JPMorgan Warns Crowded Trades And Euphoric Consensus Are The Biggest Threats For Markets

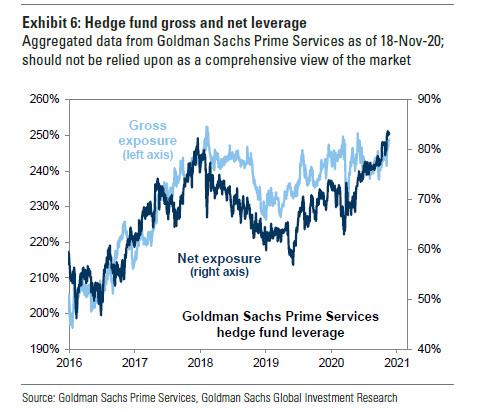

Last month, during our 13-F postmortem, we showed that just as hedge funds had gone all-in stocks, or rather a handful of momentum stocks, resulting in record gross and net hedge fund leverage...

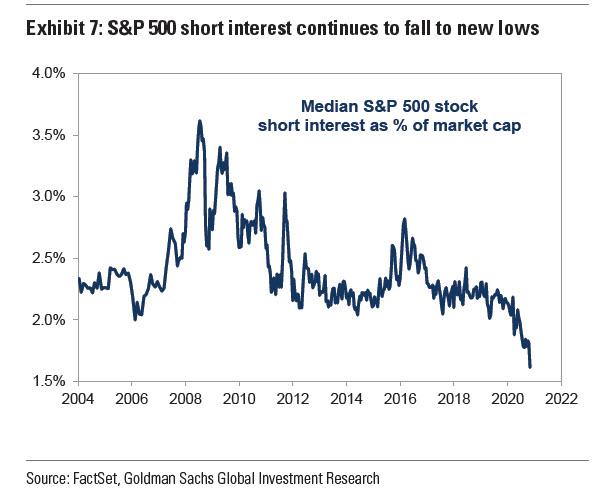

This also meant a record drop in S&P short interest as any remaining bears have been ritualistically slaughtered in the last few months.

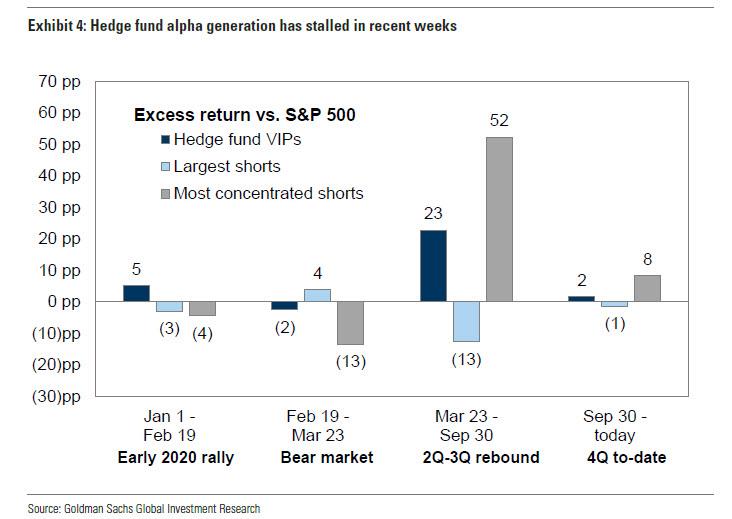

Hedge funds did what they normally do, which is to organize low lit "idea dinners" and agree to all jump in the same handful of stocks while at the same time shorting a different group of stocks (after all they have to at least pretend to hedge otherwise bye bye 2 and 20). Unfortunately, that was a terrible decision in Q3 when the most popular longs jumped but the most popular shorts soared twice as much.

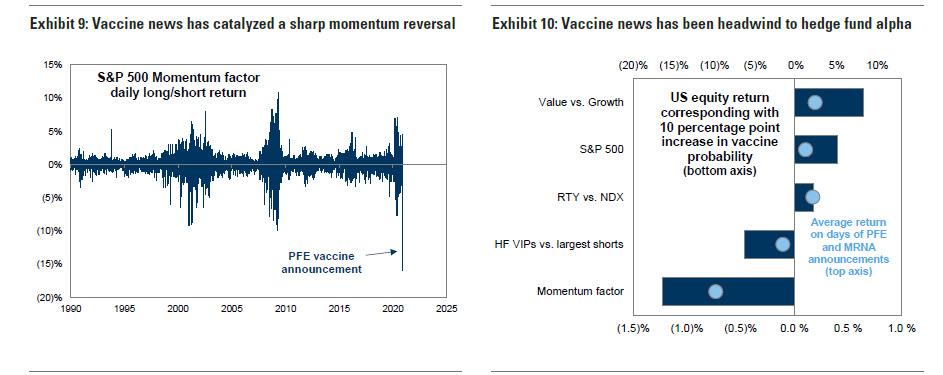

This led to another quarter of major losses for most hedge funds in Q3. It proved to be an even worse decision to pile into the same handful of momentum VIPs on Nov. 9 when the Pfizer vaccine led to a record reversal in momentum stocks, and catastrophic losses for what until then had been the best strategy of the year.

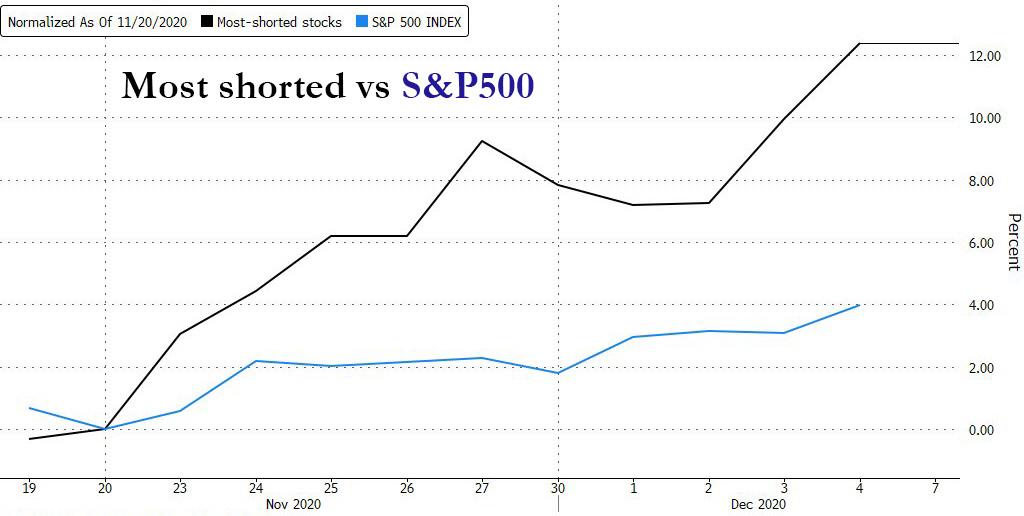

At the same time, the unprecedented short squeeze continued steamrolling over the vast majority of hedge funds, but much to the delight of our readers especially those who read our Nov. 20 article "Here Are The 50 Most Popular And 50 Most Shorted Hedge Funds Stocks", in which we said that "as usual, our advice is to go long the most hated names and short the most popular ones - a strategy that has generated alpha without fail for the past 7 years, ever since we first recommended it back in 2013." Well, after we wrote that, the most shorted stocks have soared another 12%, outperforming the S&P 3x, confirming that the best strategy on Wall Street is to do the opposite of what Wall Street consensus is doing.

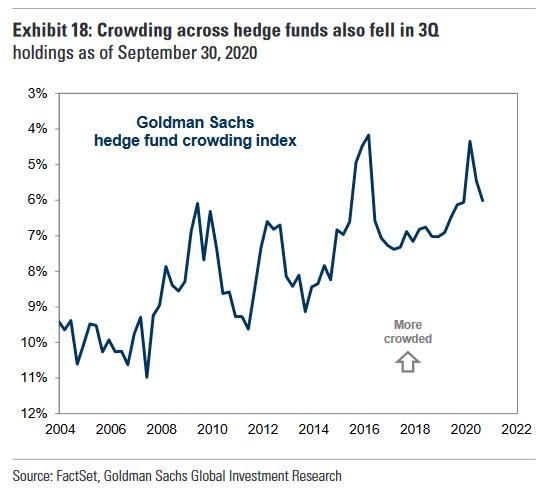

Even though it should be painfully obvious by now, what the above data show is that hedge fund position crowding is now at or near all time highs.

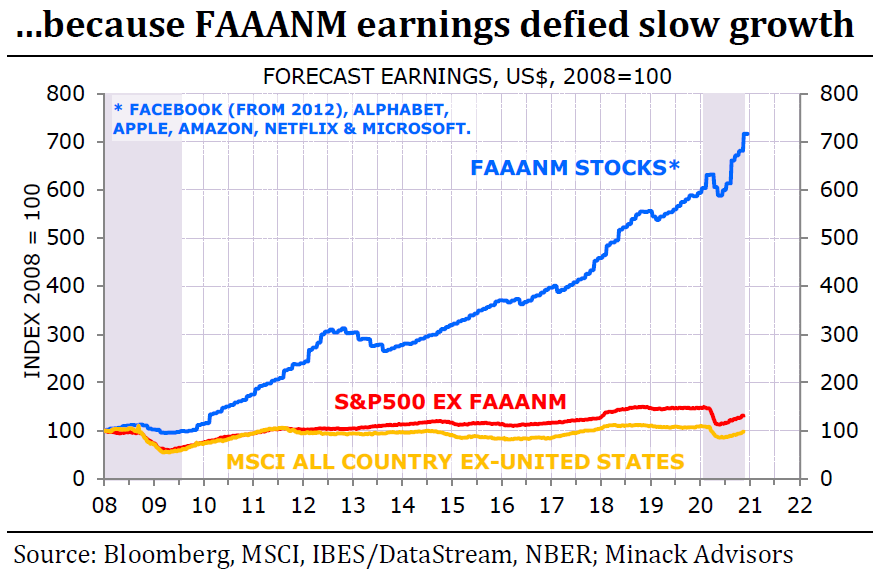

It's simply because in a world where just five stocks have generated the vast majority of returns (and profits), hedge funds don't really have a choice but to crowd.

So in light of this recent development, where there are effectively no original ideas left in the hedge fund world, and where beta-chasing crowding has emerged as the only alternative to a centrally-planned market, the Chief Investment Officer of NN Investment Partners said what we have been saying for years, namely that one of the biggest risks to the bullish equity market consensus for next year is that investors are all leaning the same way and market overcrowding could stall the rally early on.

Valentijn van Nieuwenhuijzen, who helps to manage NN IP’s 295 billion euros ($356.09 billion) of assets, told Reuters Global Investment Outlook Summit, 2021 that he broadly agrees with the consensus on overweight in equity and risk assets going into 2021 - which ironically is also the joke - as he merely contributed to the very same euphoria crowding he is warning against, admitting that "there could be problems during the year."

"We are strong believers in the evolution of markets and behavior of our peers is something we monitor very closely,” he said. "If we think consensus in thinking is changing into a large consensus of behavior, with everyone rolling into equities and the same type of strategies, that could create more volatile markets somewhere late Q1 or early Q2."

Well Valentijn, if not ours, then take Goldman's word for it: crowding has rarely been greater, and not just among hedge funds who are all chasing the same handful of growth outperfomers, but also on Wall Street, where consensus forecasts are almost uniformly for another gain of 10% in the S&P500 next year as COVID-19 vaccines are rolled out and the global economy recovers while massive monetary and fiscal policy supports persist.

Then again, even if things turn south, like an obedient, Pavlovian dog, Valentijn falls back to the old maxim that central banks will always be there to save trend-followers like him: “Central banks will be super committed,” he said. "With massive output gaps, I doubt that over a 3-5 year horizon there will be any change in the picture of debt levels or inflation."

He then continued to spout the same consensus tripe that is the basis behind all the market crowding he is warning against: stay away from bonds, tech stocks are at risk from continued reflation rotation, emerging markets are the bomb (more here).

And while there was absolutely no signal in all of Valentijn's "noise", his observation that crowding is becoming a major issue - as we have been saying for years - was the basis of the latest note from JPM's Nick Panigirtzoglou, author of JPMorgan's popular Flows and Liquidity newsletter, warns that crowding, or rather as he puts it "consensus" could be the biggest risk in the coming year.

Summarizing his client conversations over the past two weeks regarding the 2021 outlook, Panigirtzoglou writes that a clear consensus has emerged:

- a bullish view on equities overall into 2021,

- OW non-US vs. US equities;

- OW value and cyclical equity sectors over growth oriented sectors;

- OW EM assets;

- short the dollar;

- short duration and steepeners in US and Euro rates;

- long credit including corporate, EM and peripheral sovereign credit;

- long commodities including copper to play China’s cyclical upturn and oil to play a global cyclical upturn;

- long gold; and long bitcoin as short dollar proxies.

He goes on to say that "the last time we recall such strong consensus was at the end of 2017/beginning of 2018 within our discussions about the 2018 outlook. In fact, the consensus trading themes at the time regarding the 2018 outlook were very similar to the current consensus themes." As a reminder, what happened then is the January melt-up which culminated in everyone selling vol, resulting in a short-circuit in the VIX complex, with all inverse VIX ETFs imploding spectacularly in Feb 2018, leading to a brief but painful market correction.

Drawing parallels to the last time we saw such unbridled euphoria three years ago, the JPM quant then warns that "unfortunately, the consensus view rarely plays out in its entirety as 2018 reminds us" adding that "for asset allocators, what is thus important is scale exposures to avoid an overly concentrated portfolio."

Yet which of the above nine consensus trading themes should one have greater - and less - exposure to? One way of choosing among them is by limiting exposure to the most crowded ones. While we will let readers do their own homework on most of the above themes, this is what the JPM strategist writes about the crowded "long equities" position as we enter 2021:

- Near-term, we find pockets of position overextension that make this theme rather crowded and prone to correction into January. First, momentum traders are very long equities at the moment across most major equity indices. This is shown in Figure 1 which depicts the average of our short and long lookback period momentum signals for the S&P500, Nasdaq, Eustostocc50 and Nikkei indices. Most of them are close to the 1.5 std evs threshold we typically associate with a high risk of mean reversion flows kicking in. In fact, our momentum signal for Eurostoxx50 has already started decaying after exceeding the 1.5 stdevs threshold in November. A similar backdrop was seen at the beginning of June this year ahead of the June FOMC meeting, and further back during the beginning of this year and the beginning of 2018. The December 16th FOMC is only ten days away and the risk is once again that the Fed disappoints equity investors.

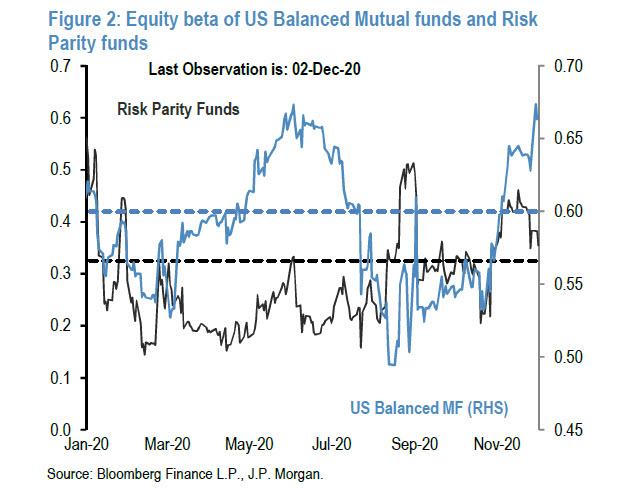

- Second, multi asset investors such as balanced funds and risk parity funds are rather OW equities (Figure 2) creating the risk of negative rebalancing flows into year end. We had previously estimated in our November 20th publication that balanced mutual funds, a $7tr universe, would have to sell around $160bn of equities globally before year end to revert to their target 60:40 allocation. Similarly, the strong equity market rally since the beginning of November has given rise to additional $150bn of potential equity selling into the end of December by those pension fund entities that tend to rebalance on a quarterly basis.

To summarize the above warnings, the "Long equities" theme is not only the most crowded it has ever been among hedge fund sporting record gross and net leverage, but also extremely crowded tactically with elevated positioning by momentum traders and rebalancing flows by balanced mutual funds and pension funds all of which poses "downside risk into year end."

But since one can't get away from the herd - even when one is warning about the risks of running with the herd (if one wants to make money by selling ideas to the herd) - JPM caveats that this time is different to the euphoria beginning of 2018 when we last saw such massive, one-sided positioning, and so JPM writes that its "medium term equity positioning indicator based on the implied equity allocation of non-bank investors globally stands at average rather than overbought levels."

Which means that, just like Morgan Stanley, JPMorgan's advice is to mind the sharp imminent correction but to promptly buy the dip, i.e., "any equity correction in the near term would represent a buying opportunity as in our opinion we are only in the middle of the current bull market."

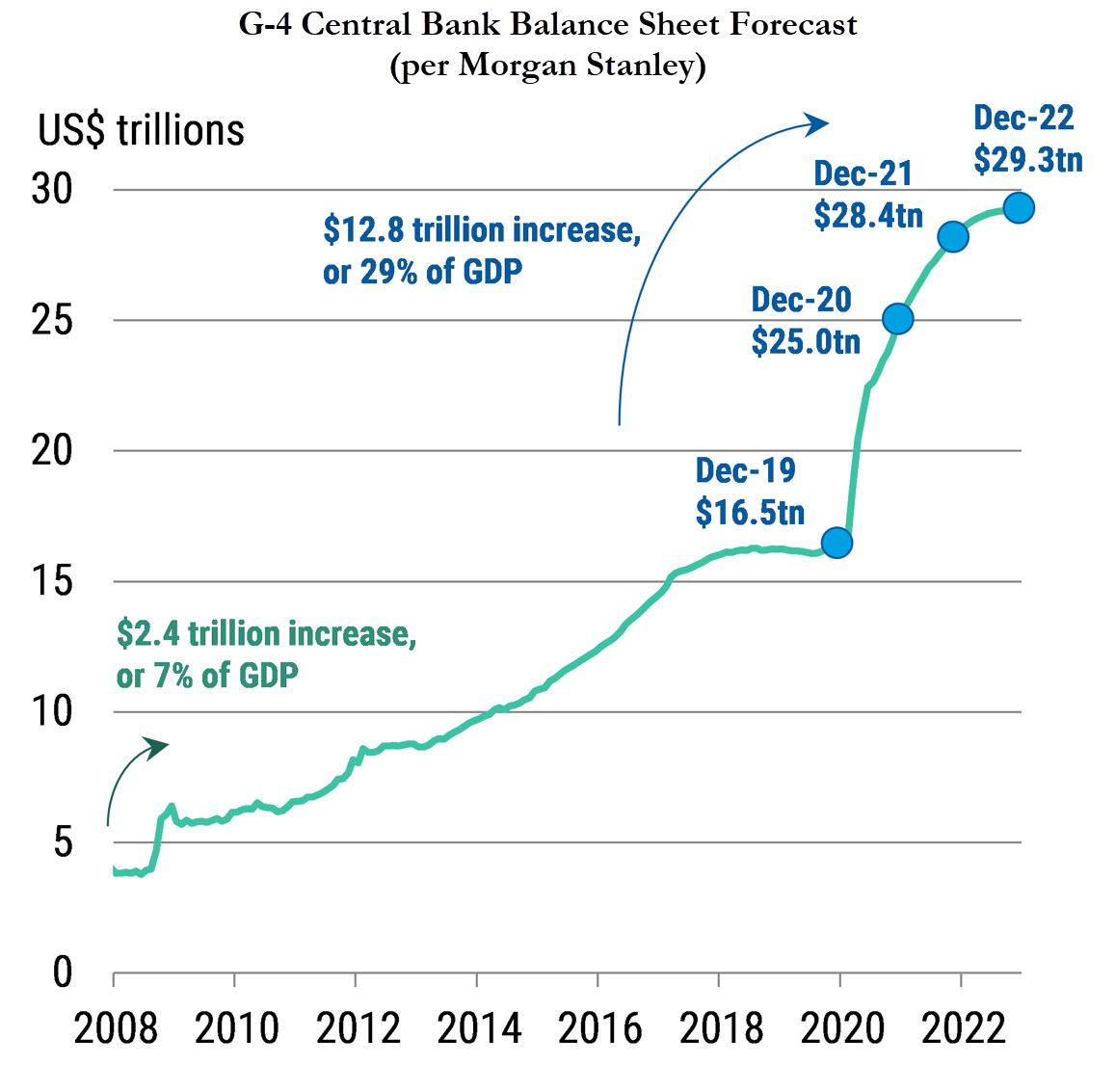

Considering that we are now in the phase where there is no stopping the money helicopter that is central bank balance sheets JPMorgan is probably right that any dips from this point on have to bought ahead of the coming hyperinflation at least until such time as fiat currencies and conventional economics finally lose all credibility, which will mark the merciful end of this Sovietization of what was once called the "market."

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more