JP Morgan Chase & Company – Banks The Good, Bad And Ugly

JP Morgan Chase Company continues to be one of the leading Banking Companies. It is on a Strong Hold, but my Indicators are breaking down. I believe it will continue to try to test its highs in the coming weeks. It has been on a steady rise in price since the lows of $33.00 per share in June 2012. My weekly study / forecast of all my High Profile Financial / Major Banks is how I determine WHY.

A Pull-Back could well be in the making for (JPM) as well as for the Banking Industry.

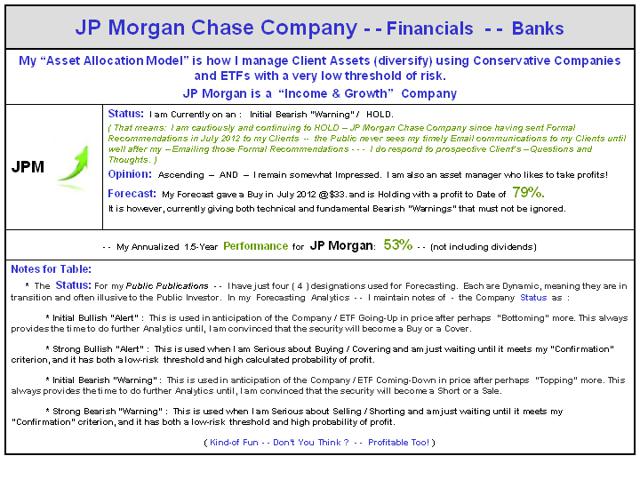

My Performance for JP Morgan can be reviewed in the below table and is over 40% per year for the last 1.5 years.

My management objective is to identify changing trends for my forecasting analytics. Simple stated, I want to have current notes to quickly refer to on the anticipated direction of this sector and industry group.

A Special Note for Seniors & Retired Investors - Dividend Yield: 2.70% This is stingy with dividends.

Forecast w/ 5 Year Performance:

Note: The below Table is for your review.

I have reservations about my fundamental valuation; however, it is on my Initial Bearish Forecast - "Warning."

I am cautiously and continuing to HOLD - JP Morgan Chase since having sent Formal Recommendations in May 2009 to my Clients.

My Current Opinion is to Hold in anticipation of taking profits. This may be at even higher prices, but there will be an end and time to sell, but that is not currently in my forecast. That is a balancing of my below three (weighted) pillars of research.

Fundamentally - ( weighting - - 40% ): My Analytics for my fundamental valuation play a vital role in profitable managing money. Earnings continue to be relatively strong.

Technically - ( weighting - - 35%): Within this outstanding company, my indicators remain strong. It is on its highs of $56.

Consensus Opinion - ( weighting - - 25% ): My third pillar of research is one that is always distorted to the positive by most all financial analysts. That's because they are afraid of being bearish. I am not! My articles on "reality" are supportive of the below 20 year Chart.

JP Morgan has taken some big hits over the years!

My previously written articles on JPM (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I will personally and promptly reply to investor inquiries as to my very cautious position for JPM. If you would like to "Invest Wisely" in my "Income & Growth Asset Allocation Model," please email me.

None.