Low Key Losses Change Little

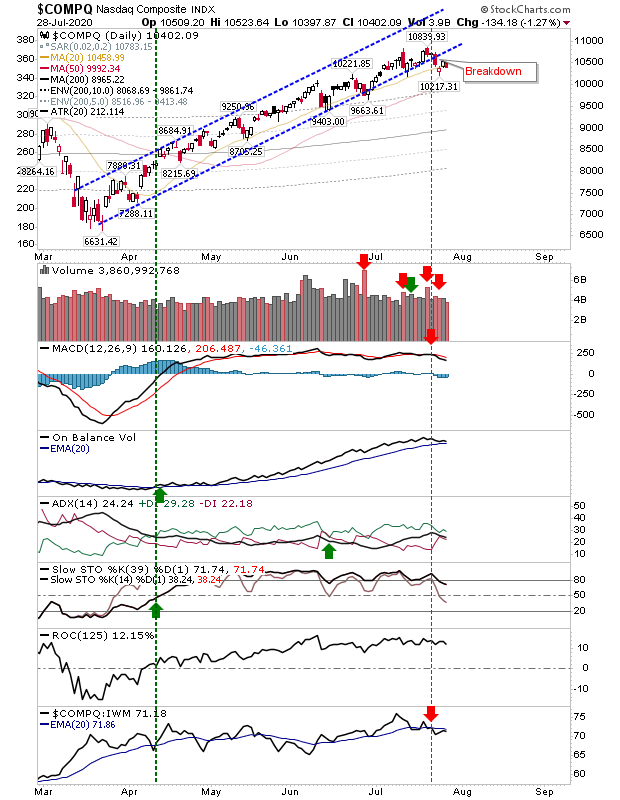

Aside from the Nasdaq which broke through rising channel support, other indices remain caught along breakout support.

The Nasdaq is on a 'sell' trigger in the MACD and a relative underperformance against the Russell 2000, but it has already outside of its rising channel where an opportunity to accelerate losses has not yet been taken.

(Click on image to enlarge)

The S&P had registered a small breakout before it drifted back to support. However such support remains in play despite today's loss and with technicals net bullish there has yet to be a 'sell' trigger which could encourage a more pronounced downside.

(Click on image to enlarge)

The Russell 2000 is holding to support which is also its 200-day MA. The breakout hasn't yet materialized but it remains in a good place to do so. Today's loss did not reverse the relative outperformance for this index relative to its peers.

(Click on image to enlarge)

We have another day to wait for a reaction in the indices, but we have seen an extended period of flat action in the index which matters most to secular bulls, the Russell 2000.