January 2020 Dividend Income Summary

Man, I can’t believe that we are already one and a half months through 2020. Time continues to fly by at an amazing clip. Soon, my daughter will be one and I’ll be reminiscing about all of her amazing milestones from her first year. I will say this, she loves to babble and crawl. I’m in store for an exciting, action-packed year at this rate! Each month, we take time to reflect on the previous month’s results and monitor our progress as we pursue financial freedom. This article will contain my January dividend income summary and discuss any major portfolio updates.

Dividend Investing is amazing for so many reasons. As we continue to build a growing, passive income stream by investing in undervalued dividend growth stocks identified by our dividend stock screener, it is always important to track your progress and make sure you are achieving your goals. Seeing the progress makes the income feel real. And it motivates us that much more to reach financial freedom.

For the last five years, we have logged each monthly dividend income total on our “Dividend Income Page.” You can see first hand the results that each dividend stock purchase, dividend increases, and reinvested dividend have had. We continue to fuel the FI/RE one purchase, one increase, and one DRIP at a time. That is why I am always so excited to type up my monthly dividend income summary. To review the results and hold myself accountable.

Bert’s January Dividend Income Summary

In January, my wife and I received $442.30 in dividend income. That is an increase of 27.63% compared to last year! Here is a detailed listing of the companies that paid us a dividend in January:

Here are some thoughts about the month:

- We only had two new companies pay us a dividend compared to last year: OXY and CSCO. OXY’s position was built up over time. It initially started before their expensive acquisition. After their price tumbled post-acquisition, I began lowering my cost basis in the position. Now, it is a high dividend-paying machine. The nearly $40 dividend was sweet this month. CSCO was a new entrant to my wife’s portfolio at the end of 2019. I am planning on building this position as well. It certainly will become easier after their price fell after their last earnings release. Stay tuned to future watch lists for sure!

- Last year, I transferred my portfolio from Ally to Fidelity. One of the nice features is that idle cash is invested in a money market account rather than just sitting there earning no interest. Because of this, we earned $12 extra dollars this month.

- I added a lot to my Canadian Imperial position throughout 2019. Because of that, the dividend nearly doubled. I sure love this company. Thank you, Lanny, for pointing them out to me!

- Other than that, the increases in the table were due to good old fashioned dividend reinvestment. Dividend increases and dividend reinvestment sure worked its magic in January!

Bert’s January Dividend Portfolio Update

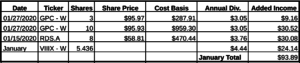

In this section, I like to discuss the impact of stock purchases and 401(k) contributions had on my portfolio. Last week, I summarized my January stock purchases in an article. So I won’t spend any time in this article discussing why I purchased Genuine Parts Company or Shell. Please see my article to view those purchases in greater detail. The table below shows how the purchase and my wife’s 401(k) contributions added nearly $94 to our forward dividend income.

Now, this is the fun chart…..dividend increases. We are always talking about dividend increases in this article. Heck, each month, I put together an article summarizing all the companies expected to announce dividend increases in the coming month. We received 5 dividend increases this month; none of which were too spectacular. The table below shows each dividend increase and the impact the increase had on our dividend income.

I told you the dividend increases were not spectacular. Dividend increases added $25 to my forward dividend income. The most surprising aspect of this dividend increase was that ADM decided to announce their increase in January instead of February. Unfortunately, it wasn’t a very good increase (<3%). They could have at least announced better news, right? On a positive note, I was pleasantly surprised by the Chevron dividend increase. If you haven’t noticed, major oil companies have taken a beating lately. It was encouraging to see an 8.4% increase from Chevron in this operating environment.

All in all, purchases and dividend increases added $119.19 in dividend income to my portfolio.

Summary

Once again, I can’t complain about the results. Especially with a 27% growth rate. We are closing in on crossing $500 in dividend income in an “Off” month. To foreshadow a future article, we may have gotten there with some of our purchases in February. But I’ll wait to tell you about all of those and keep you in suspense. But as I take a step back and review the results, I can’t help but think one thing to myself: the plan is working.

The plan of saving relentlessly, investing vigorously, and doing everything I possibly can to put myself one step closer to financial freedom, is starting to show results. 2020 will be another year of dividend increase and dividend reinvestment, which simply help push the snowball downhill faster and faster. Soon, this snowball will propel us to financial freedom. On days like this, I just need to remind myself to “trust the process” and continue working hard. Thanks, everyone for all the support and motivation over the years. Let’s make 2020 our best year yet!

Did you have a strong month of January? What stocks did you purchase this month? Which stocks are on your watch list? What impact did dividend increase have on your forward income?

Disclaimer: I do not recommend any decision to the reader or any user, please consult your own research. Thank you.