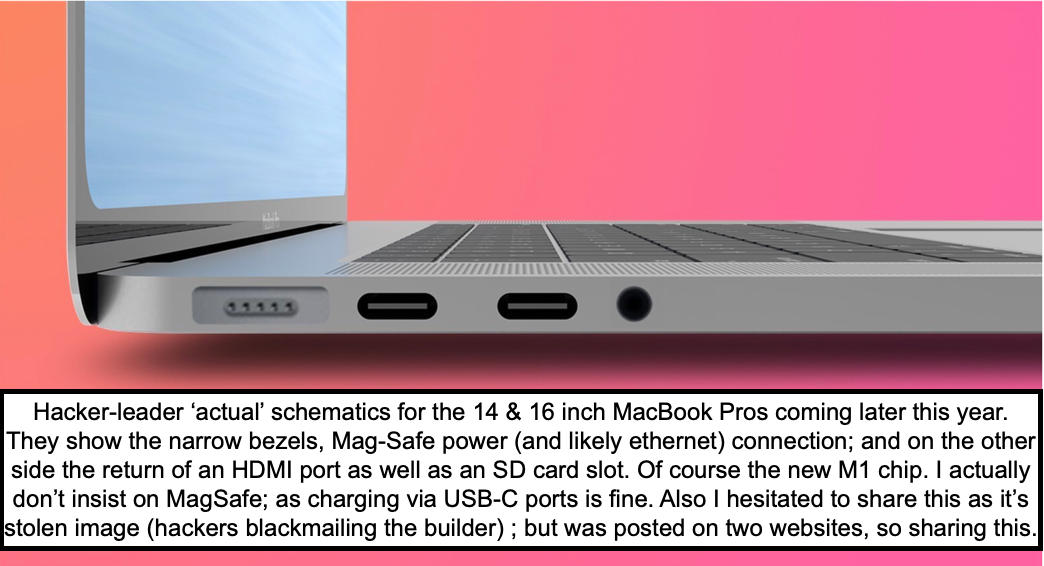

(Caught a typo, the above was 'hacker-leaker', not leader. I also think the new MacBook Pro will have mini-LED displays, and that's also for the next iMac in the larger venue which ideally goes from 27" to a 32" display + memory slots.)

Previously we saw frothy parabolic moves which historically resemble some of the temporary (at least) end of thrusts higher, not the beginning or launch of anything. I tried to emphasize that the moves were the reward for buyers around the time of a washout and reversal, specifically our 'Inger Bottom' of March 23 last year. It's important as I thought that was a 'bear market' low (albeit short duration bear) and not a setback in the decade old cycle.

So now that allows for perhaps 'more' than a nominal setback depending on a rally we're in now, and I think traders know that. So if our lengthy intermediate leg-up from the March 2020 low peaked, next we'll see a retracement sort of resumptions, that is ongoing in many of the then-favored stocks that plunged and are now trying to rebound.

Yes the super-bulls and bears alike will possibly blame the drop on a COVID '4th surge' or even some geopolitical issue that flares-up. However it's really technically what's already ongoing, which is why I've described it (surges and purges and rebounds) as a 'continuation' pattern (and that is a continuation to the downside, not upside), in FANG type stocks on a 'trend' not daily basis (AAPL, T).

In-sum: this was a day for a little washout and rebound, generally expected, at the same time inherently affirming a bit of sustainability, because breadth is improving, although that can be temporary (as I noted breadth is necessary for rebounds to gain any traction or sustainability).