Lyft IPO To Set Record... For Fastest Shareholder Lawsuit Ever

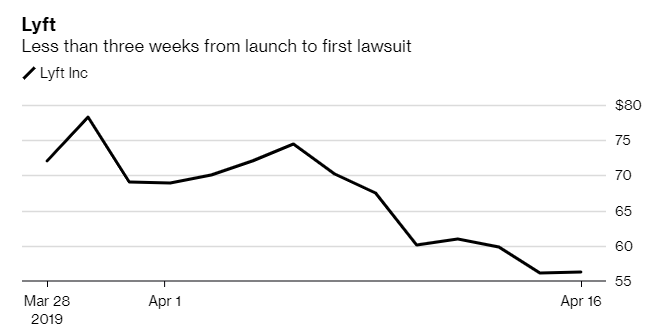

Lyft's IPO has been a disaster for nearly any open market participants that have wound up buying the stock since it has traded. But the IPO did come close to setting one recent record, according to Bloomberg: how quickly the company was hit with investor lawsuits after plunging.

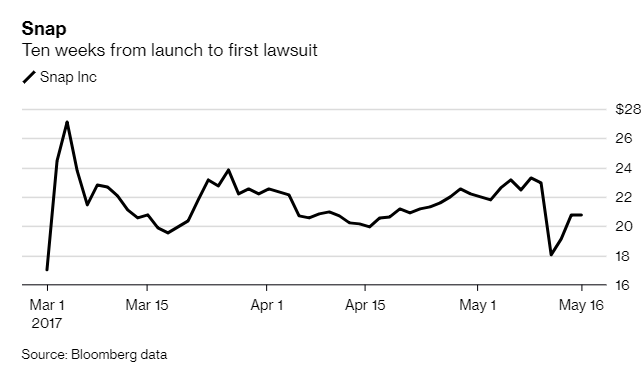

With Snapchat's IPO, investor lawsuits followed in just 10 weeks. For Blue Apron's IPO, it took only seven weeks. Lyft has now lowered that bar, seeing its agitated shareholders file suit against the company in just three weeks after its IPO.

While these kinds of lawsuits can be commonplce for newly listed companies (even more so after 2008), most are dismissed or settled out of court for pennies on the dollar. Trials almost never happen.

The standard cause of action arises from the allegation that the company's officers and underwriters over-hyped the company's prospects, leading to losses when the market figures out the "truth". It's an objective that's obvious and clear to many non-mainstream analysts in the industry, but one that's never talked about in the financial mainstream media.

This leads us to ask: if overhyping is the claim, why hasn't CNBC been party to any of these lawsuits?

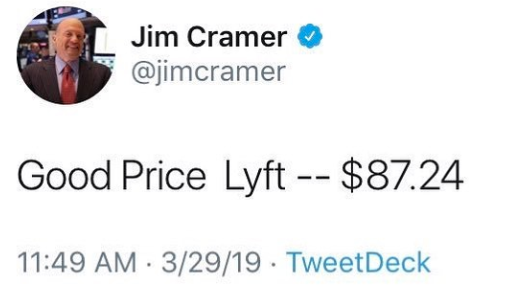

"You want to get as much Lyft as you can," Jim Cramer said leading up to the IPO on March 28.

"So get in there, try to get as much Lyft as possible, because the way deals work is that the brokers all know they have a ton of merchandise to move. So, what they do is they would whet your appetite with some really tasty morsels and Lyft will be a tasty morsel," he continued.

On March 29, Cramer called Lyft's $87 opening price a "win for the system". Cramer commented in an article for The Street:

"Lots of people were quite cynical about the whole process, instantly jumping to the conclusion that the stock was ridiculously overvalued and the brokers ripped off the customers. That's just not true."

He then called $87.24 a "good price" for the company on Twitter. Days later, while defending Lyft as it plunged back through the $70's on CNBC, he claimed people should look at it as an investment because the company had "a good balance sheet".

On April 2, Cramer backtalked his way into making excuses for the IPO plunge.

“I think the decided lack of enthusiasm for the stock deal that is Lyft is one of the best things that’s happened to this market in ages,” Cramer said.

But we digress, and Cramer is already on his way to shilling the Pinterest IPO.

Meanwhile, as Cramer was selling Lyft to mom and pop investors, reality was waiting around the corner for Lyft's shareholders. Lyft saw itself party to two complaints filed on April 16 of exaggerating its prospectus when it said its U.S. market share was 39%. The plaintiffs also alleged that the company failed "to tell investors that it was about to recall more than a 1,000 of the bikes in its ride-share program."

Lyft is now down 19% as a public company, trading with a $58 handle after its offering price of $72. The stock continued its post-IPO selloff after the news that Uber would also be filing for an IPO.

Lyft didn't see the fastest shareholder lawsuits of all time, but it's likely close. Facebook outdid it when it fell 19% in two days, prompting lawsuits within just a week on behalf of investors who lost more than $2.5 billion.

Jay Kesten, an associate professor at Florida State University’s College of Law said: “If the bad news comes out very quickly, that is going to cause investors to come out with a lawsuit right away, That’s what’s going on here.”