JPMorgan Is Now Bearish, Bullish And Neutral On Stocks All At The Same Time

At a time when markets have never been more broken and disconnected from reality (as BofA showed earlier), it is hardly a surprise that the largest US commercial bank, which appropriately enough was just surpassed in market cap by Tesla - which has never turned a true GAAP profit in its history - has two diametrically opposite views on the market, on one hand bullish, and on the other hand bearish.

Instead of delving the logic behind each "analysis" - since it is meaningless to analyze anything in this broken "market" where the only thing that matters is what the Fed is doing or will do next - we will content ourselves with merely laying out the various components of this theater of the absurd.

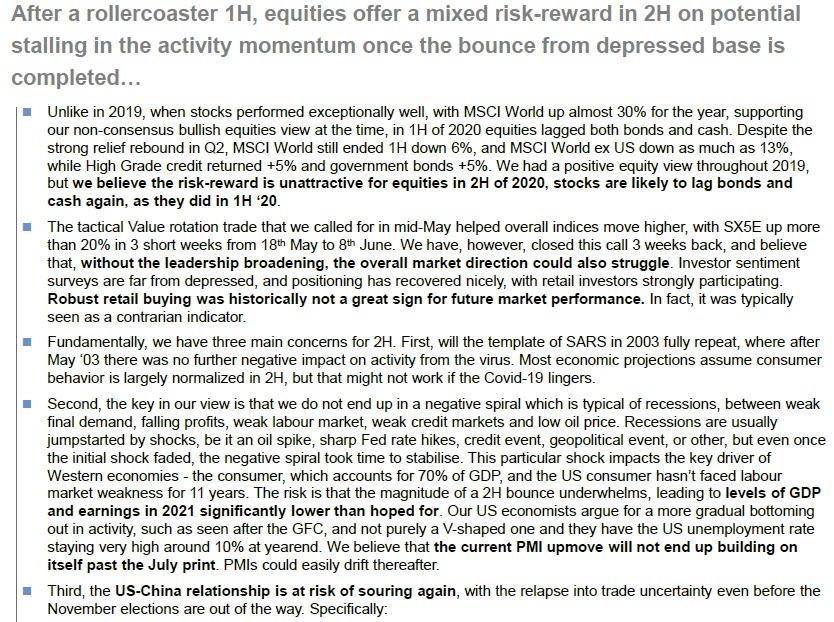

First, as first profiled here earlier this week, here is an excerpt from a report written by JPM's head of equity strategy, Mislav Matejka, published just 4 days ago on July 6, 2020. Here is the punchline: "We had a positive equity view throughout 2019, but we believe the risk-reward is unattractive for equities in 2H of 2020, stocks are likely to lag bonds and cash again, as they did in 1H ‘20." To justify his bearish slant, Matejka gives the following three main concerns for 2H:

- First, will the template of SARS in 2003 fully repeat, where after May ‘03 there was no further negative impact on activity from the virus. Most economic projections assume consumer behavior is largely normalized in 2H, but that might not work if the Covid-19 lingers.

- Second, the key in our view is that we do not end up in a negative spiral which is typical of recessions, between weak final demand, falling profits, weak labor market, weak credit markets, and low oil price. Recessions are usually jumpstarted by shocks, be it an oil spike, sharp Fed rate hikes, credit event, geopolitical event, or other, but even once the initial shock faded, the negative spiral took time to stabilize. This particular shock impacts the key driver of Western economies - the consumer, which accounts for 70% of GDP, and the US consumer hasn’t faced labor market weakness for 11 years.

- Third, the US-China relationship is at risk of souring again, with the relapse into trade uncertainty even before the November elections are out of the way.

(Click on image to enlarge)

Ok, so... bearish? Got it.

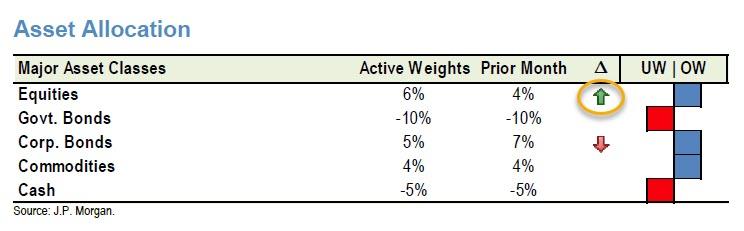

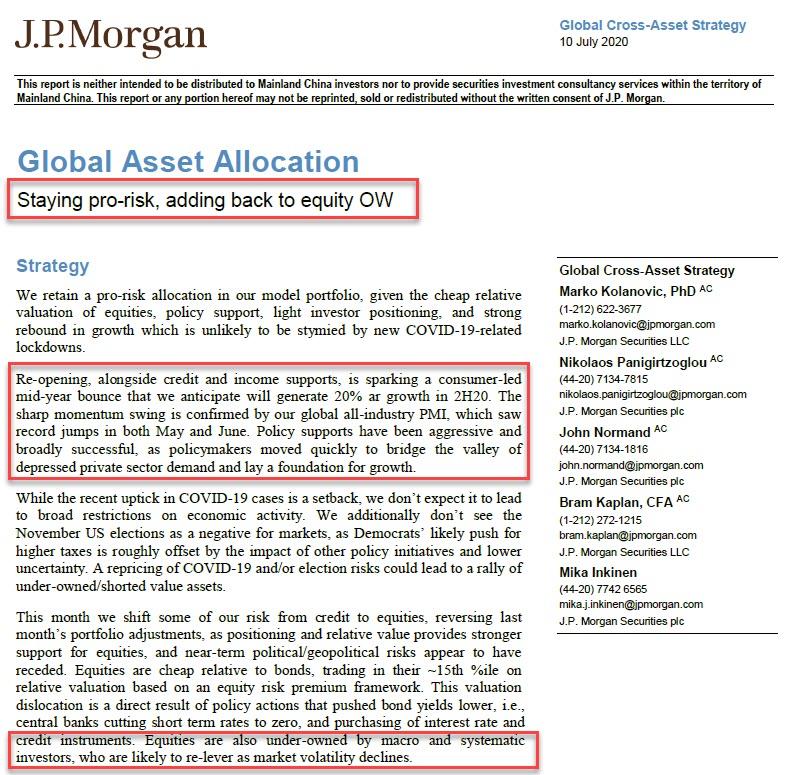

Well, not so fast, because just three days later, JPMorgan's quant permabull Marko Kolanovic took advantage of today's market uptick to release a note in which he reached the diametrically opposite conclusion: he reassigned equities back to Overweight!

(Click on image to enlarge)

Wait, what? Surely that has to be a typo after the above report? Sadly no. Here, see for yourselves:

(Click on image to enlarge)

So from the very same firm we now have two outlooks one the second half, the first:

... we believe the risk-reward is unattractive for equities in 2H of 2020, stocks are likely to lag bonds and cash again, as they did in 1H ‘20."

... and then this:

We retain a pro-risk allocation in our model portfolio, given the cheap relative valuation of equities, policy support, light investor positioning, and strong rebound in growth which is unlikely to be stymied by new COVID-19-related lockdowns. Re-opening, alongside credit and income supports, is sparking a consumer-led mid-year bounce that we anticipate will generate 20% growth in 2H20.

And in case there was some confusion, in the first report, JPM's Matejka sees "stocks likely to lag bonds and cash" while in the second, Kolanovic says "Equities are cheap relative to bonds, trading in their ~15th %ile on relative valuation based on an equity risk premium framework."

Don't think about this too much or, as Lewis Black says "blood will shoot out your nose!"

If that was enough, we would say thanks JPM, great advice if not for investing then certainly for covering your own ass in a world where stocks may go up... or down, and you will be able to say you were right in either case.

But noooo, because shortly after Kolanovic published his note, yet another JPM strategist, John Normand published his own weekly note, "The J.P. Morgan View", in which he basically says don't be either long or short stocks in general, but rather trade on a sector by sector basis, even though as the report title suggests, "The merits of underweighting US assets in global portfolios due to the second wave and elections", one would be well suited with being - well - underweight US assets (i.e., the opposite of what Kolanovic said just a few hours earlier).

(Click on image to enlarge)

What does this third JPM report recommend? Well, "rather than underweighting US assets broadly, there is better risk-reward in owning Tech/Quality to hedge the second wave." In other words, stay neutral the market, but go long the most overbought sector in history. That... "or just staying long Gold."

In other words, JPM is both bearish and bullish on stocks going into the second half, and just for kicks, it also neutral the overall market, as it believes that while there are merits to being underweight US stocks now, a better trade would be to just own the most overbought sector, or failing that, just buy gold.

What to make of all this? Well, in the span of just 4 days, JPM has recommended the entire universe of possible investing decisions and outcomes, from ...

... the risk-reward is unattractive for equities in 2H of 2020, stocks are likely to lag bonds and cash again, as they did in 1H ‘20.

... to:

retaining a pro-risk allocation in our model portfolio, given the cheap relative valuation of equities, policy support, light investor positioning, and strong rebound in growth... Re-opening, alongside credit and income supports, is sparking a consumer-led mid-year bounce that we anticipate will generate 20% growth in 2H20.

... and finally to:

... investors often ask whether US Equities and the dollar should be underweighted in global portfolios now... as much as the risk scenarios are clear, managing the second wave and elections is better done selectively rather than broadly underweighting US assets.... there is better risk-reward in owningTech/Quality to hedge the second wave, only favoring North Asian Equities and FX to hedge the virus plus a Democratic sweep, or just staying long Gold.

To summarize: cash and bonds will outperform stocks in H2 as the risk-reward is unattractive for equities ... or maybe a consumer-led bounce will generate 20% growth in H2 so buy stocks... or actually don't do anything at the "broad" level but just buy tech stocks... or maybe just stay long gold.

Thanks, JPMorgan - that's some truly "wide-reaching" if completely meaningless advice, and while nobody can figure out what JPM is actually recommending, we are confident that in 3 months when whatever happens happens, JPM will boldly say that it "called it."

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more