Leading Stock Indicator And Risk Indicator Falls To Critical Level

Risk off, risk on, risk off. That’s what characterized January 2020. It was a very challenging month, and the month is about to close at crucial levels as per our risk indicators. What to make out of this, and what does it mean for an investor or trader other than the fact that returns were not astonishing this month?

Investing is all about having a solid methodology in place that allows to spot trends. It is also about being open minded and flexible enough to admit that a trend is changing, and to be open to take a new position according to those new trends that arise.

January 2020 was a great test for traders and investors. Those that like to put their ‘ego’ on the first place because “I told you so” or “I saw this last month so the trend must go in this or that direction” will see the results of that mindset in their P/L results sooner rather than later. January was and still is a challenging month, but those are the great opportunities to learn and improve trading/investing skills, as well as trading/investing methodologies.

If anything we believe both our Momentum Investing as well as Trade Alerts methodologies handled January’s volatility extremely well. We are proud about this, and it helps us tremendously avoiding losses as that’s the biggest enemy of our ambitious goal to turn 10k into 1M in 7 years (as per our official Mission 2026).

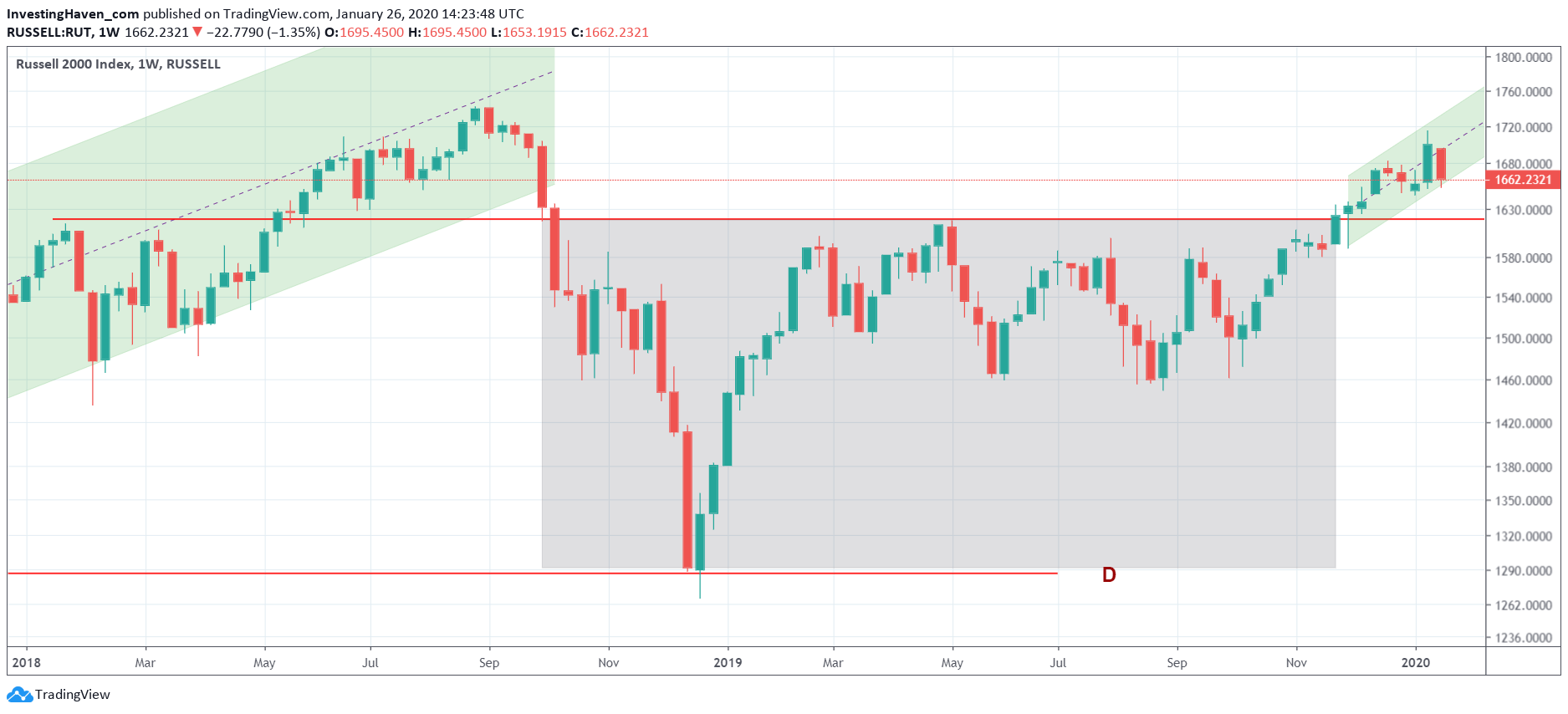

When it comes to our medium term investing portfolio as per our ‘Momentum Investing’ methodology we keep a very close eye on the risk indicator outlined below. It signals indecisiveness. Whether this is exactly a bearish engulfing candle reversal pattern or not is probably not the most important thing to note. The most important thing is the intermarket effect.

We believe this risk indicator also brings opportunities, and we see a very juicy opportunity setting up for the next few months. Read all about it in today’s weekly digest in our Momentum Investing portfolio.

We want to respect the message of the market, and promise to be cautious because of the chart below . Not only do we promise this to our members but more importantly to ourselves. Yes it is easy to be caught up in your own ideas, visions and hypotheses. But successful investors remind themselves every day again of the right priority of thinking: the market first, then the interpretation and somewhere at the last place comes everything related to ‘ego’/ personal thoughts/opinions /and all the rest that is useless when investing.

Disclaimer: InvestingHaven.com makes every effort to ensure that the information provided is complete, correct, accurate and ...

more