JPMorgan Estimates Up To $316 Billion In Forced Month-End Selling

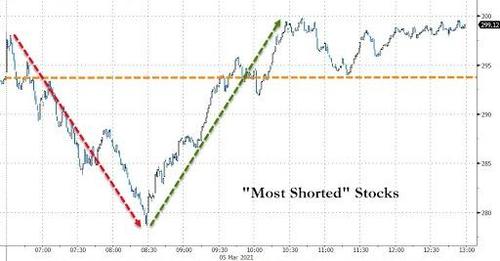

Friday's post-European close ramp notwithstanding, stock markets, and especially growth stocks, had a rude awakening this week as rising rates finally hammered high duration stocks, shown in this chart which we have been posting ever since November to warn readers of who will get hammered first.

For those who hope that the worst is now over, JPM has some bad news.

In one of his latest Flows and Liquidity reports, JPM quant Nick Panigirtzoglou writes that as we approach quarter-end, the equity rebalancing flow question is resurfacing in client conversations. As we notes, "the equity rally and the bond sell-off during the current quarter is naturally creating a pending rebalancing flow for multi-asset investors away from equities into bonds for pension funds and balanced mutual funds. How much of equity/bond rebalancing flow should we expect into current quarter-end?"

To answer this question, the Greek strategist applies a familiar framework and looks at the four key multi-asset investors that have either fixed allocation targets or tend to exhibit strong mean reversion in their asset allocation. These are balanced mutual funds, such as 60:40 funds, US defined benefit pension plans, Norges Bank, i.e. the Norwegian oil fund, and the Japanese government pension plan, GPIF.

For those curious about the details, below is a more detailed summary of the considerations behind the four key investor classes ahead of month- and quarter-end.

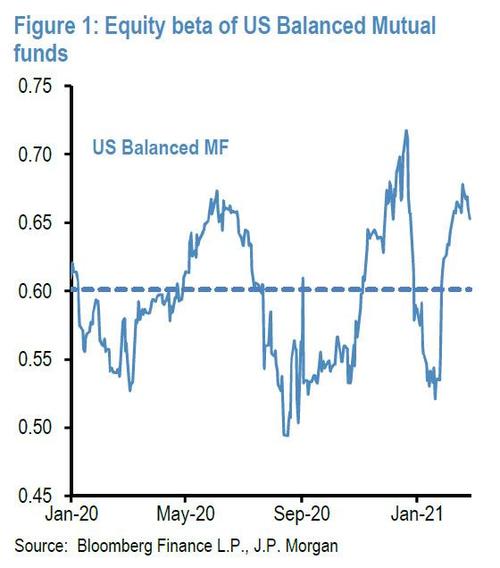

1. Balanced mutual funds including 60:40 funds, a close to $7.5tr AUM universe globally, tend to rebalance over 1-2 months or so. The lesson from last Nov/Dec is that balanced mutual funds exhibit flexibility and they do not necessarily rebalance every single month. During the previous quarter, they appear to have postponed rebalancing for Nov-end or Dec-end and to have waited until January to de-risk/rebalance. JPM believes that funds de-risked in January, as a result of the tumble in balanced MFs equity beta, and since it would have been too soon to rebalance again in February, the quant believes that they have likely postponed any pending rebalancing to March.

Assuming they were fully rebalanced at the end of January, which is a reasonable hypothesis given the reduction in their betas in January and by taking into account the performance of global equities and bonds since then, JPMorgan estimates around $107bn of equity selling by balanced mutual funds globally into the end of March in order to revert to their 60:40 target allocation.

2. US defined benefit pension plans are a similarly big universe with AUM of around $8 trillion. They tend to rebalance more slowly over 1-2 quarters or so. Assuming they were fully rebalanced at the end of December, and by taking into account the QTD performance of US equities and bonds, JPM expects that the pending equity rebalancing flow by US defined benefit pension plans into the current quarter-end is negative at around -$110 billion: "In other word, US defined benefit plans would need to sell $110bn of equities towards the end of the current quarter and buy a similar amount of bonds for their allocations to revert to end-December levels." Making matters worse, and given the improvement in their funded ratios, Panigirtzoglou notes that it is possible that they would seek to take advantage of this improvement to de-risk, "which could pose some upside risk to this estimate."

3. Norges Bank, a $1.3 trillion AUM entity as at the end of 2020, is calculated to see negative $65 billion in rebalancing (out)flows. This, according to JPM, incorporates also the fact that the Norwegian government looks set to continue to rely on net transfers from its fund to finance part of its budget deficit and assumes that the equity weight would be returned to its target of around 70%. In the second half of 2020, the Norges Bank allowed its equity weight to increase to nearly 73%, and in the event it would simply seek to keep its equity weight unchanged at 73% would imply around $22bn of equity sales, which JPM thinks of as a lower bound estimate.

4. The Japanese government pension plan, or GPIF, a $1.7 trillion AUM entity, is also set to sell: JPM estimates that the pending equity rebalancing flow by the GPIF into the current quarter-end based on current equity and bond returns is also likely negative at around $34 billion.

Putting these together, we get:

- Mutual -$107BN

- Defined Pension -$110BN

- Norges Bank -$65BN (could be -$22BN)

- GPIF -$34BN

... a grand total of $316BN.

To be sure, this number will likely be lower following last week's selloff which followed the original JPM analysis, and may be some $40BN less based on assumptions about forced Norwegian selling, we are still talking about selling in the $100BN+ range in the days before quarter end, which is why JPM concludes that "In all, we see some vulnerability in equity markets into quarter-end from pension funds entities as well balanced mutual funds selling equities and buying bonds to rebalance towards their target equity/bond allocations."

And while JPM's last forced selling forecast was a dud, with the bank's Nov 2020 prediction of a similar number ($310BN) in year-end selling never materializing (as JPM now acknowledges) and stocks shooting higher by the end of last year, the reality this time is that with markets suddenly far more jittery many whale investors will not risk testing if JPM is wrong twice in a row and may simply frontrun the potential selling, creating a self-fulfilling prophecy as fears of possible selling spark waves of actual selling. The only question we have is when does the frontrunning officially begin?

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more