Market Briefing For Monday, Sept. 14

Crushing pressures remain averted for now; with most managers or hedgers still likely to be watching nearly-identical algorithms that would trigger heavier selling. In the case of Friday, we got the morning rebound looked for, and then a selling wave; with yet another rebound and then a bit of a late pre-weekend fade.

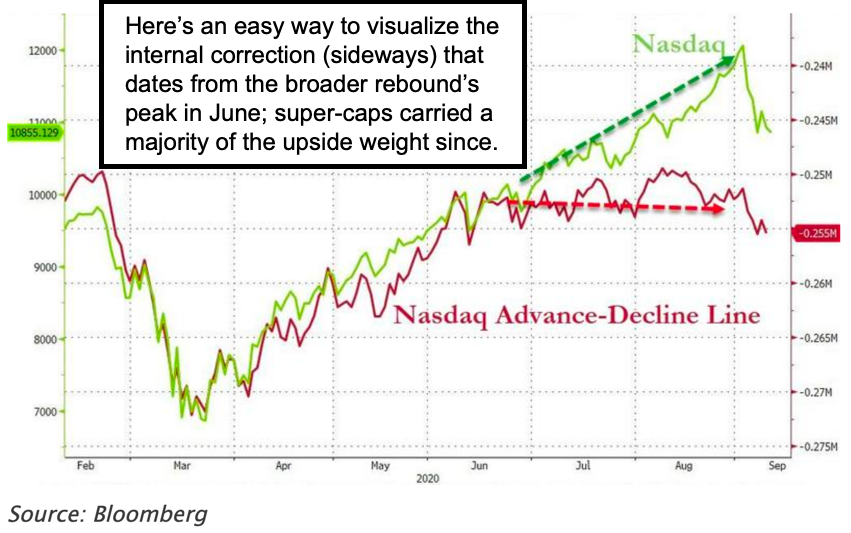

At the same time a sort of unique 'fragility' persists in this market; which has never had such a narrow leadership group on which to rest the next move by the S&P. It's precisely why I described it for weeks as 'the Generals out in-front of the Troops'.

At this point the troops (which barely budged forward) are hunkered down in those trenches merely 'waving' along market trends; while the Generals retreated notably, as they ponder when they can prod the troops into another advance or back-away and hope to avoid enemy assaults in the process. Meanwhile S&P notched to lower levels with a likely interim rebound, regardless how Monday starts (as I'll describe as well as note it possibly could be spearheaded or impacted by Apple on Tuesday).

Executive Summary:

- Technical evolution marches onward; from the 'worry wall' extended climb with a series of warnings for several weeks; followed by an S&P and NDX thrust above the rising tops (or 'bands') that we saw as an upside capitulation;

- That blow-off was viewed primarily as a lightening-up selling spot in max-priced lunacy moves; especially as it was immediately in the wake of uninformed buying of split stocks (Apple & Tesla; with Tesla all along being the more vulnerable);

- Those two were destined to subsequently drop after a low-quality buying spree (as experienced investors don't chase stock especially post-splits, even if they like a particular stock for down-the-road prospects);

- Concurrently, many low-priced so-called value or growth plays only eroded when the 'super-caps' broke; as most had been correcting internally for a few months;

- Apple will host a 2-hour presentation Tuesday; and I doubt they'd do 2 hours just to announce Apple Watch 6 or a new iPad Pro; hence speculation about iPhone;

- However, there's 'one more thing' to watch for; and that's what preliminarily has been rumored named 'Apple One'; which would 'package' other services in one bundle, with the composition determined by baskets offered to customers;

- These could include Apple News; Apple Music; Apple Games (Arcade); Apple TV+ (movies and aggregated guides that have improved greatly); or even their excellent iCloud (data storage) service that ties the 'ecosystem' together;

- Apple sold-off Friday as they changed App Store rules to prohibit using a single App to select multiple games; and most analysts think that's to upset Microsoft or Google and just demand separate App payments for individual games;

- Yes that's part of it; but I suspect many such games have signed non-disclosure bulk pricing agreements with Apple to be bundled within Arcade / Games portion of Apple One (or whatever Apple calls the Games portion or overall);

- If that's the case Tuesday (I chat about this more in Video 2) Apple will likely rally and lift the S&P in the process; hence there's an 'intraweek' rally prospect for the new week, almost regardless of whether we break first Monday or not;

- There's no change in my overall views about S&P technical pattern evolution; as it stands for now; there's more 'pain' ahead for 'super-caps' but it's a process.

Now we'll focus on Covid-19 a bit:

- France reports an exponential growth in Covid-19 cases; hospitals reactivating surge measures from the Epidemic's height; and the UK is almost similarly seeing heavy surges of Covid; here in the U.S. it remains absurdly politicized;

- Covid brought the world almost to a grinding halt; and there is a misconception that masks alone and measures taken will get us out of the pandemic quickly;

- Dr. Fauci emphasized little prospect of returning to normalcy until late 2021 even if we get a vaccine approved late 'this' year; that dovetails with my warning that a normal economic recovery is more like 2022 if that's the case;

- 'Normality' can return much quicker, almost in a rush, if we get a reliable drug or as terms, a therapeutic; several are working on that; Sorrento's ST-1499 is one; however although the IND was filed 3 weeks ago; Trial recruiting hasn't begun;

- At the same time 25% partially-owned New Jersey colleague Cingularity has started their first trial at UC Irvine (California); first patient injected yesterday;

- There's talk of 'paying people to get them to be vaccinated'... wow.. that's cruel and unusual (many would be nudged I suppose) if before 'total' approval;

- However, even if so, the S&P would have completed correction and resumed or initiated upside behavior well before as the market again 'discounts' recovery; an impact of paying people to be vaccinated seems almost unethical;

- The rub on that is of course fiscal and tax policies that might create upheavals, which would be more costly than the expenditures to get the major inoculated; though the legalities of compelling people to do so argue against it;

- Besides with the experiences reported so far, it seems many will 'opt' to rely on a therapeutic if that's available should need arise, and skip all the early vaccines;

- Meanwhile the lag in fast approvals gives second and third level vaccines and therapeutics time to refine their products and perhaps better results.

Politics and Geopolitics:

- Though the media (of course) won't emphasize it; the Peace Agreement between Bahrain and Israel was 'agreed to' Friday; and had been in the works (I suspect Jared Kushner and Israeli officials met with the Emir at a private negotiation while briefly in the UAE on that historic 'first ever' El Al flight from Tel Aviv; and also the President spoke with him Friday morning to affirm things before announcement;

- The President continues to deserve serious credit for these peace achievements (especially since so many incorrectly argued that moving the US Embassy from Tel Aviv to Jerusalem was somehow going to prevent peace);

- The opposite occurred; and the pattern of Israeli normalization of relations with a long-hostile Arab world continues; and also offsets Iran's efforts to destabilize; it is not emphasized, but the Middle East may have been Trump's best achievement;

- Meanwhile China & India have again agreed to meet for 'deescalation' talks; so for the moment the border skirmishes have simmered-down to ongoing tension;

Other noteworthy developments:

- Office space rising; while a few firms like JP Morgan want traders centralized back in main facilities; this is the exception; while disengagement is prominent along with decentralization; especially as regards the technology industry with the exception of a few, notably Twitter, saying they'll cut pay for those moving away;

- That is a trend ongoing or a few years (led by Apple and Intel for a decade); and it is a prime reason for the growth in cities like Austin (used to be Dell country);

- All this is spurred on by the pandemic; digital working advances; lower tax and living costs, and better 'quality of life' perceived away from most cities;

- These trends are away from major traditional financial centers, so today one is dumbfounded by New Jersey dredging-up the 'financial transaction' tax again;

- That NJ move triggered the NYSE issuing a Letter saying they're prepared to move all live-trading activities 'out of New Jersey' if Trenton actually imposes that;

- New York and New Jersey are already in a big debt-pickle; and while grasping of course why they need to increase revenues somehow; this seems to be a non-starter and should prompt legislators to be more creative (VAT tax perhaps);

- My comment about the NYSE moving to Orlando in a video was tongue-in-cheek; but,

- Speaking of Florida; the Miami Herald today noted impossible driving and auto insurance costs in already-expensive (for decent areas of) Miami; average $3000 a year car insurance and $600 a month to park downtown (really?);

- Aside no personal income tax, Florida for the most part is about half those costs; hence Tampa, Orlando and even Jacksonville growth; aside all that these cities overall living costs, while rising, entice companies to open as salaries don't have to be sky-high (like impossible California) to attract talented qualified workers;

- A tropical depression forming East of Miami should become a Tropical Storm overnight and possibly a Hurricane by Sunday as it moves across the Gulf;

- The fires on the West Coast indeed emphasize climate change and should not be viewed as surprising; just tragic; similar horrors were seen in Australia; all this is going to create a construction boom next year; however ideally better planned.

In-sum: there's a common denominator to almost all these issues and trends. It's the pandemic. So much has been geared toward the reopening, which isn't going as well or as smoothly as desired; and that's especially so in Europe as well as with opening U.S. schools, where politicians have not carefully structured advanced arrangements or conveyed the serious implications of Covid-19.