Litecoin Tumbles Amid Speculation Walmart News Is Fake

Update (1005ET): In an odd turn of events, many on social media are raising doubts about the legitimacy of this announcement.

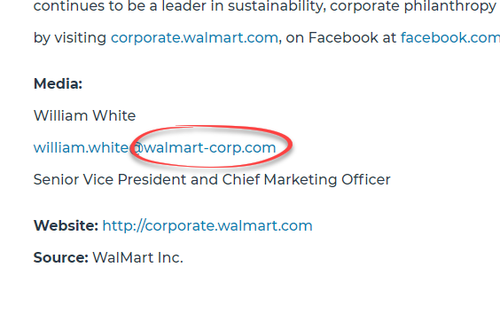

The biggest red flag was that while William White is indeed Chief Market Officer of Walmart - the email address links to a site that is not Walmart's.

Additionally:

1) it’s not in their newsroom https://t.co/dtcvVCLrDS

— Neeraj K. Agrawal (@NeerajKA) September 13, 2021

2) the wire account for “Walmart Inc” hasn’t posted anything else https://t.co/SLuxs5yO9X

3) the contact email is @ https://t.co/broFIRjHvB, which is owned by a squatter (h/t @tomhschmidt)

And finally, we note that Litecoin’s verified Twitter account deleted a tweet that linked to a press release announcing a partnership between Litecoin and Walmart.

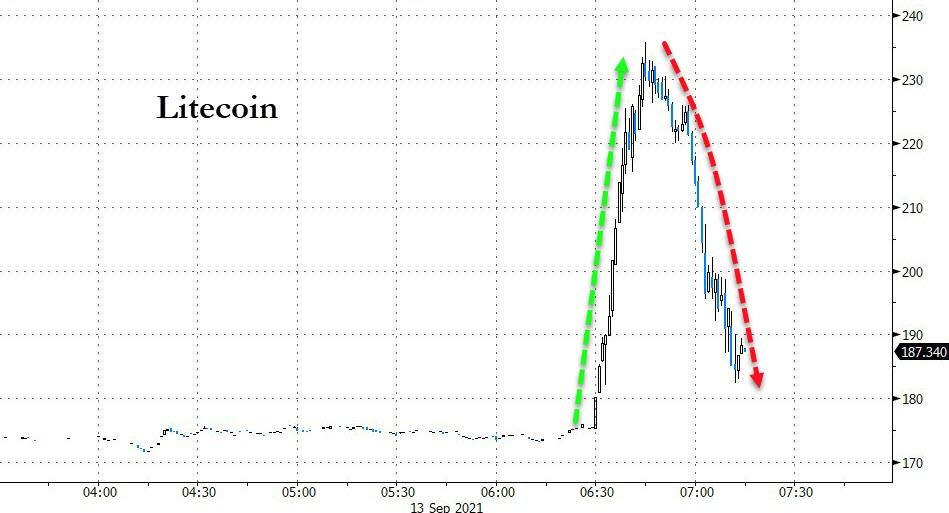

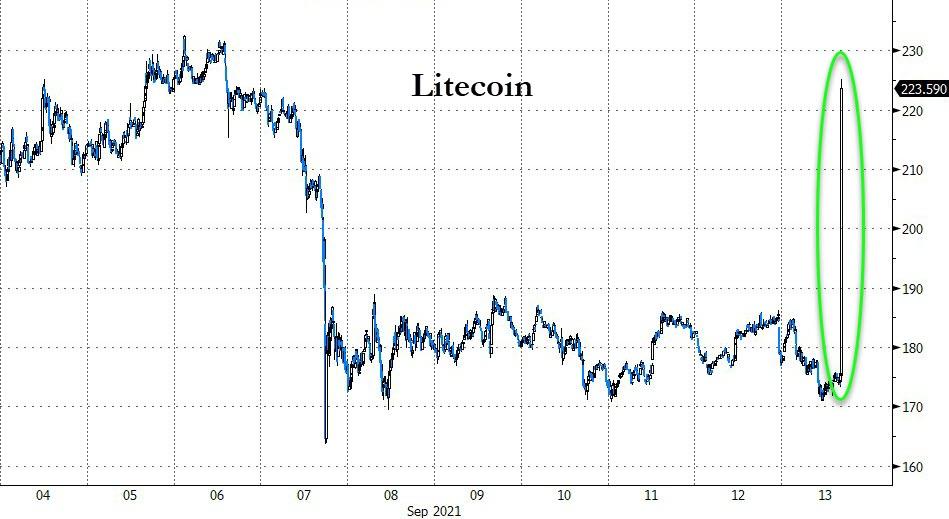

The end result is Litecoin tumbling back to earth...

CNBC reports that a Walmart spokesperson confirmed the press release is not authentic.

* * *

Update (0935ET): In another indication of the mainstream adoption of cryptocurrencies, giant retailer Walmart has announced a partnership with Litecoin. The eCommerce giant intends to give its millions of shoppers across the world an opportunity to seamlessly make payments with cryptocurrencies.

"The momentum and excitement around the use of cryptocurrency are undeniable, and we are poised to make online shopping easy for our customers. As a leading eCommerce store, we are committed to bringing innovations to the online shopping experience.

By integrating Litecoin, we will enable shoppers to experience a very smooth checkout experience with near instant transaction confirmation, and near-zero fees regardless of where in the world they are.

We're very excited to be working together with the Litecoin Foundation, and further innovate our business.

Starting October 1st, all eCommerce stores will have implemented a 'Pay with Litecoin Option,'" said Doug McMillon, Walmart CEO.

Litecoin is spiking on the news...

Charlie Lee, Litecoin's creator and the CEO of Litecoin Foundation shared,

"LTC's super low fees and fast transaction times are perfect for a leading eCommerce store like Walmart. We are thrilled and extremely excited that our cryptocurrency is now supported by Walmart, opening up more opportunities for any merchants to accept Litecoin in the future."

Litecoin is similar to Bitcoin, in that it uses the same code as the latter, and shares many similarities. However, Litecoin is cheaper and faster than Bitcoin. Litecoin is also a peer-to-peer cryptocurrency that facilitates cross-border transactions and enhances digital payment systems. Like Bitcoin, Litecoin has no central authority.

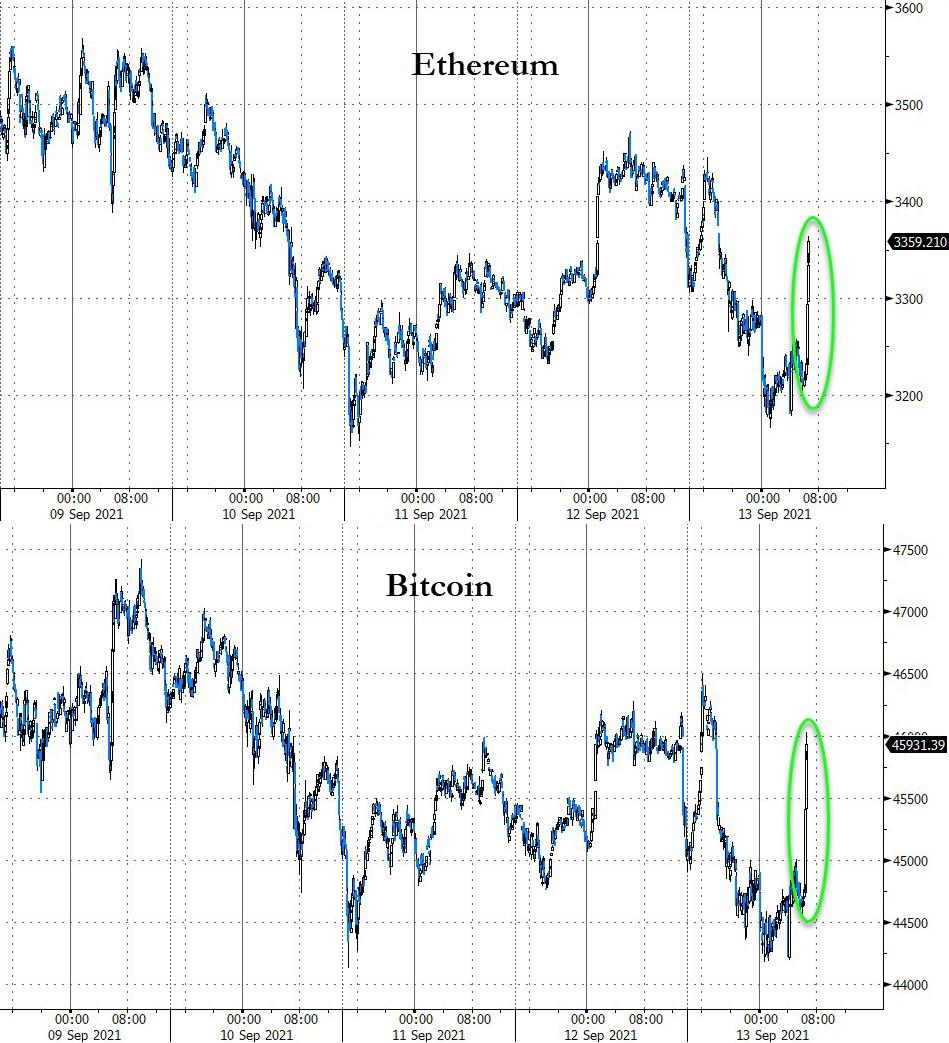

Bitcoin and Ethereum are also rising on the news as WMT's announcement signals a clear shift to broader acceptance of crypto...

* * *

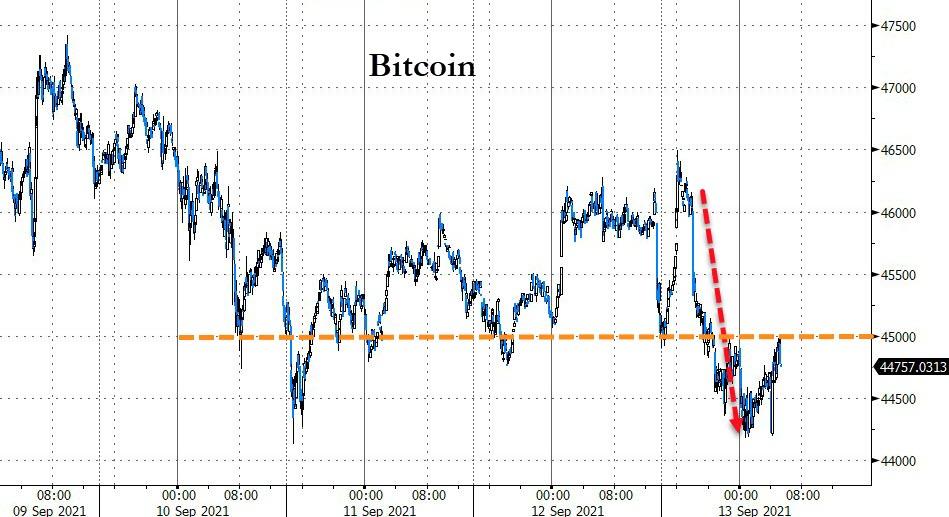

As we detailed earlier, after a chaotic and choppy weekend, Bitcoin had slid back below the somewhat magical 'Maginot Line' of $45,000 amid a flurry of headlines.

Source: Bloomberg

As the deadline for South Korean crypto exchanges to meet new compliance requirements looms fast (all operators expected to submit requests for an official license with the Financial Services Commission no later than Sept. 24), failure to meet requirements is expected to wipe out tens of crypto exchange operators.

As CoinTelegraph reports, insiders reportedly expect that close to 40 of the country’s estimated 60 crypto operators will be forced to shut down.

The crux of their objection has been the obligation that all exchanges show evidence that they are operating using real-name accounts at South Korean banks.

The FSC has justified by arguing that there is a high demand from customers for more protection for their assets held at smaller crypto platforms. Yet South Korea’s banks have, for the most part, refused to engage in any risk assessment process for applicant exchanges, except for the country's top four trading platforms.

The new measures have been designed to curb Koreans’ enthusiasm for crypto trading amid concerns that retail investors, especially those from younger generations, are borrowing excessively in order to trade as they struggle with suppressed wages, a frozen job market and ever-rising real-estate prices.

Amid massive growth of the stablecoin market, CoinTelegraph reports that the United States Treasury Department has reportedly discussed potential regulation for private stablecoins.

The Treasury conducted several meetings last week to examine the risks of stablecoins for users, markets, or the financial system, as well as learn about their benefits and consider potential regulation, Reuters reported Sept 10.

“The Treasury Department is meeting with a broad range of stakeholders, including consumer advocates, members of Congress and market participants,” Treasury spokesman John Rizzo said.

The news comes shortly after U.S. Senator Elizabeth Warren called the cryptocurrency industry the “new shadow bank,” suggesting that it’s “worth considering” banning U.S. banks from holding reserves to back private stablecoins.

On the positive side of the ledger, giant UK-based hedge fund Brevan Howard plans to "significantly expand" its cryptocurrency and digital assets, according to a new report from Reuters.

Chief Executive Aron Landy, who has been at Brevan's helm since its co-founder and long-time crypto backer Alan Howard stepped down in 2019, has stated that the firm has a "commitment to rapidly expanding its platform and offerings in cryptocurrencies and digital assets."

We also note that Coinbase is looking to raise $1.5 billion in a debut bond offering, according to a statement Monday.

This capital raise represents an opportunity to bolster our already-strong balance sheet with low-cost capital.

Coinbase intends to use the net proceeds from the offering for general corporate purposes, which may include continued investments in product development, as well as potential investments in or acquisitions of other companies, products, or technologies that Coinbase may identify in the future.

MicroStrategy CEO Michael Saylor announced the purchase of 5,050 BTC for about $242.9 million at an average of $48,099 per coin.

In a Form 8-K filing with the United States Securities and Exchange Commission published on Monday, MicroStrategy stated that it has added 8,957 BTC to its corporate Bitcoin treasury in Q3 2021.

As a reminder, MicroStrategy sold the first-ever junk bond to fund Bitcoin purchases in June. Its $500 million of bonds due in 2028 have risen since then to over 102 cents on the dollar, according to Trace pricing data.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more