JP Morgan: These Are Our Top Tax Cut Stock Picks

The reform tax plan is gaining steam. In its current form, the plan would cut taxes for businesses by approximately $1 trillion. And JP Morgan has singled out the best stocks set to benefit from the proposed reforms.

“We think the most significant near-term upside catalyst for equities is still ahead – passage of the US Tax Bill. Our analysis indicates the market is significantly underestimating the probability of tax reform passage,” says JP Morgan derivatives strategist Shawn Quigg. He continues: “We think the potential passage of tax reform could provide 5 percent near-term upside to the S&P 500. However, the potential upside could be significantly higher for those high-tax stocks poised to outperform in a more tax-friendly regime.”

To find these top tax bets, the bank screened its index of tax-linked companies for stocks with robust options trading volume as well as low implied volatility. The bank calls the resulting stocks ‘The Top Tax Outperformers for Upside Call Buying’.

Here we zero in on the ‘Overweight’ rated stocks in the report. TipRanks reveals that out of these 5 stocks, 4 have a bullish ‘Strong Buy’ analyst consensus rating. We can also dig down further and see what the Street’s best-performing analysts have to say on these stocks.

Let’s take a closer look at these 4 ‘Strong Buy’ stocks now:

Concho Resources

Texas-based Concho Resources (NYSE:CXO) is a leading petroleum and natural gas exploration and production company. CXO operates exclusively in the Permian Basin in west Texas and southeast New Mexico. RBC Capital’s Scott Hanold is also bullish on the stock. He says the 2018 set up is still strong and believes the stock can outperform its peer group over the next 12 months. “CXO has strong upside potential to production growth driven by an abundant inventory of potential drilling locations” writes Hanold. He upped up his price target by $6 to $164 last month.

Overall, this ‘Strong Buy’ stock has 100% Street support with 8 buy ratings in the last three months. These analysts believe (on average) that the stock can spike 15% to $157.40. You can click on the screenshot for further insights.

Southwest Airlines

Another Texas-based stock, Southwest (NYSE:LUV) is the world’s largest low-cost airline carrier. Five-star Raymond James analyst Savanthi Syth has a buy rating on the stock. In respect of the impact of the tax reforms she says this: “With the exception of legacy carriers, U.S. airlines pay the full corporate tax rates with potentially lower cash taxes as a result of accelerated depreciation (likely to continue under a new tax plan) and, thus, would be significant beneficiaries of a lower corporate tax rate.”

As for LUV specifically, she writes “If Southwest was to see a material benefit, management expects some of this to be passed through to employees and shareholders. With not all airlines likely benefiting from a tax change in a similar manner, we believe the risk of any benefit being competed away is lower.”

With a ‘Strong Buy’ analyst consensus rating, LUV has received 5 buy ratings and 1 hold rating in the last three months. The $67.50 average analyst price target stands at 6.6% above the current share price.

ConocoPhillips

This multinational energy giant (NYSE:COP) has operations in 27 different countries and over 18,400 employees. COP is looking forward to the proposed reduction in corporate tax rate from 35% to 20-22%. “Such a reduction would make companies like ours more competitive globally and would eliminate the current incentive for some U.S. companies to incorporate overseas for tax purposes” says ConocoPhillips. Plus COP says the bill would also encourage domestic business investment while boosting US global competitiveness by leveling the global playing field.

We can see from TipRanks that COP boasts 4 back-to-back buy ratings over the last three months. With an average analyst price target of $57.25, the Street is projecting an 11% boost for the stock over the coming months.

Marathon Petro

Marathon Petroleum (NYSE:MPC) is a US petroleum refining, marketing, and transportation company. Oil refinery stocks like MPC are the ‘clear winners’ of the proposed tax reforms according to top Piper Jaffray analyst Guy Baber. He told Bloomberg on December 4 that refiners have enjoyed fat margins and the group is in a stronger position to benefit from a lower corporate tax burden.

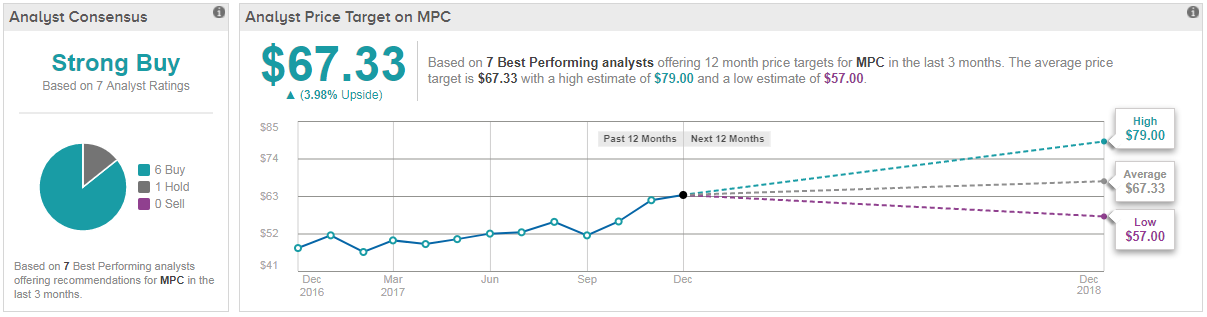

If we focus specifically on only top analyst ratings, the stock has a Strong Buy analyst consensus rating. In the last three months, best-performing analysts have published 6 buy ratings and only 1 hold rating on the stock.

Meanwhile, the average analyst price target works out at $67.33- but note that Cowen & Co’s Sam Margolin (a top 100 analyst) has just ramped up his MPC price target from $60 to $79. This translates into big upside potential of 22%. He says the company’s large asset drop down will boost its sum-of-the-parts valuation.

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more