LexinFintech Lockup Expiration A Short Opportunity

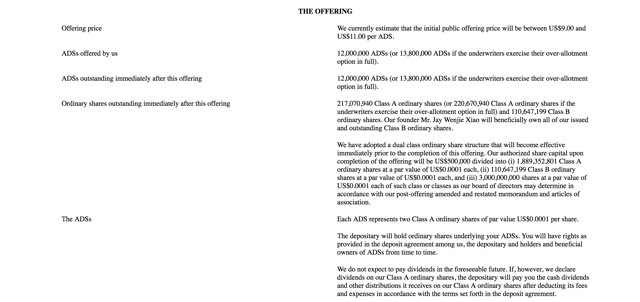

The 180-day lockup period for LexinFintech Holdings (LX) ends on June 19, 2018. When this six-month period ends, the company’s pre-IPO shareholders will have the opportunity to sell currently restricted shares. Just 7.3% of LX shares outstanding are currently trading pursuant to the IPO.

(Click on image to enlarge)

The potential for a sudden increase in the volume of shares traded on the secondary market could negatively impact the stock price of LexinFintech.

Currently, LX trades in the $15 to $16. Shares of LexinFintech had a first-day return of 18.9%. The shares reached a high of $19.09 on March 9, and then dropped to a low of $12.03 on April 6. The shares recovered in price, and LX has a return from IPO of 77.1%.

Business Overview: Online Consumer Financial Products Platform in China

LexinFintech Holdings offers consumer financial products online through its platform in the People’s Republic of China. It operates its online consumer financial platform known as Fenqile, which offers installment purchase loans, personal installment loans, and other loan products. In addition, the company offers its Le Card credit line. It pairs consumer loans with a range of diversified funding sources such as individual investors over its Juzi Licai electronic investment platform and institution partners through direct lending programs.

(Click on image to enlarge)

Through September 2017, LexinFintech had approximately 6.5 million active consumers with approved credit lines. They also had more than 20 million registered users. The company focuses on young, well educated adults between the ages of 18 and 36. This consumer base in China has high income potential, high consumption needs, high education backgrounds, and a desire to build a strong credit profile. Through September 2017, this consumer group comprised more than 90% of LexinFintech’s customer base.

Since its inception, the company has cumulatively originated $9.0 billion in loans. For the nine months through September 30, 2017, LexinFintech originated $4.7 billion in loans for an increase of 124% over the same period the prior year.

The company was formerly named Staging Finance Holding Ltd. It became LexinFintech Holdings in March 2017. The company has approximately 2,600 employees and keeps its headquarters in Shenzhen, China.

Company information was sourced from LX's S-1/A.

Financial Highlights

LexinFintech Holdings reported the following financial highlights (in RMB) for the first quarter ended March 31:

- Operating revenue was RMB1.6 billion for an increase of 56.7%

- Gross profit was RMB412 million for an increase of 52.2%.

- Net income was RMB146 million for an increase of 160%.

- Total loan originations reach RMB14.8 billion for an increase of 98.3% compared to the first quarter of 2017.

- Total outstanding principal balance on loans was RMB21.3 billion for an increase for 99.3%.

- Total registered users was 26.4 million for an increase of 94.8%. Consumers with credit lines was up 64% to reach 8.2 million.

- Active consumers using loan products increased 39.2% to reach 2.6 million. The number of new consumers using loan products was 0.44 million.

- The 90-day delinquency ratio was 1.44%.

Financial highlights were sourced from the company's website.

Management Team

Founder and CEO Jay Wenjie Xiao has more than 10 years of previous experience in the financial industry, specifically online products, at Tencent. Mr. Xiao earned a B.A. in design from Nanchang Hangkong University.

President and Director Jared Yi Wu has served the company since May 2016. His previous experience comes from positions at Tencent and WeChat. He earned a master’s degree in internet systems and computing from King’s College in London and an EMBA from China Europe International Business School.

Management biographies were sourced from the company's website.

Competition: JD Finance, Ant Financial Services, and Others

Although LexinFintech is a leader in online consumer financial products in China, it faces considerable competition from other online platforms, traditional consumer financial institutions, banks, other internet players, and installment loan providers. These include WeBank, JD Finance, and Ant Financial Services Group.

Early Market Performance

The underwriters for LexinFintech Holdings priced its IPO at $9 per share, at the low end of its expected price range of $9 to $11. The stock closed on its first day of trading at $10.70 then reached a high of $19.09 on March 9. The stock subsequently declined to hit a low of $12.03 on April 6. Currently, the stock trades around $15 to $16.

Conclusion

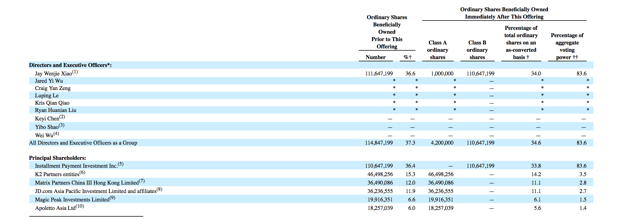

When the LX IPO lockup expires on June 19th, pre-IPO shareholders and company insiders will have the opportunity to sell currently-restricted shares of LX for the first time. This group of pre-IPO shareholders and company insiders includes a director and six corporate entities.

Since such a small percentage of shares outstanding are currently trading, significant sales of currently-restricted shares could flood the secondary market and cause a sharp, short-term dip in share price. Aggressive, risk-tolerant investors should consider shorting shares of LX ahead of the June 19th lockup expiration. Interested investors should cover shares of LX either late in the trading session on June 19th or during the trading session on June 20th.

Disclosure: I am/we are short LX.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more

Looks like an interesting #short opportunity. Thanks. $LX