Little Churn In The Latest Low Volatility Rebalance

Market gains in the first four months in 2019 more than made up for what it lost in the turbulent last quarter of 2018 as the S&P 500 jumped 18%. Predictably enough, the S&P 500 Low Volatility Index trailed the broader benchmark (up a “mere” 16% in the first four months), although Low Vol has led the broader benchmark during May’s pullback.

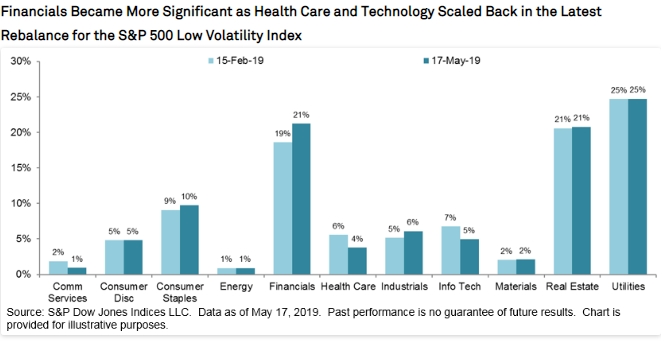

The May rebalance (effective at the close on May 17th) yielded minimal change in the sector distribution within the low volatility index. The most significant changes include added allocations to Financials and a scaling back of Technology.

(Click on image to enlarge)

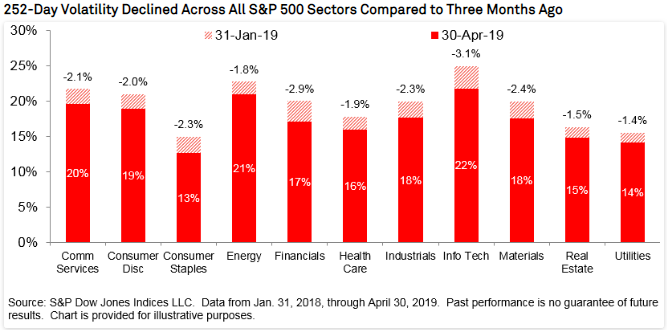

Trailing one-year volatility for each S&P 500 sector declined in the last three months. The volatility reduction was more or less equally distributed, so it’s not surprising that the latest rebalance wrought minimal changes in sector exposure for Low Vol. In fact, this latest rebalance is notable for its low turnover. The index replaced only 9 names, nearly half the count of the average of 17 over the last two years.

(Click on image to enlarge)

Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information ...

more