Livongo And Teladoc: Undisputed Leadership In The Future Of Healthcare

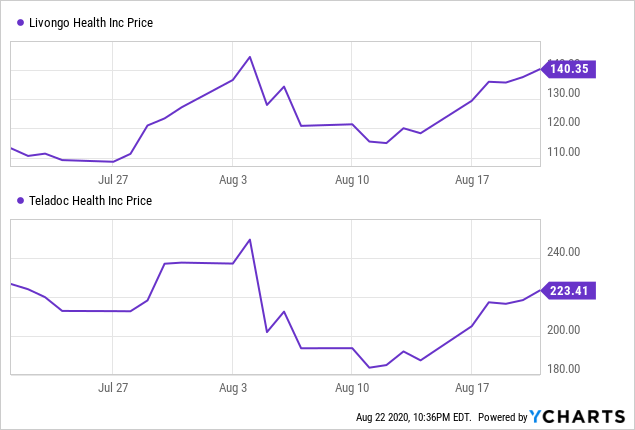

Shares of both Livongo (Nasda:LVGO) and Teladoc (NYSE:TDOC) suffered big declines after the merger announcement on August 5. But now the market seems to be understanding the rationale behind the deal much better, and the two stocks have substantially recovered from their post-announcement drawdowns.

It is easy to see why investors may have initially reacted in a negative way to this deal. However, on a forward-looking basis, Livongo and Teladoc offer the opportunity to invest in an undisputed growth leader with enormous potential to benefit from the digital transformation in the healthcare sector over the years ahead.

The Reasons For Disappointment

I can perfectly understand why investors would initially feel disappointed with the merger. In fact, and in the interest of full disclosure, I sold half of my Livongo position as the merger was announced on August 5.

The deal changes the potential return and reward equation in Livongo, and the stock was the largest position in my portfolio by a wide margin at the time of the announcement after generating a 500% gain in a few months.

I generally let my winners run, but when the position is so large and the company makes such a transformative move, it makes sense to take some chips off the table and reassess the investment with more information.

However, I also maintained a sizeable position in Livongo stock because I was frankly intrigued by the upside potential of the two companies together. Upon further analysis, I am feeling increasingly confident about the future of Livongo and Teladoc after the merger.

The market seems to be having a similar perspective since Livongo and Teladoc have recovered a lot of lost ground in recent days.

Data by YCharts

The initial disappointment among investors in the two companies is completely understandable. If you owned Livongo stock, you were holding a disruptive growth stock that was growing revenue at more than 100% year over year and was still relatively small, with enormous room for sustained growth.

Investors in Livongo naturally consider that Livongo stock is undervalued based on its long-term potential, so the fact that the stock was sold at a relatively small premium versus the market price at the time can be a disappointment.

Investors in Livongo are getting 0.592x shares of Teladoc plus $11.33 in cash for each Livongo share. Teladoc closed at $249.42 on August 4, so this gives a conversion value of $159 while Livongo was trading at $144.53 the day before the merger announcement. Many investors in Livongo were feeling that management sold the company for an insufficient premium.

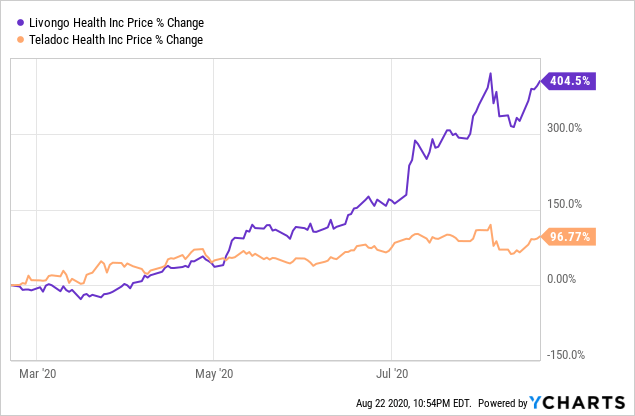

But we also need to consider that these kinds of deals are negotiated over several months, and Livongo stock is up by 404.5% in the past six months while Teladoc has gained 96.77% in the same period.

We can't know exactly at what price levels the deal was negotiated, but Livongo was probably much cheaper than Teladoc in comparison to current prices during the negotiations, which means that the premium over market prices for Livogno was obviously much higher at that time.

The main reason why the premium looks unimpressive at current levels is that Livongo has delivered massive returns in a relatively short period of time. It is quite a stretch to say that Livongo management should have predicted such a meteoric rise for the stock in a few months. Even if you are aggressively bullish on a stock, these kinds of moves don't happen very frequently.

Data by YCharts

Investors in Teladoc could consider that the company paid an excessive price for Livongo. If you own Teladoc stock and you think that the stock is undervalued, then you probably do not want the company to issue more shares in exchange for Livongo.

In simple terms, if you own shares in a business and then this business goes through such a transformative merger, then you own something else than what you initially bought. It is perfectly reasonable, and even to be expected, to have some doubts and hesitations about the implications of this deal.

Putting this aside, investors need to analyze these kinds of situations on a forward-looking basis. It is not about comparing your stock before the merger versus your stock after the merger. The main question that you need to answer is if you want to own shares in the new company after the deal, and there are some interesting reasons to consider doing so.

The Right Kind Of Deal

Mergers and acquisitions can happen from a position of weakness or from a position of strength. Companies with declining growth rates and stagnant fundamentals many times try to buy their way to growth via acquisitions. This rarely ends well for shareholders, there are some things that money can't buy, and a culture of innovation and sustained growth is one of those things.

However, both Livongo and Teladoc come to this deal from a position of strength. The two companies have reported very strong numbers in recent quarters, and they have delivered massive returns for investors in the past year. They don't need to do this deal to survive, both parties want to do this deal because they are stronger together.

Investors need to consider not only how much Livongo and Teladoc are worth before the acquisition, but also how the value of the two companies changes with this deal. To begin with, Livongo and Teladoc would eventually become competitors without a deal. In the words of Teladoc CEO Jason Gorevic, "Our two companies were either on a path of convergence or collision." This transaction is eliminating a major competitive risk for investors in both companies over the long term.

Reducing competitive risk is not enough of a reason to justify a merger, but it is clearly a factor that should not be disregarded when assessing the pros and cons of the transaction.

Looking at the upside opportunities from this deal, Livongo is the top player in data science technologies to improve the health and the overall quality of life of patients with chronic and behavioral health conditions. Teladoc, on the other hand, is the global leader in virtual care, and the company offers a global leadership position across distribution channels, with over 70 million individuals in the U.S. alone.

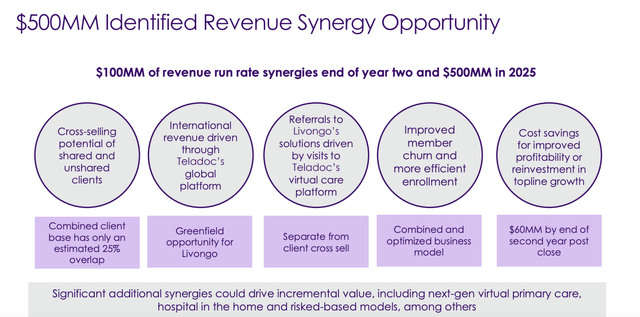

The combined customer base has only a 25% overlap, so the opportunities for cross-selling and referrals are quite large. Besides, Teladoc has an international presence in over 175 countries, and this could be a game-changer for Livongo in terms of international expansion.

Management has identified $500 million in revenue synergy opportunities, and there is a big chance that this estimate will end up being too conservative if it can execute well and successfully capitalize on its opportunities.

Source: Teladoc

Focus On The Big Picture

The healthcare system is in urgent need for innovative change. Livongo and Teladoc together are offering personalized care and more efficient solutions, leveraging on massive amounts of patient data and real-time information powered by Artificial Intelligence.

Both Livongo and Teladoc have statistically proven to produce better outcomes for patients and lower healthcare costs, and combining the two platforms opens the door to exciting possibilities for even better results over the long term.

The pandemic has accelerated demand for both companies, and regulators are rapidly recognizing that we need to provide better solutions. Demand has never been higher, the technology is more powerful than ever, and regulations for virtual healthcare exceptionally favorable. This is the right deal, and it comes at the right time.

Mergers and acquisitions always carry significant challenges and implementation risks, and this is no exception. However, the healthcare industry is going through a major transformation, and this is going to produce massive opportunities for growth in the years and decades ahead.

The merger between Livongo and Teladoc gives birth to an undisputed powerhouse with exceptional potential for growth. If you are looking to invest in the future of healthcare, Livongo and Teladoc could offer a fairly unique opportunity to do so.

Disclosure: I am/we are long LVGO.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more