Lincoln Educational Services - A Top 100 Stock

Summary

- 100% technical buy signals.

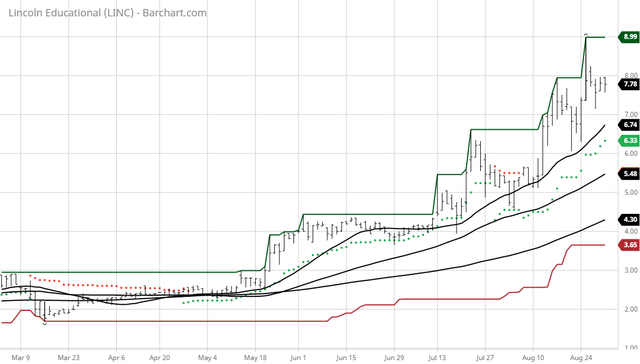

- 10 new highs and up 48.10% in the last month.

- 289.50% gain in the last year.

The Barchart Chart of the Day belongs the job training company Lincoln Educational Services (LINC). I found the stock by sorting Barchart's Top 100 Stocks list first by the highest technical buy signals hen used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 8/6 the stock gained 38.37%.

Lincoln Educational Services Corporation, together with its subsidiaries, provides various career-oriented post-secondary education services to high school graduates and working adults in the United States. The company operates through three segments: Transportation and Skilled Trades, Healthcare and Other Professions, and Transitional. It offers associate's degree, and diploma and certificate programs in automotive technology; skilled trades, including welding, computerized numerical control, and electrical and electronic systems technology, as well as heating, ventilating, and air conditioning programs; healthcare services comprising nursing, dental assistant, medical administrative assistant, etc.; hospitality services, such as culinary, therapeutic massage, cosmetology, and aesthetics; and information technology. The company operates 22 campuses in 14 states under the Lincoln Technical Institute, Lincoln College of Technology, Lincoln Culinary Institute, and Euphoria Institute of Beauty Arts and Sciences, as well as associated brand names. As of December 31, 2019, it had 11,285 students enrolled at 22 campuses. Lincoln Educational Services Corporation was founded in 1946 and is based in West Orange, New Jersey.

(Click on image to enlarge)

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 198.50+ Weighted Alpha

- 289.50% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 48.10% in the last month

- Relative Strength Index 66.74%

- Technical support level at 7.62

- Recently traded at 7.79 with a 50 day moving average of 5.48

Fundamental factors:

- Market Cap $206 million

- P/E 23.66

- Revenue expected to grow 3.10% this year and another 7.40% next year

- Earnings estimated to increase 75.00% this year, an additional 157.10% next year and continue to compound at an annual rate of 15.00% for the next 5 years

- Wall Street analysts issued 2 strong by and 1 buy recommendation on the stock

- The individual investors following the stock on Motley Fool voted 139 to 13 that the stock will beat the market

- 1,890 investors are monitoring the stock on Seeking Alpha

Disclosure: None.