Looking Ahead Of Wall Street: Arrowhead Research Corp, Oracle Corporation, And BlackBerry Ltd.

Holiday shopping and festivities are in full swing, but several companies are slated to report earnings this week ahead of the holidays. Here’s what to watch for in reports from Arrowhead Research Corp (NASDAQ: ARWR), Oracle Corporation (NYSE: ORCL), and BlackBerry Ltd (NASDAQ: BBRY):

Arrowhead Research Corp is set to release its Q4 2015 earnings on Monday, December 14 after market close. For this quarter, analysts estimate revenues of $0.15 million compared to last quarter’s revenue of $0.1 million, and a loss of ($0.39) per share, compared to last quarter’s loss of ($0.27) per share. One main highlight from this past quarter was the release of positive data regarding ARC-520, a drug developed to treat Hepatitis B. During clinical trials, the company reported that the drug reduced HBV’s viral antigens in the DNA of chimpanzees. According to the company, “These data strongly support advancement of ARC-520, and Arrowhead has initiated multiple studies aimed at producing a functional cure of HBV.”

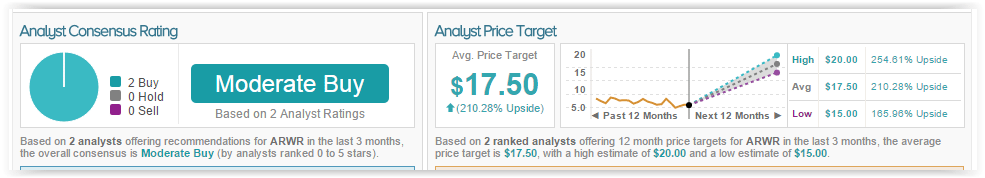

According to TipRanks’ statistics, 2 analysts have rated ARWR in the last 3 months with a Buy rating. The average 12-month price target for the stock is $17.50, marking a 210% upside from where shares last closed.

Oracle Corporation is set to report its Q2 2016 earnings on Wednesday, December 16 after market close. Analysts expect non-GAAP revenues of $9.1 billion for this quarter, compared to last quarter’s non-GAAP revenues of $8.45 billion. Furthermore, analysts estimate non-GAAP earnings of $0.61 per share, compared to last quarter’s non-GAAP earnings of $0.53 per share. The company has been in the news this quarter due to its court case with Google over its Java platform, though analysts are more interested in the company’s recent gains in the cloud industry.

Analyst Heather Bellini of Goldman Sachs believes Oracle’s cloud computing profits will increase this quarter due to old contracts expiring. She states, “It is understandable that investors have concerns around ORCL’s ability to meet its FY16 cloud revenue target given the steep ramp required. That said, there is a unique dynamic at play here with promotional periods ending on deals signed 6-18 months ago which we believe will help to drive a cloud revenue acceleration in F2H16.”

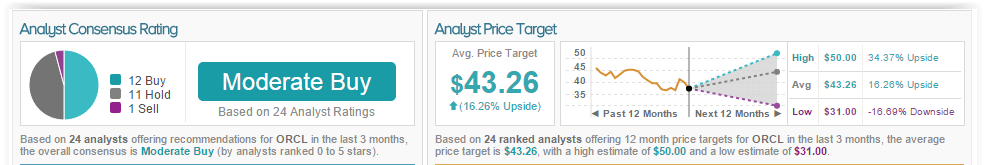

According to TipRanks’ statistics, out of the 24 analysts who have rated ORCL in the last 3 months, 13 gave a Buy rating, 1 gave a Sell rating, while 10 remain on the sidelines. The average 12-month price target for the stock is $43.35, marking a 16.5% upside from where shares last closed.

BlackBerry Ltd will report its Q3 2016 earnings results on Friday, December 18 before market open. Analysts expect the company to post non-GAAP revenues of $488 million, compared to last quarter’s non-GAAP revenues of $491 million, and a non-GAAP loss of ($0.15) per share, compared to last quarter’s non-GAAP loss of ($0.13) per share. This past quarter, the company ended operations in Pakistan due to security concerns, as the Pakistani government wanted access to all of its customer’s messages and emails. On a more positive note, stores such as Walmart and BestBuy sold out of the company’s Priv Android smartphone in early December, causing the stock price to surge. Analysts will be looking to see if this recent success is indicative of John Chen’s efforts to turn the company around.

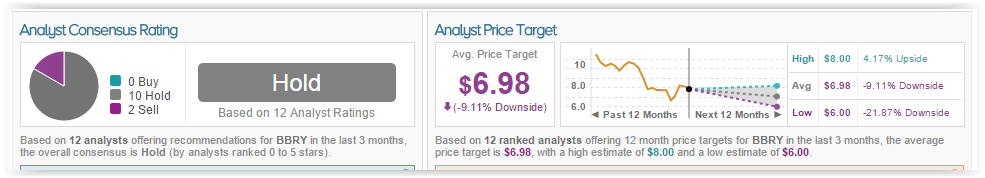

According to TipRanks’ statistics, out of the 12 analysts who have rated BBRY in the last 3 months, 2 gave a Sell rating while 10 remain on the sidelines. The average 12-month price target for the stock is $6.98, marking a 9% downside from where shares last closed.

Disclosure: To see more, visit more