Lisa M Jones’ Q4 Stock Picks: NVIDIA Corporation, Micron Technology, Inc., And Apple Inc.

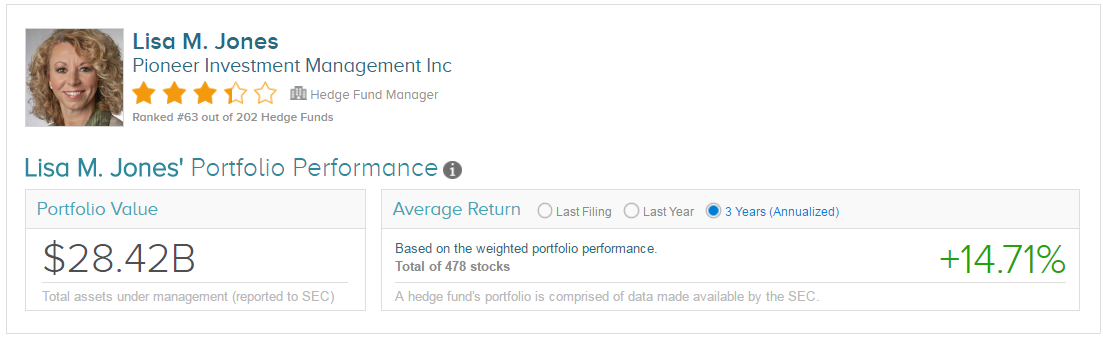

Hedge fund manager Lisa M Jones is the CEO and President of the $28.42 billion Pioneer Investment Management fund. In Q4 she demonstrated a bullish attitude towards NVIDIA Corporation (NVDA) and Apple Inc.(AAPL), but 13F forms filed with the SEC reveal that she slashed the fund’s shares in semiconductor Micron Technology, Inc. (MU).

Jones is ranked #63 out of 202 hedge funds tracked by financial accountability engine TipRanks. The ranking is based on the performance of Pioneer Investment Management. The fund has been generating respectable returns of 14.71% on a three-year annualized basis, rising to just under 18.6% last year. We can see that the fund’s measured performance of 70.52% is considerably higher than the average hedge fund portfolio (51.58%), although it still falls short of the S&P 500 (84.20%).

The fund believes it has a distinctive investment approach based on a strong collaboration between portfolio managers and research analysts. The approach involves understanding buy disciplines (for example, discounted stock) and sell disciplines (target price reached, story changes, better opportunities). These are ascertained by both fundamental and quantitative research.

Now let’s see how this approach manifested in three of Jones’ key Q4 portfolio moves:

NVIDIA Corporation

Jones increased the fund’s holding in chipmaker Nvidia by 21.93% to 255,177 shares worth $27.24 million. Since the last filing date, these shares have dropped in value by 7.67% following a slight cut to EPS by the Street post F4Q EPS. Prices are now just under $100 compared to the high of $119 on Feb 3. Goldman Sachs’ Toshiya Hari says “we have spoken with a large number of investors who… remain on the sidelines given concerns around valuation, despite their positive view on Nvidia’s fundamental outlook. We recommend investors take advantage of this recent pullback.”

On the flip side of the coin, Nomura analyst Romit Shah believes that the Street is underestimating the gaming slowdown and that the value implied to NVDA’s datacenter and automotive businesses is too high. He sees better upside potential in Intel (INTC). Shah downgraded the stock to sell with a $90 price target (-8.56% downside) on Feb 23.

Nvidia shares rocketed 224% higher in 2016- leaving analysts nervous that prices were entering overblown territory. But due to the recent share weakness, the average analyst price target on TipRanks of $111.09 is now equivalent to a 12.86% upside from the current share price.

Micron Technology, Inc.

While the market is very bullish on Micron, Jones drastically cut the fund’s Micron position by over 80%. The fund’s remaining position in the stock of 616,386 shares worth $13.51 million have gained 16.65% since the last filing date.

On March 2, Micron announced that it was significantly increasing its 2017 guidance for the February quarter. The new non-GAAP EPS guidance is now up to ~$0.86, from the prior range of $0.58–$0.68 while FQ2 revenue guidance of $4.65 billion +/-$50 million beats the previous proposed range of $4.35 billion–$4.70 billion.

Needham’s Rajvindra Gill, who is ranked #57 out of 4,513 analysts on TipRanks comments: “The company is benefiting from strong demand for DRAM and NAND products during a tight supply environment. An uptick in ASPs is leading to improved margins… Micron stated that improved guidance was due to favorable product mix, cost improvements and positive pricing environment.”

In fact, the analyst consensus rating on the stock based on recommendations published in the last three months is strong buy, with no hold or sell ratings. The average analyst price target of $29.61 is an attractive 15.8% upside from the current share price.

Apple Inc.

In Q4, Jones increased the fund’s substantial Apple position by 3.18% to 9.3 million shares with a reported value of $1.09 billion. So far, her decision is paying off: the shares have gained 21% since the last filing date. Apple is the biggest holding of the fund, making up 3.81% of the portfolio, just ahead of Microsoft (MSFT) and Home Depot (HD).

The International Data Corporation (IDC) released results on March 2 showing that Apple is now the third top wearable device maker. In 4Q16, Apple watch Series 1 and 2 had 13.6% market share with 4.6 million units shipped and y-o-y growth of 13%.

According to IDC the Apple watches “proved to be a magnificent success… as it was the company’s best quarter ever in the wearables market. The lower entry price point and the inclusion of GPS on the Series 2 along with a completely revamped user interface have helped the company grow its presence.”

In other news, Apple music rival Spotify announced that it reached the 50 million subscriber mark on March 4. While Apple music has grown with impressive speed to 20 million subscribers in December, the consumer giant is nonetheless having a hard time eroding subscribers from competitor Spotify.

Based on 36 ranked analysts offering 12-month price targets for AAPL in the last three months the average price target is $144.83 (3.6% upside) while the analyst consensus rating is strong buy (29 buy, 7 hold).

Disclosure: None.

thanks for sharing