"It's Like Gambling, Isn't It?": First Time Retail Investors Piled Into Stocks During March Plunge

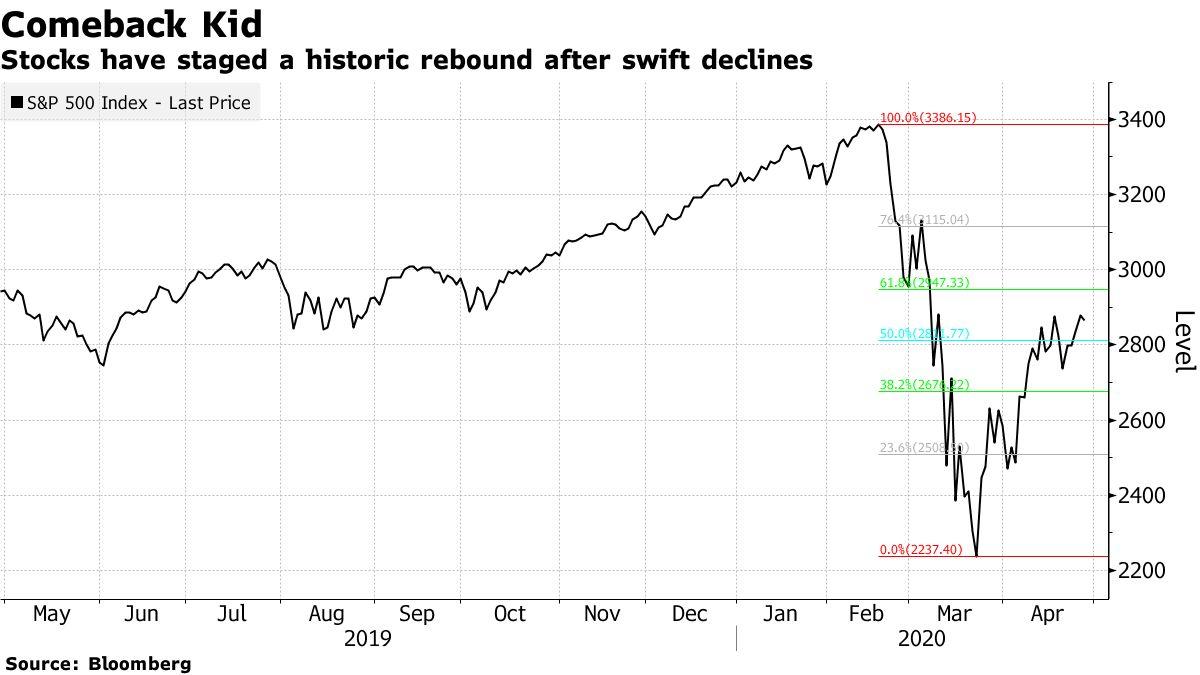

Scores of retail investors took their first shot at the stock market this past March, while equities fell more than 30% as a result of the coronavirus shockwave that hit the country. And it's retail that has helped act as a "formidable force" to put a bid under stocks for the last month, according to Bloomberg.

In fact, E*Trade, Ameritrade and Schwab all saw record signups in the three months ending in March as a result of retail investors wanting their first taste of the market.

Schwab opened a record 609,000 new accounts with almost half of them coming in March alone. It also saw 27 of its 30 most active trading days ever, including every session in March. Ameritrade saw net new assets of $45 billion - of which, about 60% of which came from retail clients.

Take romance novel writer Nichole Kelleher. She urged her followers on Twitter on March 24 that: "The time to buy is NOW, people!"

She took $5,000 of her own money and spread it across names like Peloton, Fitbit (which is in the process of being acquired), Trivago, Dropbox and MFA Financial. Within 5 weeks, she was up 12%.

She said the attraction of opening an account with Robinhood was due to the fact that it didn't charge a fee.

“I’m a complete noob when it comes to stocks. It’s not thousands and thousands of dollars that I invested," she commented about the literal thousands of dollars she invested,"but it’s a start. We’ll see what happens. I hate to say it, but it’s like gambling, isn’t it?”

She is monitoring her risk by checking her portfolio daily, she says. “I would only say that I am being very conservative in the amount that I am investing because of not knowing what is next. It’s coming directly from savings, and I just want to make sure we are covered in case everything closes down.”

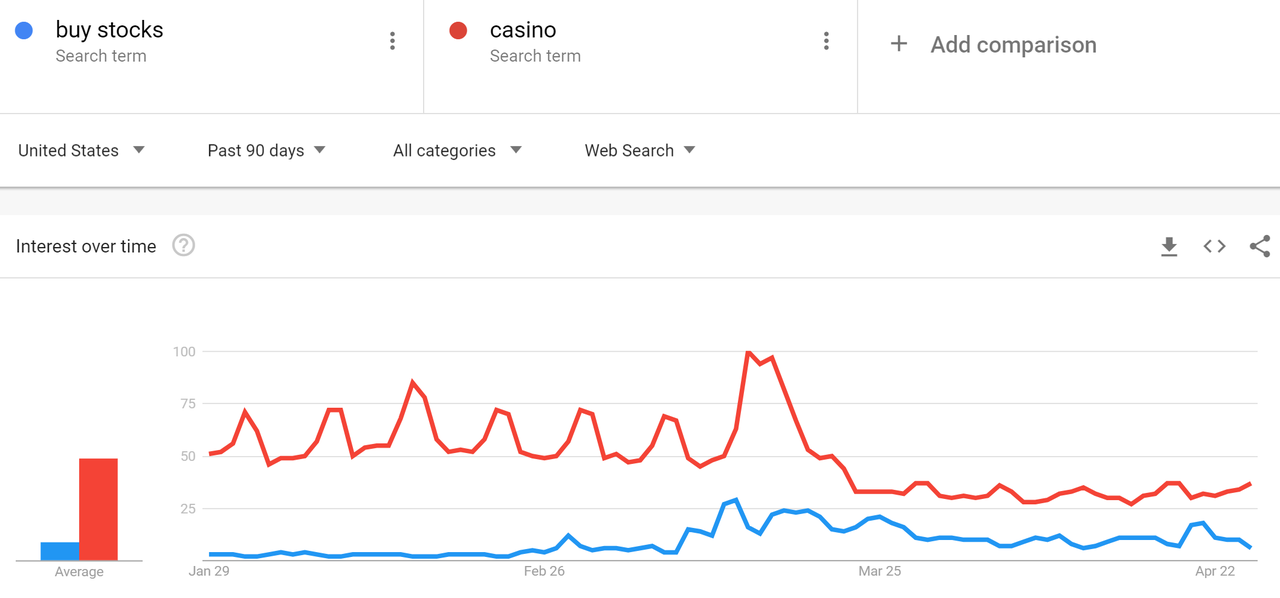

Her stock picks and inability to understand what a couple thousand dollars is aside, she's right about one thing, though: it is like gambling. And that's why Google Trends may show a rise in interest for stocks as casinos and sports betting sites shut down.

One Twitter user wrote:

"I opened an E*TRADE account too. It’s like playing Fantasy Stock Market! So far I’m winning more than I started with, so no complaints as of yet."

Retired firefighter Tommy McDougall is another great example. He bought two shares of PayPal when the stock was at $92 as his first trip down the stock market rabbit hole. PayPal trades around $123 per share as of this week.

McDougall said the E*Trade platform that he used was "very user friendly" and that he had gotten a call from an employee of the firm to make sure he was comfortable using the services after he signed up.

He said:

“When I put money into the market, I did have the theory that we had hit rock bottom. I’ve been checking in and trying to be in tune with the stock market more than I ever have in my life.”

But obviously the excitement from "beginners luck" isn't always a good thing. In fact, it could wind up exacerbating any further fall in stocks, should the market sour once again.

Chris Gaffney, president of world markets at TIAA said: “It’s a question of how they react to the market sell-off. If they don’t have the staying power that some of the institutional investors typically have that are more accustomed to these swings, it can create even more volatility.”

Jason Thomas, chief economist at AssetMark, agrees that retail is helping drive the market:

“What’s happening right now is that fear has turned to greed for the retail investor. Nobody wants to be left behind. Have they been part of what has driven the market in the past month? I think so.”

Yousef Abbasi, global market strategist at INTL FCStone, concluded: “Retail investors -- with more time on their hands -- were watching and stepped in early, which considering the rally we have seen so far appears to be right on time. That of course can change as we are still in a tape that is very susceptible to headlines around the virus.”

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more