Kate Spade Is An Interesting Turnaround Story, But Tapestry Is Now A Sitting Duck

The evolution of luxury retail during the last decade

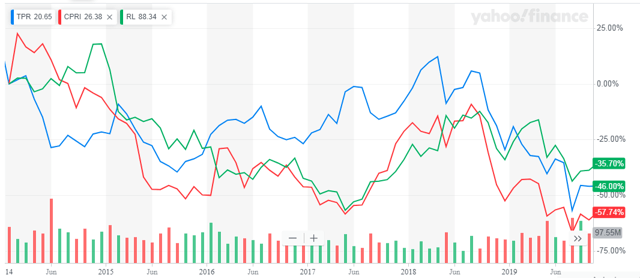

After 2014, luxury brands like Michael Kors (CPRI), Coach (TPR), and Ralph Lauren (RL) have gone through some tough times. The landscape changed. Far behind was the post-2007 crisis that revealed to be the perfect place to grow accessible luxury brands through heavy discounting.

Graph 1 – Stock price for Capri, Tapestry, and Ralph Lauren (April 2014 to present)

(Source: Yahoo Finance)

Against the current backdrop, being a standalone brand won’t cut it for several reasons. The biggest problem relates to the stagnant growth that followed in 2014. One can argue that, as consumer psychology changed after the initial post-crisis years, buyers started to look beyond discounting when selecting luxury brands. Companies that wanted authentic, valuable, brands had to stop discounting. The boom years were over.

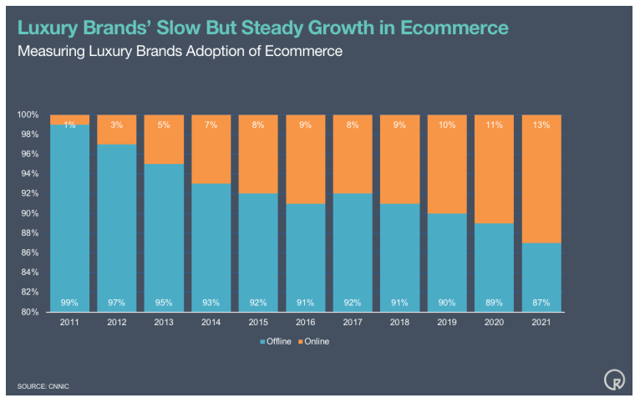

Additionally, the post-2014 years saw Amazon (AMZN) emerging as a threat to all types of retailers. Converting to digital commerce became critical for luxury brands. To scale the investments in the distribution infrastructure (eCommerce and brick-and-mortar) in the absence of growth, the alternative is M&A.

(Source: financescp.net)

That’s the reason why, for instance, Michael Kors went after Jimmy Choo and Versace, while Coach acquired Stuart Weitzman and Kate Spade. The answer seemed to be that big standalone brands would start conglomerates by acquiring smaller brands in order to survive. And, that’s the strategy that they’ve been following. Several companies have followed that recipe. Now, the big question is if those big brands are capable of turning into well-run conglomerates.

Transforming luxury brands into conglomerates

As mentioned, Coach was one of the brands whose management team decided to transform into a conglomerate. Now, to run a conglomerate, the necessary skill set is different, from the one necessary to run a luxury accessories brand.

In this case, there is one common denominator: luxury brands. The conglomerate is supposed to identify, acquire, and manage a set of luxury brands. However, brands have different ethos and identities, and the conglomerate management team has to be sensitive to that fact. You can’t just copy the Coach’s recipe and apply it blindly to Kate Spade. Those are very different brands appealing to different consumers at different price points.

Therefore, what can a conglomerate offer to the brands? We see three main things: dilute eCommerce platform costs, offer scale in underdeveloped countries, and cross-sell items in retail stores.

Tapestry, like most other luxury retailers, is trying to fend off Amazon’s threat to their retail business. And, the best way is to have an in-house eCommerce platform. Developing a good online experience, and efficient logistics, for eCommerce is hard and costs money. If you have an extra two or three brands, you can dilute those costs through economies of scale.

Scaling international operations is another opportunity. For instance, Kate Spade has most of its market exposure in the US. However, for Coach, China has been the growth driver for the last couple of years. Using Coach’s network to help Kate Spade developing a footprint in the Chinese market will be a very interesting opportunity.

Where does Tapestry stand?

Tapestry is trying to dilute eCommerce costs while scaling Coach’s international network retail knowledge to the other brands. In theory, the strategy is good enough to suggest potential long-term growth. If the experience that Coach managers have, about growing an international retail footprint, is scaled to the other brands, then, we have exciting growth potential.

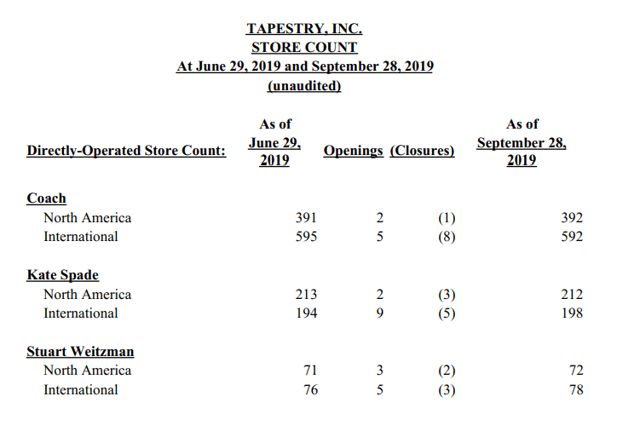

(Source: Tapestry 20Q1 8K)

Looking at the table above, we can see that Coach has roughly 1.5 international stores for each US-based store. On the same metric, Kate Spade has 0.93 international stores. There is huge potential to grow KS’s international retail footprint. The same goes for Stuart Weitzman. If nothing else, that should be enough to justify the conglomerate setup.

Growing international retail is a strategic imperative for all the brands, but it doesn’t seem the like only one. When Tapestry acquired Kate Spade, it changed the management team by bringing Anna Baskt, from Michael Kors, to be CEO, and Nicola Glass, also former MK, to be Creative Director. That means Tapestry wants to have a saying in the direction of each brand. I am not saying that they want to influence the artistic direction, it’s more about the price positioning.

Again, that is all about applying Coach turnaround playbook to the other brands. In KS’s case, we are talking about reigning in years of sales driven by discounting. That, in part, explains the -16% sales comps. If we look at the company’s total sales, the picture is less grim, with a 6% decline. These are the same symptoms that Coach experienced during its turnaround.

Final Thoughts

Right now, all eyes are on Kate Spade’s performance. I’ve seen this horror movie before. Wall Street is going nuts about high-teens comps sales declines, which are part of the pricing cure. If we look at non-GAAP 20Q1 operating earnings (excluding some impairments), we’ll see that Kate Spade still has around 6.3% operating margin. A higher weight of full-price (plus international store expansion) is partially offsetting the US sales decline. In due time, the US will likely stabilize, the international expansion, and better pricing-mix will drive sales growth and margin improvement.

However, the current stock price at around ten times forward earnings offers some room for surprises. The fact that the company is trading around 2.5 times its book value, and 1.3 its sales, against the 5-years averages of 3.7 and 2.2, respectively, makes it a sitting duck, in my opinion. One might argue that this is the best time for other conglomerates to try to swallow the company. And, the same rationale is valid for Capri.

Therefore, a new set back in one of the brands might result in an outsider trying to buy the company. A couple of things might happen. As mentioned before, an established conglomerate coming to the scene, trying to buy the company. Another possibility is one activist investor buying a stake in the company to force a break-up. Or even a merger with other companies in the same situation. Capri comes to mind.

In my view, the prospects of the current turnaround succeeding are good. The low valuation offers a theoretical floor to the losses, mainly, because a slump in the share price will, likely, attract some M&A action. Therefore, I remain positive in this company.

Disclosure: I am/we are long TPR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more