JPM Reports Blowout Earnings On $5.2BN Reserve Release; Stock Drops On Warning Of "Challenged" Loan Demand

During a Q1 that was marked by steadily climbing interest rates and fresh record highs across equity markets, JP Morgan kicked off bank earnings season by beating on its expectations, but not by a wide enough margin to impress investors, who pushed the stock lower in reaction.

First, a quick look at what the bank reported at the top line:

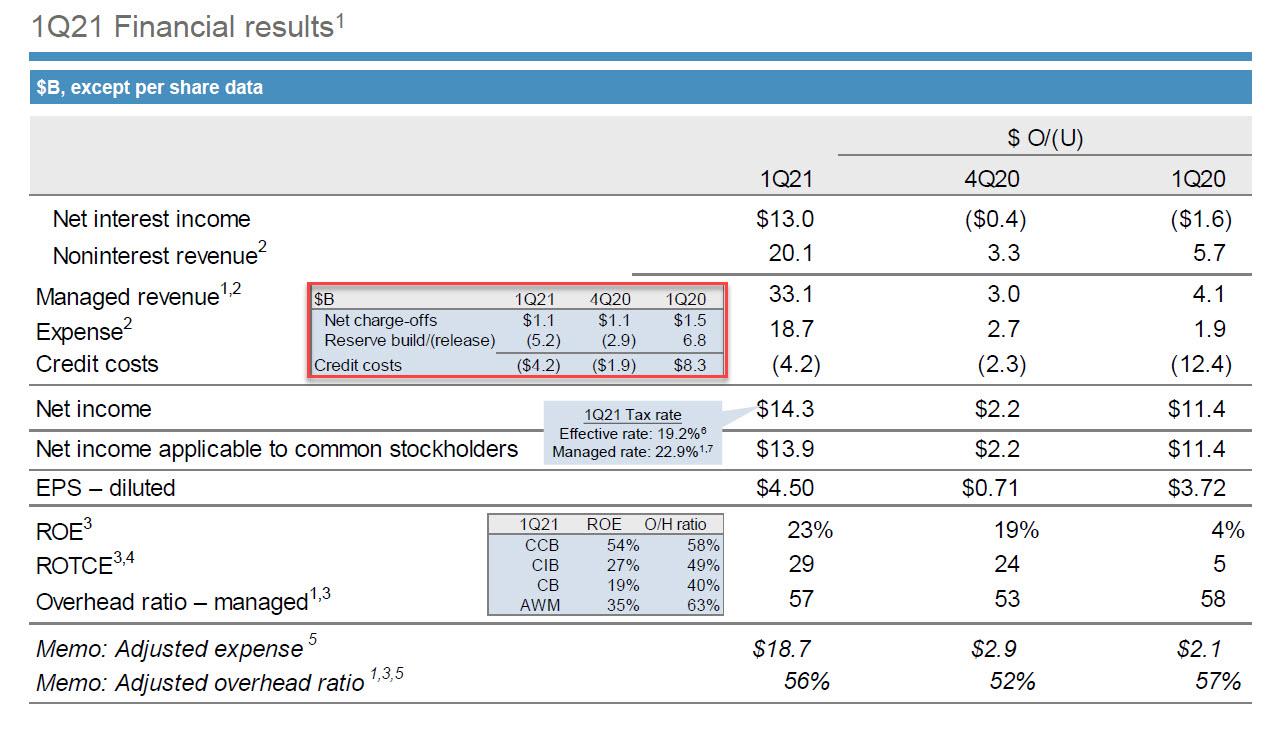

- Adjusted EPS $4.50, smashing expectations of $3.09, and more than 5x higher than the 78c reported a year ago

- Adjusted revenue $33.12 billion, +14% y/y, also smashing expectations of $30.42 billion.

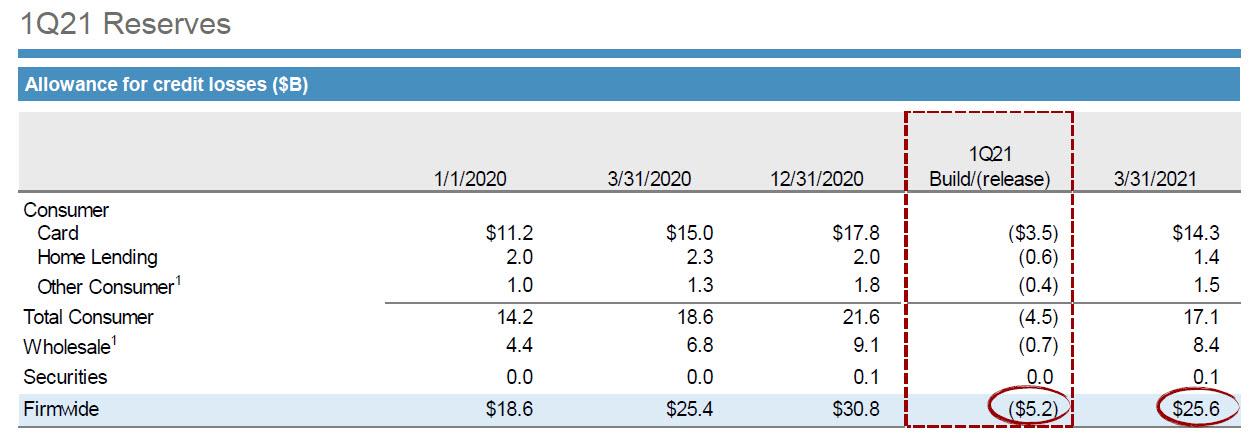

And yet, this blowout report apparently was not enough for investors, who quickly pushed JPM stock lower. A big reason - one quarter after US banks raised loan loss reserves by amounts similar to the global financial crisis, they are now releasing reserves en masse, and JPM certainly did so, with $5.2BN of the $14.3BN in net income the result of reserve releases, compared to just $1.1BN in estimated releases. Net of Q1 releases, the bank's total reserves in Q1 were $25.6BN, almost exactly where it was one year ago, and which according to Jamie Dimon "are appropriate and prudent, all things considered.”

In other words, ex reserve releases, EPS would have been just below $9BN, and the resulting EPS would be below $3.00.

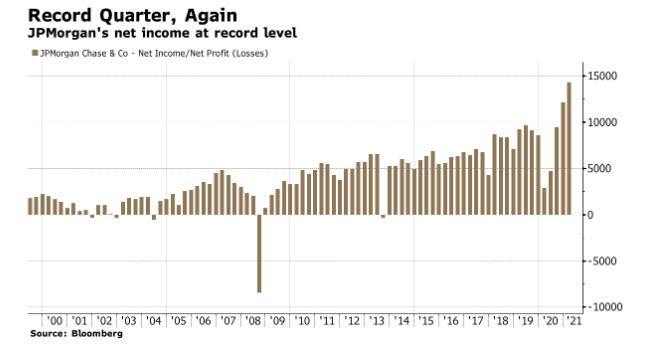

Including the releases, however, meant that JPM reported another record quarterly net income... again.

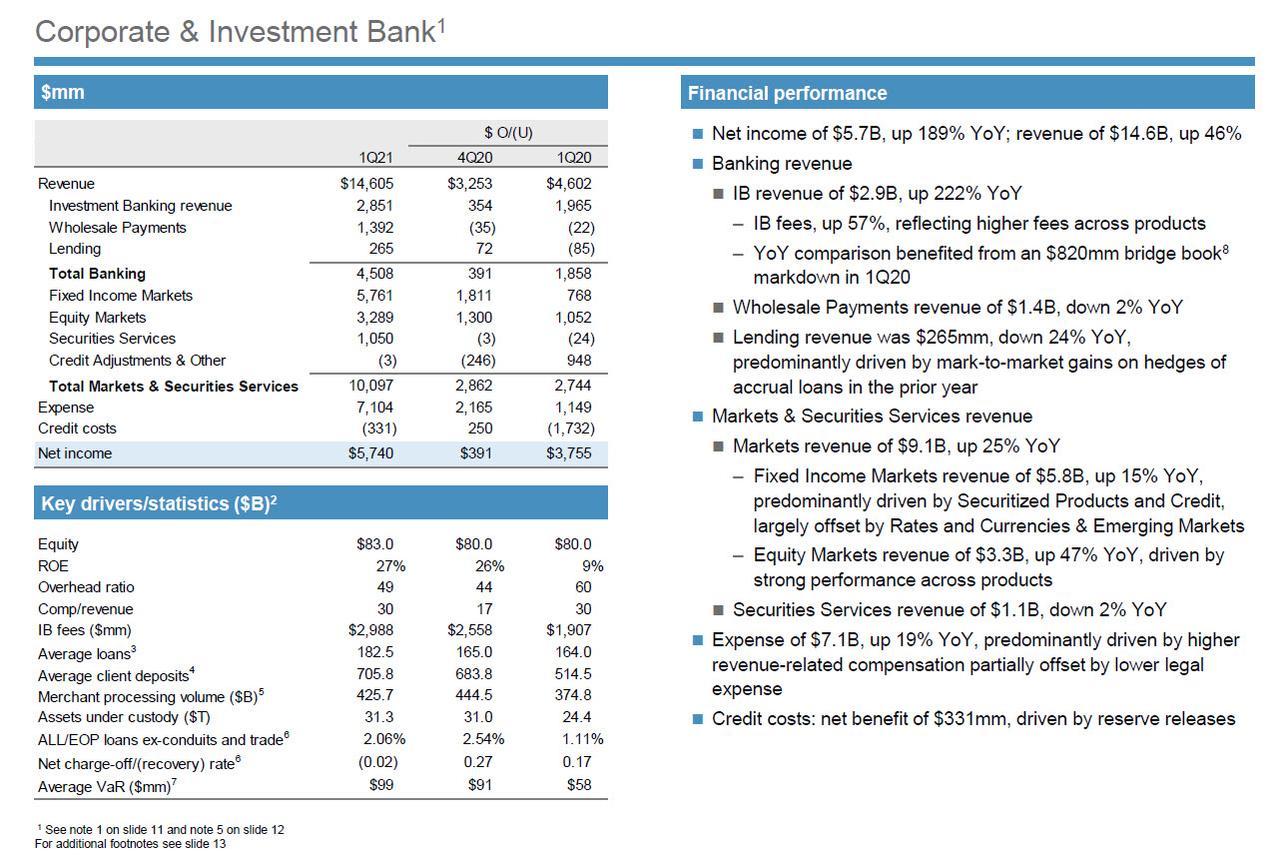

To be sure, it wasn't "just" reserve releases, and in the quarter, the bank did report stellar corporate and investment banking results:

- Investment banking revenue $2.85 billion, smashing the $2.46 billion estimate and 222% higher than the $886 million Y/Y. The bank said that IB fees were up 57%, "reflecting higher fees across products", while YoY comparisons benefited from an "$820mm bridge book markdown in 1Q20." Remarkably, equity underwriting was up 219% on the back of the SPAC boom, which beat the nearly 152% estimate from analysts.

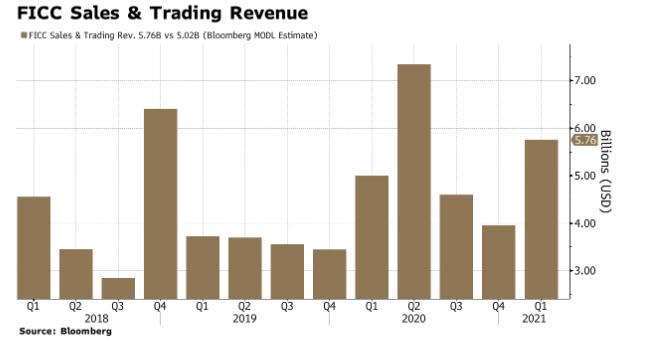

- FICC sales & trading revenue $5.76 billion, +15% y/y, and blowing out the $5.02 billion estimate; the outperformance here was predominantly driven by Securitized Products and Credit, largely offset by Rates and Currencies & Emerging Markets

- Equities sales & trading revenue $3.29 billion, +47% y/y, also blowing out the estimate $2.32 billion; the profit was driven by strong performance across products

A summary breakdown of the Q1 Ibanking results is below:

The problem, of course, is that with volatility fading and the SPAC boom ending, the bank is unlikely to repeat this stellar corporate and markets performance in the second quarter.

On the expense side, the bank reported expenses of $7.1B, up 19% YoY, "predominantly driven by higher revenue-related compensation partially offset by lower legal expense."

Some other data from the quarter:

- Net yield on interest-earning assets 1.69% vs. 2.37% y/y, estimate 1.81%

- Net charge-offs $1.06 billion, estimate $1.37 billion

- Basel III common equity Tier 1 ratio 13.1%

- Return on equity +23% vs. +4% y/y

- Assets under management $2.8 trillion

- Compensation expenses $10.60 billion, +19% y/y, estimate $10.12 billion

- Managed net interest income $13.00 billion, -11% y/y, estimate $13.31 billion

On the commercial bank side, JPM reported that total loans fell 4% year on year to $1 trillion. The biggest drop there came from credit card loans, which fell 14% year on year. Notably, small business lending plunged by 50%, according to the release as the bank was no longer in the government-backstopped PPP business. The bank raised $8 billion of credit for U.S. small businesses in the first quarter of 2020, an amount that fell to $4 billion this most recent quarter.

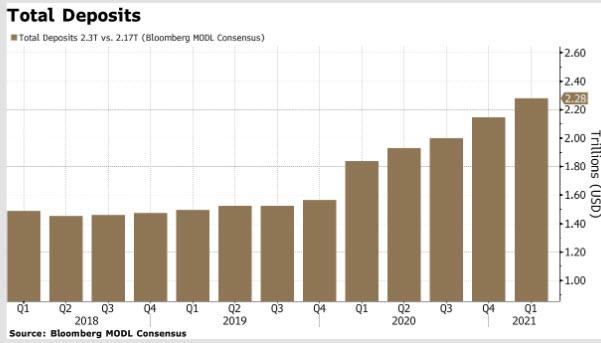

However, thanks to QE, as loans declined deposits rose, and JPMorgan continued to attract a huge sum of new deposits which is how QE materializes on bank balance sheets. JPM's deposits are now up 24% year on year to $2.3 trillion. Combined with the drop in lending the bank’s loans-to-deposits ratio fell to 44%. It was at 57% this time last year.

The bank's outlook was unchanged:

- Expects FY 2021 FY net interest income to be $55BN, Est. $55.12B

- Expects FY 2021 adjusted expense of $70BN.

Commenting on the quarter, Jamie Dimon sounded an optimistic note about the economy in his quote, echoing his comments in his annual letter that he expects there to be a post-pandemic boom. The CEO said that “consumer spending in our businesses has returned to pre-pandemic levels, up 14% versus the first quarter of 2019. We are also seeing good momentum in T&E with spend up more than 50% in March versus February. Home Lending originations were very strong, up 40%, with almost 75% of consumer mortgage applications completed digitally, but we expect this to slow with the recent rise in interest rates. Loan demand remained challenged as Card outstandings remain lower despite spend recovering to pre-COVID levels. Deposits were up 32% and investments were up 44%. In the Corporate & Investment Bank, we maintained our wallet share, Global IB fees were up 57% and Commercial Banking generated IB revenue over $1 billion. Corporate clients continued to access capital markets for liquidity and repay revolvers. In Asset & Wealth Management, continued strong investment performance, growth in new products, and advisor hiring led to net inflows of $48 billion into long-term products. Also, AWM has seen strong and steady loan demand primarily to support business growth and mortgages.”

Summarizing the macro environment, Dimon said that "with all of the stimulus spending, potential infrastructure spending, continued Quantitative Easing, strong consumer and business balance sheets and euphoria around the potential end of the pandemic, we believe that the economy has the potential to have extremely robust, multi-year growth. This growth can benefit all Americans, particularly those who suffered the most during this pandemic. If all of the government programs are spent wisely and efficiently, focusing on actual outcomes, the benefits will be more widely shared, economic growth will be more sustainable and future problems, like inflation and too much debt, will be reduced.”

Good luck with the "spent wisely" part - you are, after all, talking about government.

In any case, it appears that as we previewed a few days ago, the earnings season has already been priced to perfection and despite the blockbuster beat, albeit largely on the back of reserve releases, the stocks is actually lower by about a dollar in premarket, the last trading at $153, down 0.75%. According to Bloomberg, investors may also be focusing on the warnings the bank’s provided: Home loan originations are expected to slow with the recent rise in interest rates and Dimon says that loan demand remains "challenged." As investors prepare for today's conference call, the question is does Dimon expect that challenged loan demand to persist? Or can that engine start roaring again soon?

The full investor presentation is below:

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more