JPMorgan: A Top Quality Stock For An Attractive Valuation

You don't need to reinvent the wheel in order to do well in the stock market over the long term. Far from that, a simple and straightforward investment thesis can be particularly effective. JPMorgan (JPM) is a top-quality stock trading at attractive valuation levels, and this can be a sound strategy for superior returns going forward.

A Top-Quality Player

JPMorgan is the biggest US bank based on deposits and revenue. The company is also the largest issuer of credit cards, and it leads the industry in investment banking. In addition to this, JPMorgan has a wide global presence in trading services all over the world.

Brand recognition, scale, and market leadership are key sources of competitive strength for the company. Access to low-cost funding generates superior profitability. Besides, JPMorgan can offer more services to clients, which increases revenue per dollar of assets.

A large percentage of the costs of doing businesses for banks are relatively fixed in comparison to revenue, so a big revenue base has a positive impact on profitability for a market leader such as JPMorgan.

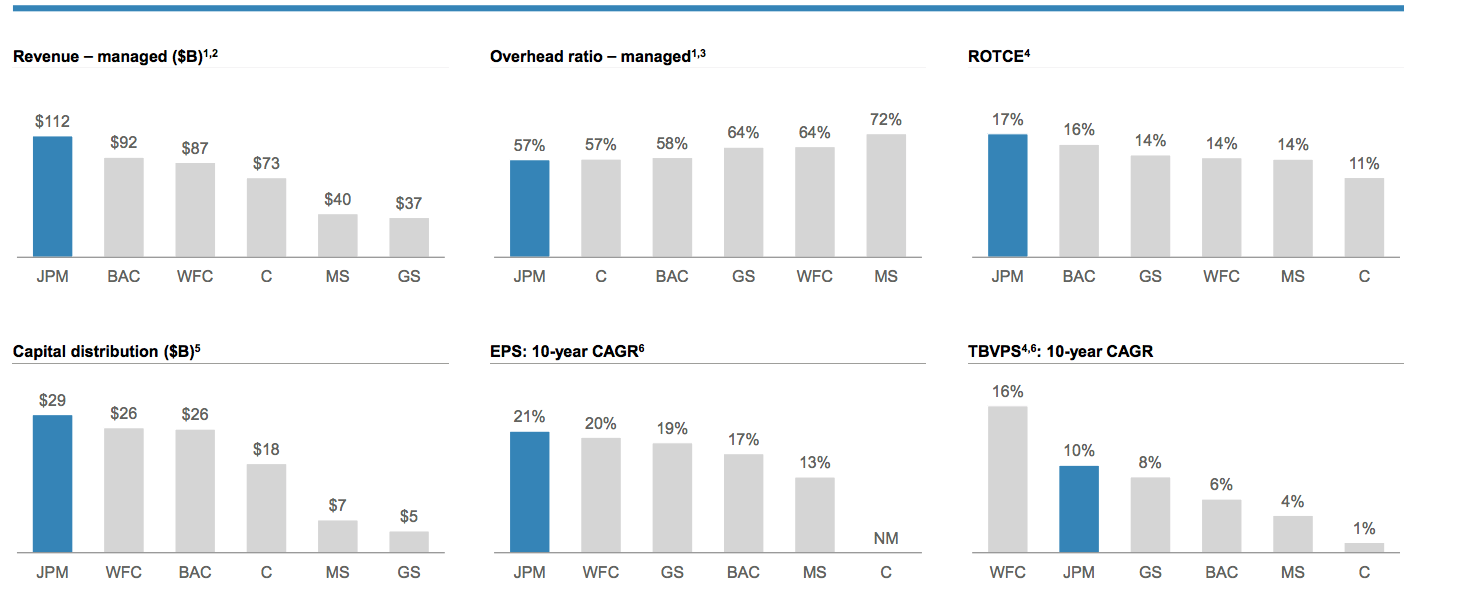

In terms of financial performance, JPMorgan has outperformed rivals such as Wells Fargo (WFC), Bank of America (BAC), Citigroup (C), Goldman Sachs (GS), and Morgan Stanley (MS) over the long term.

(Click on image to enlarge)

Source: JPMorgan Investors Presentation

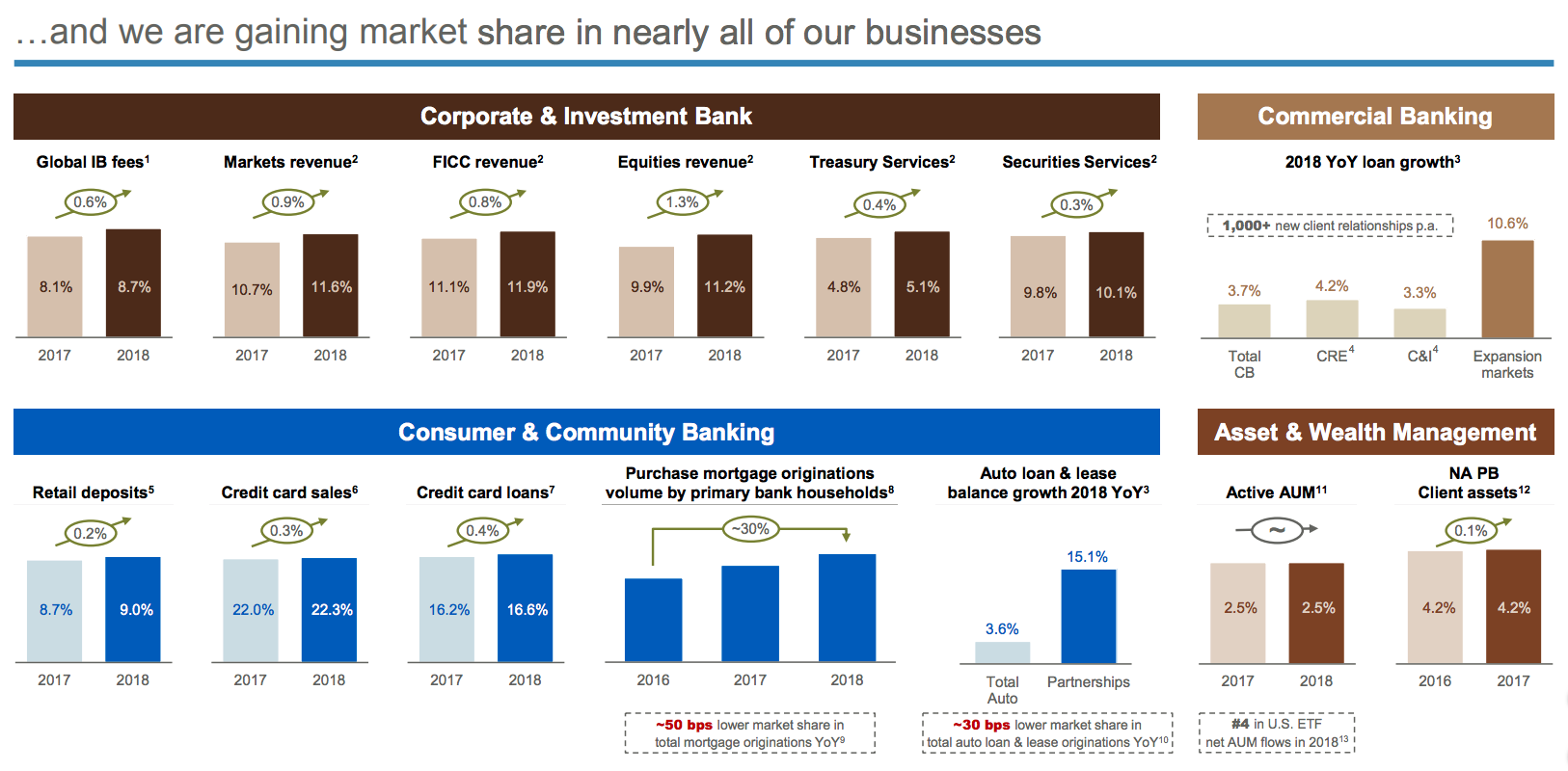

In a very competitive industry, JPMorgan knows how to leverage its strengths to consistently gain market share versus the competition across different business areas.

(Click on image to enlarge)

Source: JPMorgan Investors Presentation

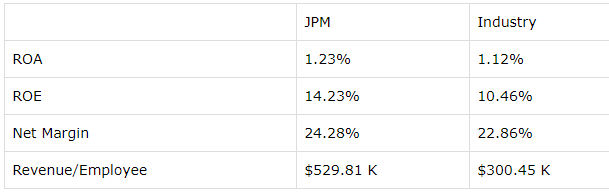

The table below shows key profitability statistics such as return on assets, return on equity, net margin, and revenue per employee for JPMorgan versus the average stock in the banking industry. These kinds of general comparisons are always painting with a broad brush, but the numbers look quite favorable for JPMorgan.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Attractive Valuation

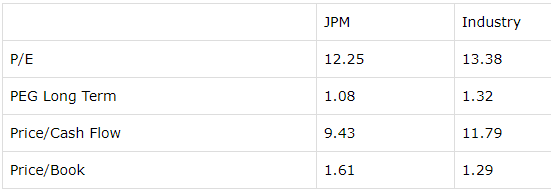

JPMorgan stock is valued at very reasonable levels, if not downright undervalued. The table shows price to earnings ratio, price to earnings growth based on long-term growth expectations, price to cash flow, and price to book value for JPMorgan versus the average industry participant.

Except for price to book value, JPMorgan is valued at below average levels across all of the other metrics considered. Importantly, JPMorgan has a higher ROE ratio than the average, and the more profitable each dollar of equity, the more valuable it is for shareholders. In simple terms, companies with higher ROE ratios deservedly trade at a higher price to book value ratios too.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

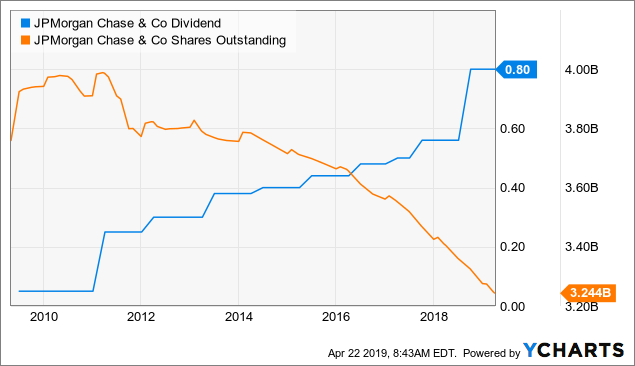

In June of 2018, JPMorgan announced a new capital return program that included a 43% increase in dividends, raising the quarterly dividend from $0.56 to $0.8. The company also launched a new stock repurchase program for $20.7 billion.

Including both dividends and buybacks, the company distributed $30.1 billion in cash to investors during 2018. This represents nearly 8% versus a market capitalization value around $368.5 billion for JPMorgan.

Investors in JPMorgan are being rewarded with generous cash distributions in terms of dividends and buybacks and this is a major consideration in terms of valuation. It's one thing to say that a stock is cheap based on earnings or book value, but valuation is a far more tangible concept when considering capital distributions through dividends and buybacks.

JPMorgan has done an impressive job at delivering consistent dividend growth and reducing the number of shares outstanding via buybacks over the years. Management has proven both its willingness and capability in terms of capital distributions over the long term.

(Click on image to enlarge)

Data by YCharts

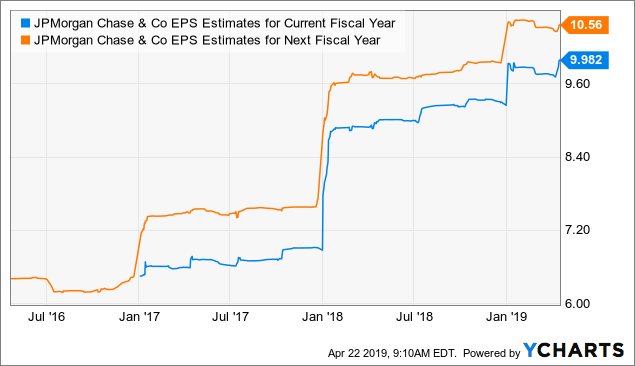

Importantly, valuation is a dynamic as opposed to a static concept. A stock's current market price is reflecting a particular set of expectations about the company's financial performance. If the company outperforms those expectations, then the market price tends to rise in order to reflect higher expectations for the business going forward.

Fundamental momentum can be a strong return driver for stocks, and JPMorgan is benefitting from vigorous momentum. The chart shows how earnings expectations for the company in both the current fiscal year and next fiscal year have significantly increased over time.

(Click on image to enlarge)

Data by YCharts

If the company continues delivering better than expected numbers and earnings expectations for JPMorgan to keep moving higher in the middle term, this would mean that the stock is more attractively valued than what current expectations are reflecting.

The main point is that the valuation metrics should always be interpreted in their due context, also considering other return drivers such as financial quality and fundamental momentum.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

In order to deliver solid returns for investors, JPMorgan will need to continue on the right track in areas such as competitive strength, profitability, and capital distributions. However, it's good to know that JPMorgan is attractively valued when the valuation ratios are analyzed in combination with other quantitative metrics.

Risk Considerations And Final Words

JPMorgan is a market leader in a mature industry, so it's not easy for the company to find growth opportunities which are big enough to move the needle in terms of global financial performance. Because of its size, it doesn't make any sense to expect explosive returns in the short term from a company such as JPMorgan.

Financials are also exposed to considerable macroeconomic risk. JPMorgan has proven its ability to successfully go through all kinds of environments, as the company emerged from the global financial crisis in 2008 in much better shape than other big industry players.

The London Whale Scandal in 2012 had a net cost for the company of nearly $6.2 billion, but JPMorgan sill made a record profit of $21.3 billion that year. This is just an impressive display of resiliency in terms of financial performance through good and bad times.

Nevertheless, even if JPMorgan is an exceptionally strong business from a fundamental perspective, variables such as interest rates, economic growth, and activity in the housing market can have a considerable impact on the stock price in the short term.

Those risks being acknowledged, JPMorgan is arguably the top-quality play among the big US bank, and the stock is very reasonably priced at current levels. A simple investment thesis can be particularly effective, and JPMorgan looks like a solid bet for long-term investors.

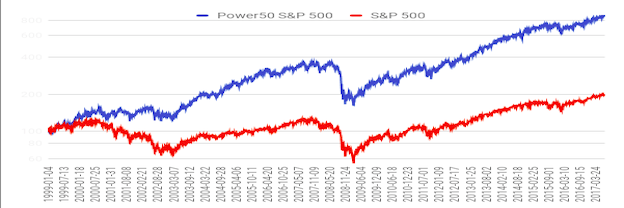

Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term.

(Click on image to enlarge)

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more