Macquarie: Enjoy The Rally, But We'll Revisit The Lows Of 2018

Earlier this week we asked if, just like in early 2016, a new "Shanghai Accord" was coming.

Implicitly responding to our rhetorical inquiry, Macquarie's Victor Shvets published a report titled "Shanghai redux & Benjamin Graham" in which he agrees with us that "investors seem to be increasingly expecting that a new Shanghai Accord (a laFeb ’16) is on the horizon" an assessment which be in line with Macquarie's view that asset-based economies are "utterly dependent on ample (excessive) liquidity, persistently low (declining over time) cost of capital, contained volatilities and regular public-sector-inspired reflationary momentums" which can be achieved only by pumping liquidity at a faster clip than nominal GDP, tightly co-ordinating monetary policies and China pumping a reflationary pulse while avoiding extreme geopolitical outcomes.

That - according to Shvets - is exactly what occurred in early ’16, giving us two years of synchronized growth, collapse of volatilities and a weaker US$. This ended in ’18, and in ‘19 the rubber truly hits the road.

So with all that said, is a Shanghai Accord 2.0 indeed coming? Well, not so fast, because as Shvets explains below, while such an outcome is likely, "more pain needs to be endured first." Here's why:

The climb down by all parties (including the Fed) has always been as close as one gets to an absolute certainty. The only question that we have been raising is one of timing and how much pain would need to be endured. Neither CBs nor China are yet embracing our bleak view of the future of ever diminishing windows of acceptable cost of capital and volatilities, as private sectors atrophy under pressure of technological evolution and financialization. Instead, we see everyone (from IMF to PBoC) debating debt sustainability, reforms and returning to private sector primacy. Hence, neither US, Fed nor China want to ‘overreact’; as a result, they run the constant risk of ‘under-reacting’.

There's more, because as the macro strategist further explains, "this time around, there are also significant differences with late ’15."

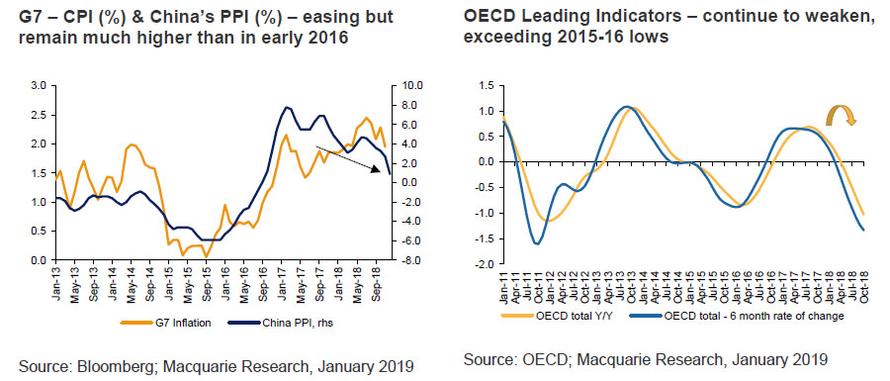

- First, the commodity complex (CRB), is ~20% higher.

- Second, wage pressures in most key economies, though relatively tame, are stronger.

- Third, inflation rates are higher (G7 CPI is ~1.9% vs 0.6% in Feb ’16), while China’s PPI is no longer negative (-5.3% in Jan ’16 vs 0.9% today).

- Fourth, investors need to take into account far more unpredictable and nationalistic political background.

- Fifth, Europe is potentially facing a revolution. But as in ’15, all measures of liquidity have turned negative, and global momentum is ebbing.

These in turn cause regular ‘heart palpitations’, testing ever higher levels of volatilities, while regularly closing market access for the most vulnerable players according to Macquarie.

What does this mean? According to Shvets, since today's environment is more complex than early 2016, "we might have to revisit the 2018 lows" before some tangible action is taken, and here's why.

We believe there is a high probability that investors might revisit lows of late ’18 as policy-makers dither. It seems unlikely that China would embark on a sufficiently large stimulus until later in ’19. As the state is on both sides of any transaction, nothing moves until the state significantly raises spending. At the same time, we don’t believe that just ending balance sheet reduction and pausing (Fed) is sufficient. Also, Europe might be paralysed until elections and changes in key portfolios (including ECB). The threshold required to go from normalization to liquidity injections is high; hence, pain is likely to rise.

Yet ultimately, Shvets contends that since no one is in a mutual suicide pact, the Macquarie strategist stays constructive for later ’19, yet concludes with the following lament that markets no longer function at all:

"If Benjamin Graham today applied to be a fund manager, he probably would be rejected. Investors no longer invest, but try to optimise (with limited success) against unpredictable & rapidly re-pricing signals."

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more