Last Week’s Heavy Selling Drives Several Metrics Into Severely Oversold Territory, Not Investors Intelligence Bulls

Last Friday, amidst heavy selling, bulls put foot down near October 2019 lows. By then, several indicators got pushed into grossly oversold territory. Not Investors Intelligence bulls, whose count this week was 41.7 percent.

Since last Friday’s intraday reversal, stocks have been on a rollercoaster ride with an upward bias. The S&P 500 large-cap index opened the week with a 4.6-percent jump on Monday, followed by a 2.8-percent drop on Tuesday and another 4.2-percent surge on Wednesday. With two more sessions to go this week, the index is up six percent. This followed an 11.5-percent collapse last week, which helped push several indicators into grossly oversold territory.

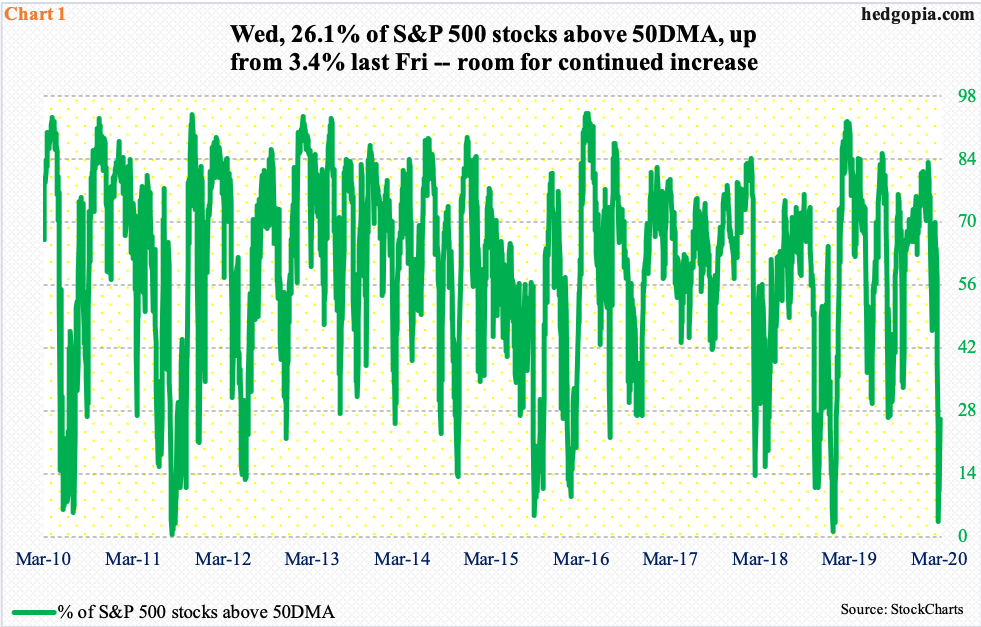

Friday, merely 3.4 percent of S&P 500 (SPY) stocks were above their 50-day moving average – the lowest since early January last year. Back then, amidst a three-month sell-off in the index, the metric bottomed at 1.2 percent on December 24, which laid the foundation for the rally that followed. From that low through the February 19th record high, the index shot up nearly 45 percent!

Wednesday, 26.1 percent of S&P 500 stocks were above the 50-day (Chart 1). There is a long way to go on the upside – and longer to get into overbought territory.

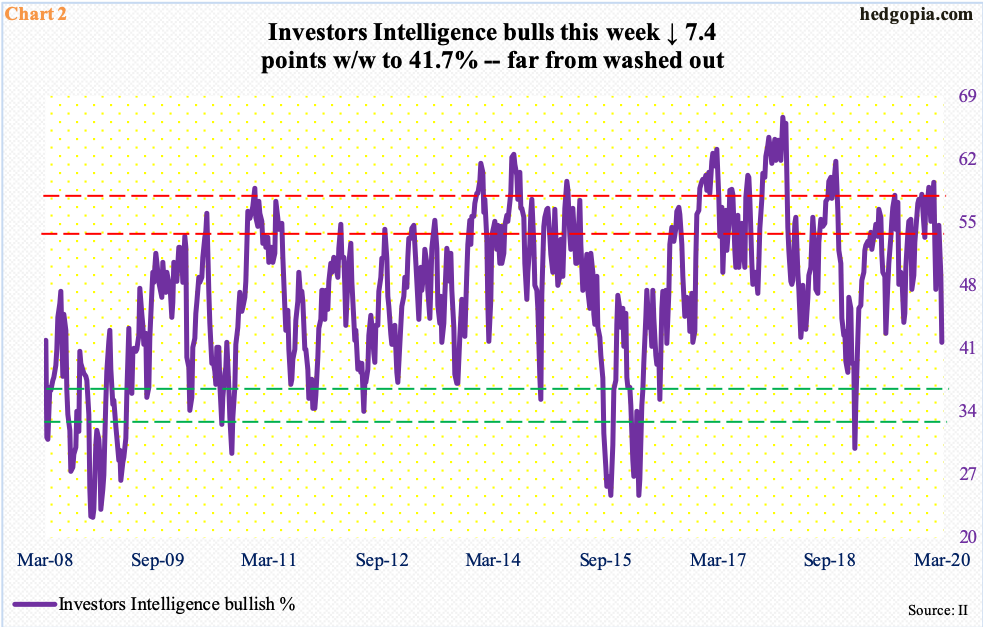

At the same time, there were several other indicators during last week’s rout that were not remotely as washed out. Investor sentiment measured by Investors Intelligence, for instance.

This week, bulls dropped 7.4 percentage points week-over-week to 41.7 percent, bears rose 1.2 percentage points w/w to 20.4 percent. In the week to January 21, bulls reached 59.4 percent, which was the highest since 61.8 percent as of October 3, 2018 (Chart 2). From that frothy level, bulls have come down quite a bit over the past seven weeks but remain high.

In the week ended January 2 last year, bulls dropped to 29.9 percent and bears rose to 34.6 percent. This, too, laid the foundation for the subsequent rally in the S&P 500. This is clearly not the case now. Several times in the past, bulls dropped to low- to mid-30s, which is suppressed enough to then act as a tailwind for stocks.

Viewed this way, last Friday’s intraday low of 2855.94 on the S&P 500 probably does not represent a major bottom – along the lines of the low of December 2018. Nonetheless, as long as 2800-plus is not breached, bulls deserve the benefit of the doubt. Off of that low, the index (3130.02) already rallied 9.6 percent.