Looking Ahead: The Correction Will End When...

It is said that stock market corrections are only "normal and healthy" until you are in the middle of one. The problem is it can be tough to see the bright side of the macro picture when volatility begins spiking, prices start to crater (and then recover, and then crater again), and all kinds of scary arguments/narratives start to be made in the popular financial media.

From my seat, this is exactly what the stock market is going through right now - a corrective phase. Or call it a consolidation. Or, as I like to say, a sloppy period. A period in which the way forward starts to look a bit cloudy or perhaps even downright stormy.

Again, while this is just my opinion, traders appear to be looking for clarity on a number of issues right now. And until we get a better view, the road ahead might be a little bumpier than normal.

Probably the most important "issue" traders are dealing with here is the reality that growth is slowing. To be clear, this does not mean a recession is imminent. No, the issue here is we're seeing the RATE of growth slow.

As we've discussed a time or two, this was to be expected at some point. Remember, the explosive economic and earnings growth rates seen in recent quarters were artificially high - because the economy had been intentionally shut down, and then reopened on a dime. So, BAM, you got some eye-popping growth when things reopened and were juiced by all the stimulus from Washington.

So, with the stimulus now wearing off and the initial surge behind us, the question becomes, what does future economic growth look like? Will it be 4% as many Wall Street firms are projecting? And if so, for how long? Or will we return to the more pedestrian growth rates seen pre-COVID (I.E. Something in the 2-2.5% zone)?

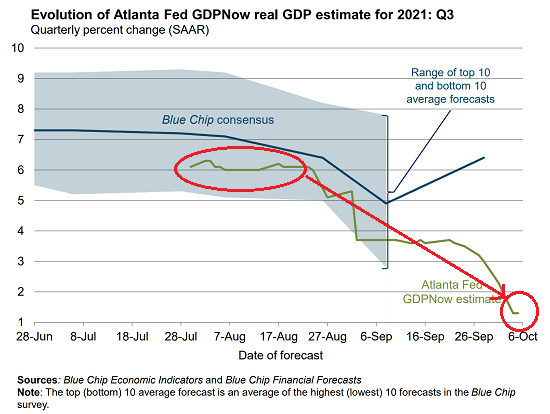

Here's an example of my point. In mid-August, the Atlanta Fed's GDPNow (a real time estimate of GDP growth) for the 3rd Quarter was sitting comfortably above 6%. This meant that, at the time, GDP was growing at a 6% annual clip. Now fast-forward to early October, you know, after Delta put a big 'ol crimp in everyone's return-to-normal plans. As of October 6, the Nowcast had fallen to just 1.3%. Ouch.

Image Source: Atlanta Fed

From my seat, this is really the crux of the reason why stocks stopped dancing merrily higher when the calendar page flipped to September. In short, economic reality set in. And right now, the future doesn't look near as bright as it did back in the summer. As such, a 4-5% pullback seems to make some sense - well, to me, anyway.

Additional pieces of evidence here include Goldman Sachs dropping their 2022 GDP estimate this week from 4.4% to a still upbeat 4.0%. Goldman's team cited expiring stimulus, a slowdown in consumer spending, supply chain issues worsening, and the general economic drag created by the Delta surge as the reasons for the cut. Seems logical.

But #GrowthSlowing isn't the only thing weighing on traders' collective psyches. In addition, there is the worry about stagflation (defined as stagnating economic growth and increasing inflation), the earnings season, Fed policy, the status of Chair Powell, and, of course, China. Ugh.

Even Apple (AAPL) got into the mix Tuesday afternoon by announcing they were cutting iPhone production by 10 million units due to, everybody now... chip shortages. So, heck, if the biggest company on the planet can't figure this out, I guess we really do have some issues to noodle on.

I could go on (and on) about any/all of the above. But the bottom line - at least in my brain - is that traders just don't know what the future looks like. And there are lots and lots of questions. How long will it take for the chip shortage to get fixed? When will supply chain issues stop impacting prices? When will there be enough truckers to get everything to where it needs to go? When will prices of "stuff" stop rising? Are rising wages here to stay? And so on, and so on.

So, until we can get some clarity of some of these issues, we should probably expect to see more of this sloppy period. As such, we probably shouldn't be surprised to see some additional volatility in both directions - or for the computers to freak out every now and again. It's just the way the game is played these days.

For me, I take comfort in the smallish amount of dry powder I have in portfolios. Because at some point, the corrective phase will end and a dip-buying opportunity may arise. Fingers crossed.

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should ...

more

What about inflation?

My suggestion was very specific in at least halting all of the actions that are intended to cause inflation. If it could be halted that would be good, at least for a wh[le

OK, so folks are not making as much profit as somebody predicted. Get over it!! still making a profit, still coming out ahead of where you were, just not as far. And certainly the federal reserve team got the inflation that they intended to cause, and then it took off because of secondary results of their actions, which even a zuchini could have seen coming. So the ones hurt by the stagflation that is caused are those who have been struggling to get by on small fixed incomes. They are really getting hurt. And also those who are living on what was quite adequate fixed incomes, now that the buying power of their money has been reduced so much.

So I am suggesting that the inflation be stopped completely for some trial period, perhaps ten years should allow an adequate analysis of how well we do without the nemisis eating our assets. And perhaps our government can learn how to live within it's means, just like a lot of the folks not in that top 1% do.

Of course that will not happen because it will hurt that small crowd that the federal reserve works for.

Why would it hurt them?

The intent of inflation is to reduce the purchasing power of our money so that we will borrow from the banks. That benefits the bankers. inflation also increases the price of shares, because each dollar has less value. That bennefits the traders. I am not cler on the mechanism of the other benefits to the stock market, others have claimed that inflation does benefit the market somehow.

Thanks.

Great read.