JPMorgan Finds That Shorts Across The Globe Have Capitulated

Three months ago, shortly after the March crash bottom, JPMorgan's strategist Nikolas Panigirtzoglou predicted that stocks would rise, among other things, because there was a massive short overhang, one which would squeeze prices higher as the Fed injected liquidity, providing a secondary thrust to the market.

Then, one month ago, in the June 16th version of Flows and Liquidity, the JPM quant doubled down by asking if there is a regional bias to the shorting activity, namely "how much higher is the short base outside US equities?”, arguing that the regional short base backdrop favored non-US equities, in particular European stocks, something which subsequent price action confirmed.

The argument at the time was that while the post-virus short base in individual US stocks had been largely covered, short covering had looked a lot less advanced outside US stocks. In particular, less than a third of the previous short base that had opened up on Euro area and UK stocks during Feb/Mar had been unwound by mid-June. Across EM stocks, around half of the previous short base had been unwound by mid-June.

However, in his latest observation on this topic, Panigirtzoglou writes in his latest weekly F&W report that "this previous advantage for non-US stocks appears to have been diminished as short covering advanced."

Indeed, as the following four charts show, the bulk of the previous short base that had opened up during Feb/Mar across Euro area, UK and Japanese stocks has been largely normalized. It is only in EM stocks that there is some remaining short base, around 20% of that opening up during Feb/Mar, left to be covered.

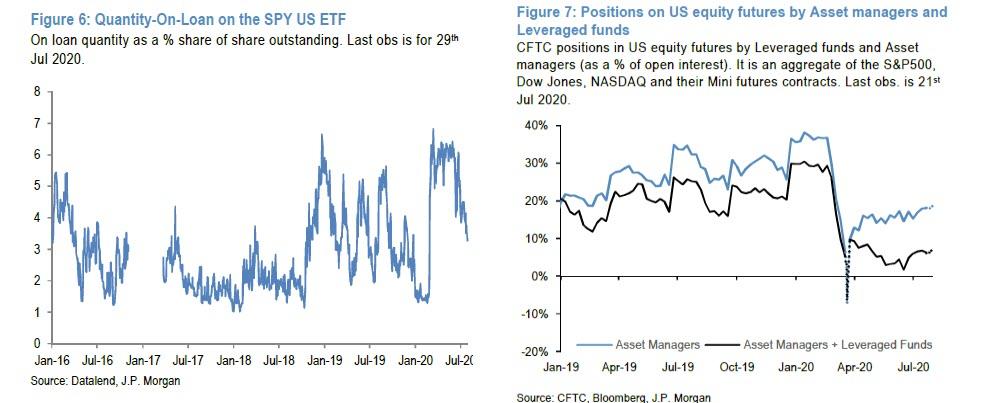

To JPM, this raises the chance that the past two months outperformance of non-US vs. US equities is close to being exhausted "and that going forward US stocks are more likely to resume their outperformance trend." Why the pro-US bias? Because as the JPM strategist noted before, there is a modest remaining short base to be covered in US stocks at an index level even as the previous short base at individual stock level has been more than fully covered. For example, the short base in important US equity ETFs such as the SPY ETF remains above pre-virus despite recent declines as shown in the chart on the left...

... while the right and final chart shows that the positions of asset managers and leveraged funds in US equity futures remain low and well below pre-virus levels.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more