JPM Beats Expectations On Record Trading Revenue As Credit Loss Charges Soar Above $10BN

JPM has officially launched Q2 earnings season, with what was essentially a story of an impressive Income Statement vs a rather ugly Balance sheet.

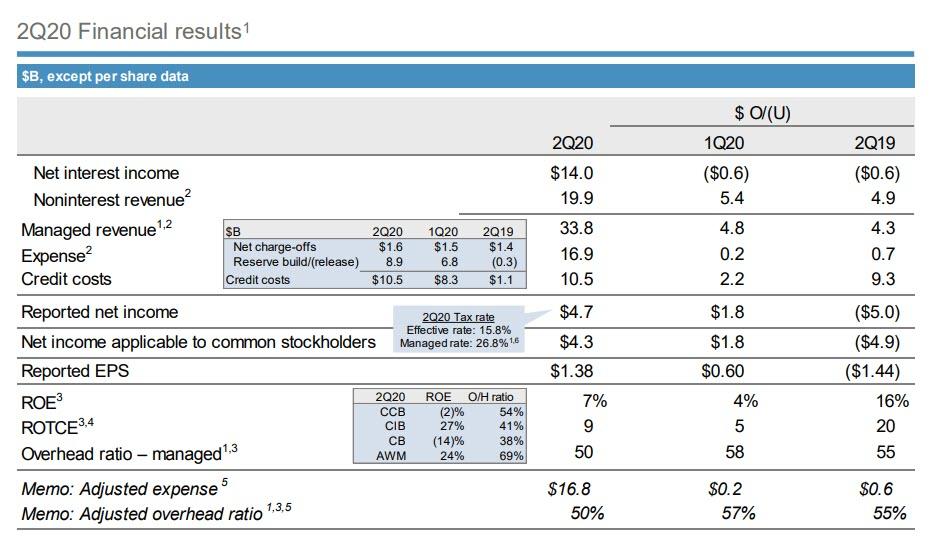

Looking at the income statement first, JPM reported Q2 revenue of $33.8BN, up $4.3BN Y/Y, and smashing expectations of $30.3BN, largely as a result of a surge in trading and iBanking revenue, offset by a higher than expected credit loss provision. Indeed, despite the surge in revenue, net Interest income was actually down $0.6BN Y/Y to $14 billion as the bank's net interest margin continues to be depressed. Still, the bank reported EPS of $1.38, which while down $1.44 from the $2.88 a year ago, was also stronger than the $1.01 expected. Why the nearly $5 billion drop in Net Income? Because JPM continued to aggressively build loan loss reserves ahead of what is shaping up to be the worst financial crisis since Lehman (more below).

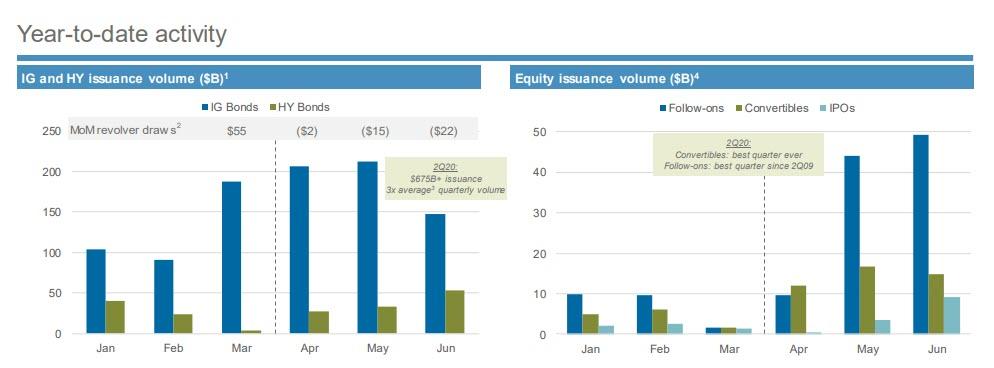

How did JPM manage such an impressive Q2 revenue recovery? Simple: the refi flood started by COVID, and with the explicit guarantee of Powell, allowed JPM to unleashed a record amount of debt and equity issuance, even as M&A slowed sharply in the quarter.

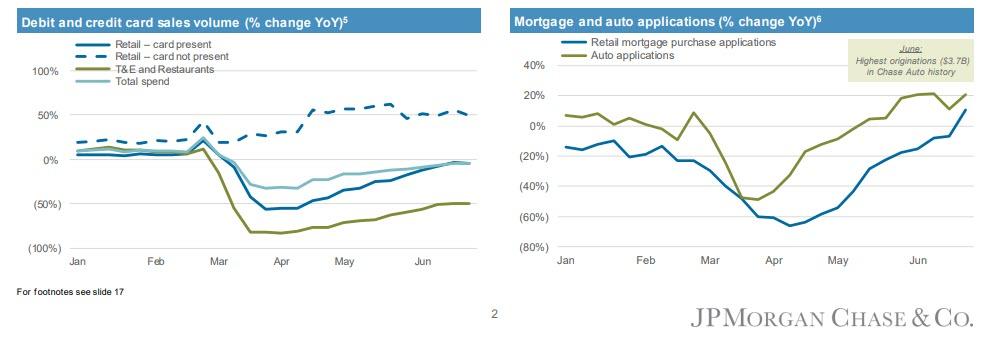

Meanwhile, despite the slowdown in debt and credit card sales volumes, these have almost normalized, while mortgage and auto applications have soared in recent weeks to take advantage of near-record low interest rates.

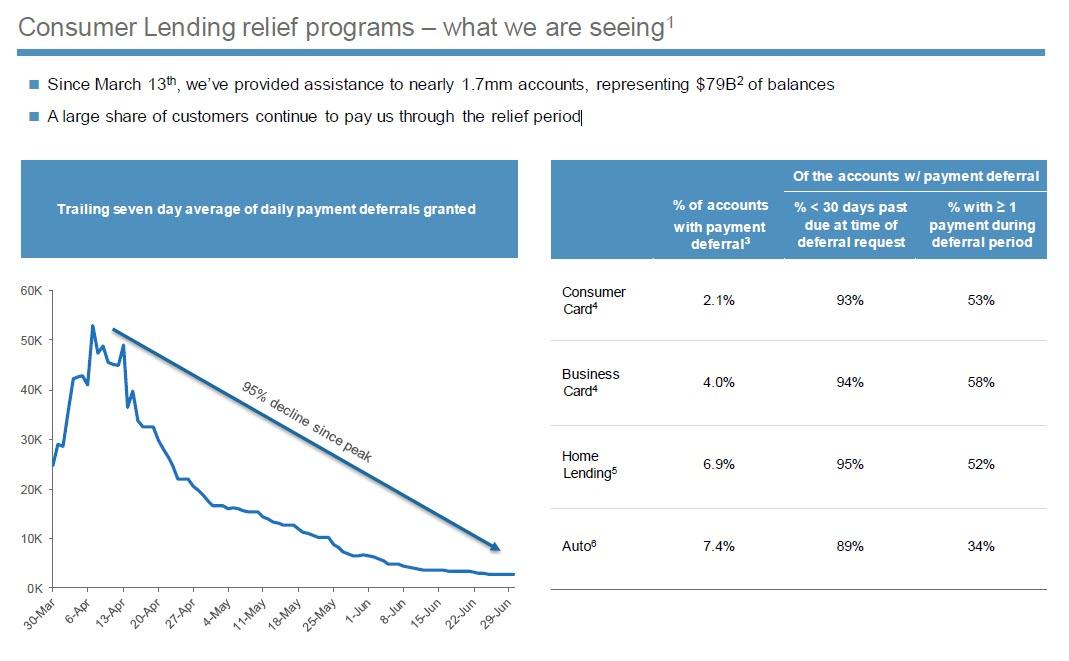

JPM also tried to deflect criticism for its disappointing participation in the PPP Program, claiming that "since March 13th, we’ve provided assistance to nearly 1.7mm accounts, representing $79B2 of balances" and adding that "a large share of customers continue to pay us through the relief period"

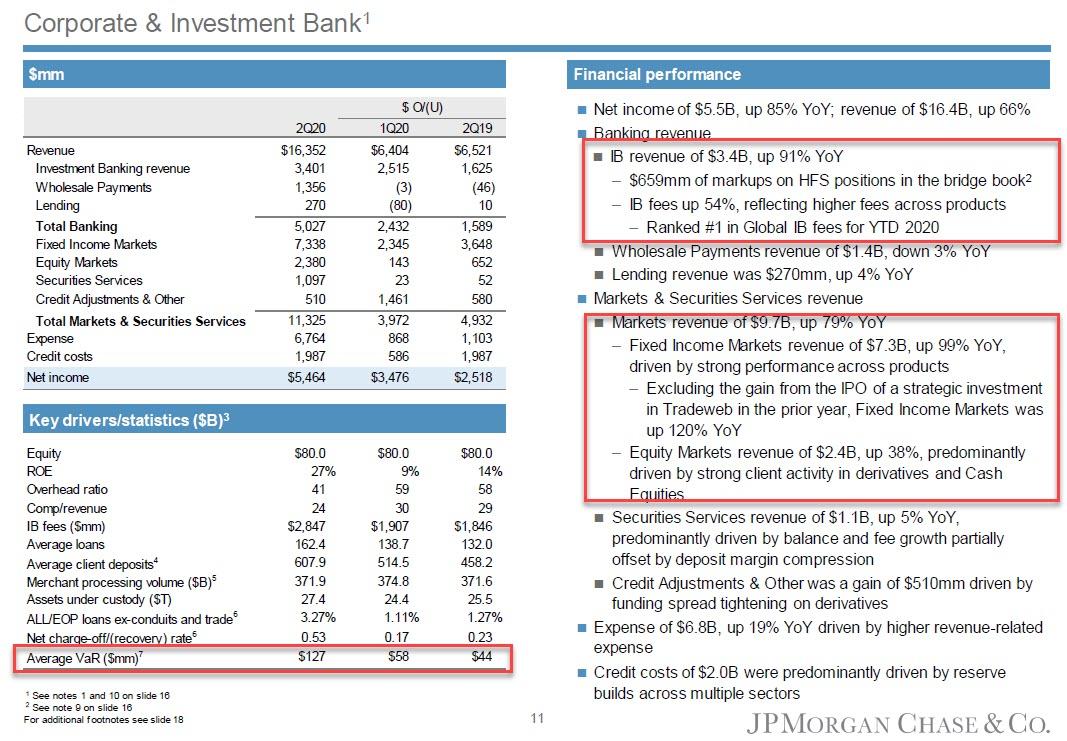

Yet for all the pretty charts and slides, the only one that really matters was the bank's corporate and investment bank, where JPM reported a staggering 85% increase in net income to $5.5BN, while revenue exploded a whopping 66% higher to a record $16.4 BN.

What was behind this surge:

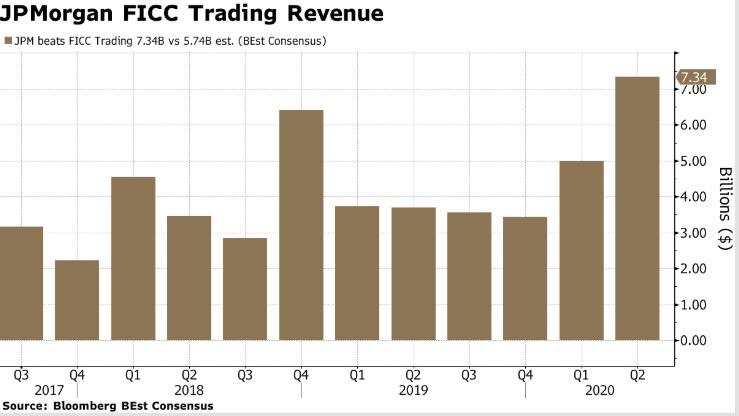

- Markets revenue of $9.7B, up 79% YoY, of which Fixed Income Markets revenue of $7.3B, up 99% YoY, while Equity Markets revenue of $2.4B, up 38%, predominantly driven by strong client activity in derivatives and Cash Equities

- Investment Banking revenue of $3.4B, up 91% YoY with IB fees up 54%, reflecting higher fees across products (the number included $659mm of markups on HFS positions in the bridge book).

- While far less relevant, Q2 banking expense were $6.8B, up 19% YoY "driven by higher revenue-related expense"

Putting the fixed-income trading revenue in context, it rose to a record $7.34BN, as the Fed backstopped all debt capital markets, providing an effective subsidy to JPM. But we are about to listen to Jamie Dimon lecture us again how JPM did not need the Fed again, like in 2009

What we also found especially remarkable, was the surge in JPM VaR from $44 a year ago to a record $127 in Q2.

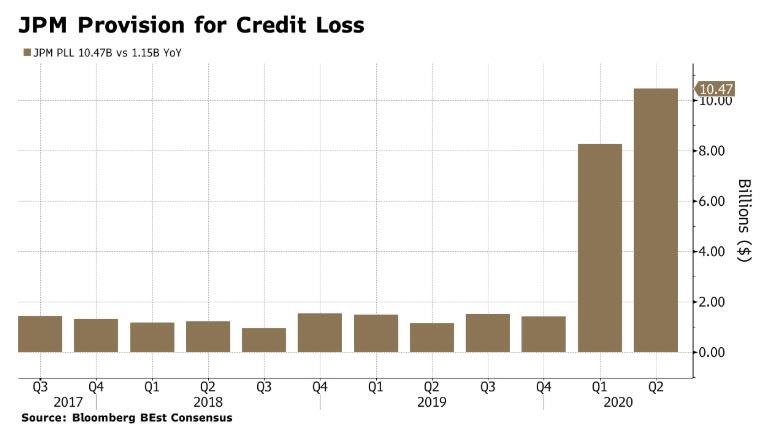

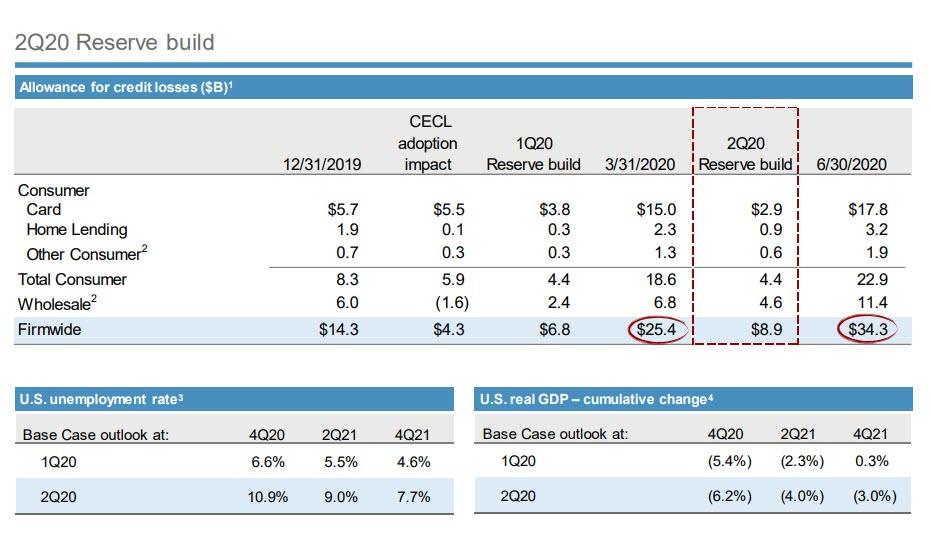

So all of that was the good news. What was not so good? Well, as we warned last quarter, JPM did not provision nearly enough in potential credit losses, and sure enough moments ago we got confirmation of that when the bank reported $10.5BN in credit loss provisions (consisting of $1.6BN in net charge offs and $8.9BN in reserve build), a sharp increase from the $8.3 billion in Q1.

A detailed breakdown of Q2 reserve builds is below:

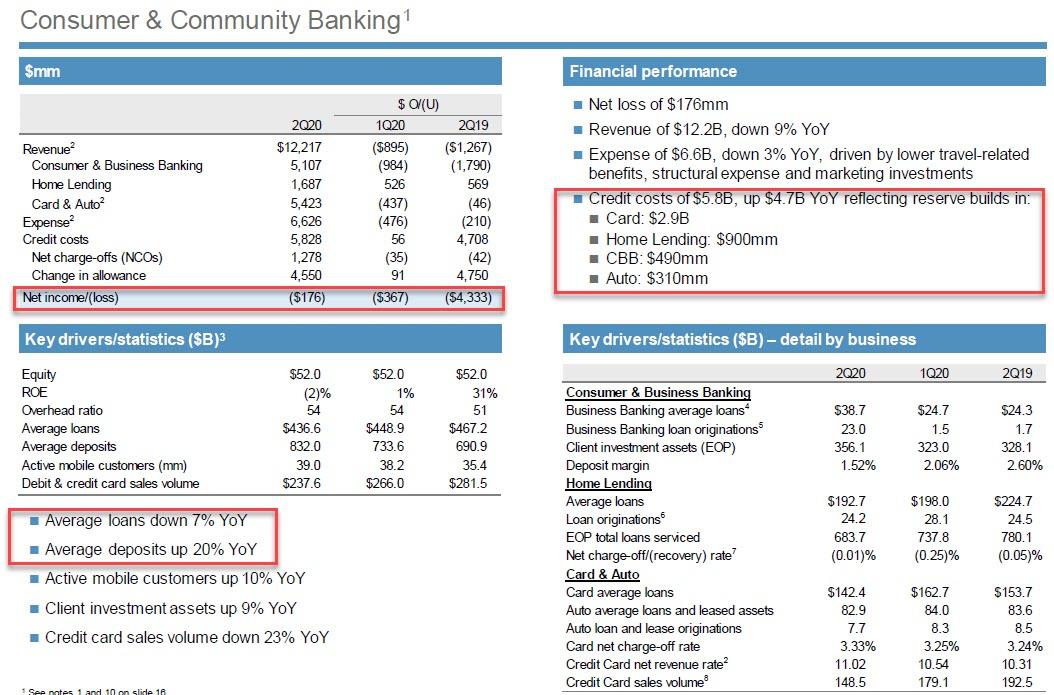

This meant that Net Income for the bank's Consumer and Community bank tumbled by $4.3BN, largely offsetting the gains in trading. Indeed, as JPM reports, credit costs in its consumer bank division soared $4.7BN Y/Y to $5.8B, reflecting reserve builds in:

- Card: $2.9B

- Home Lending: $900mm

- CBB: $490mm

- Auto: $310mm

Some more unpleasant numbers: average loans were down 7 YoY, while average deposits soared 20%. This is money that should be in the market - at least according to the Fed - but instead, it is collecting electronic dust in JPM's digital vault.

Overall lending was up 2% year-on-year, to about $979 billion, and was as a result of a 9% jump in wholesale loans to about $528 billion, even as total consumer loans fell 2% to about $309 billion, while credit card loans dropped 10% to about $142 billion as consumers paid back loans aggressively.

Despite the impressive top-line beat, Dimon sounded rather cautious in his prepared comments:

"Despite some recent positive macroeconomic data and significant, decisive government action, we still face much uncertainty regarding the future path of the economy. However, we are prepared for all eventualities as our fortress balance sheet allows us to remain a port in the storm."

That said, should the worst-case scenario come to pass, Dimon is confident it has enough capital to offset even more losses:

“We ended the quarter with massive loss-absorbing capacity -- over $34 billion of credit reserves and total liquidity resources of $1.5 trillion, on top of $191 billion of CET1 capital, with significant earnings power that would allow us to absorb even more credit reserves if needed. This is why we can continue to serve all of our stakeholders and to pay our dividend -- unless the economic situation deteriorates materially and significantly.”

And in a world where virtue-signaling is now expected, JPMorgan didn't disappoint, with Dimona hilariously claiming that his bank - which was dragged kicking and screaming into the PPP program - helping to drive "policies and programs for the benefit of all society."

"We are fully committed to doing our part both in promoting the safety of our employees and customers and helping the economies of the world recover from the impact of the ongoing COVID-19 crisis, including helping to drive policies and programs for the benefit of all of society and create opportunity for those who have been left out of the economy for far too long."

Looking ahead, JPM provided the following outlook:

- FY2020 net interest income to be ~$56B, below the $56.39BN expected.

- FY2020 adjusted expense of ~$65B

In short, everything can change depending on whether the US economy is shutdown again because of COVID, and as many democratic states have hinted, that's precisely what is coming ahead of the Nov 3 presidential election.

In response to the earnings, the stock surged initially, likely boosted by the strong read of trading revenue, which however then faded as attention turned to the balance sheet.

Full Q2 presentation below:

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more