It’s Late In The Earnings Cycle, But Adobe And Oracle Both Report Next Week - How Do They Look?

The earnings season is winding down and the next one will be starting early next month, but there are still a few widely-held stocks that haven’t reported yet. Two major software companies will report next week and both stocks have performed well in recent years. Oracle (ORCL) is scheduled to report on Tuesday, June 15, and Adobe (ADBE) is scheduled to report on Thursday, June 17.

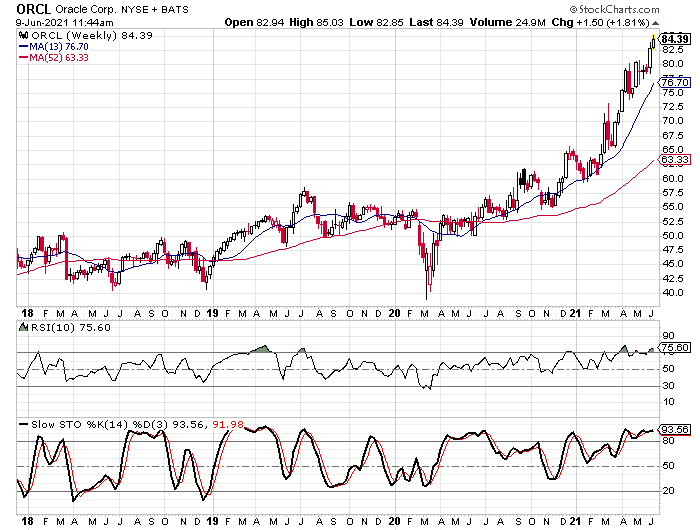

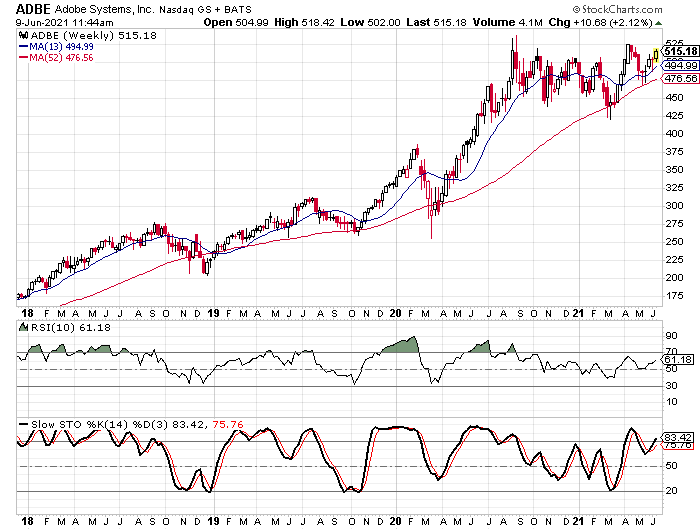

If we look at the weekly charts for both companies, Oracle has outperformed Adobe over the last four months with Oracle gaining 33.5% since February 9 while Adobe is only up 2.65%. Unfortunately for Oracle, the rally has put the stock in overbought territory based on the 10-week RSI and the weekly stochastic indicators. The stock is up right at 50% over the last seven months and the trend has been pretty steady to the upside.

Adobe hasn’t fared as well with the stock seemingly caught in a range between $425 and $525 over the last 10 months. The stock has rallied off of its March low and is up around 21% in the last three months.

We see that the overbought/oversold indicators for Adobe aren’t nearly as high as those for Oracle and that could potentially help the stock as it tries to break through the $525 level. The stock first approached the price level last August and it did trade above it but wasn’t able to close a week above $525. The stock did close above that price in April, but only by $0.44.

Adobe Has Outperformed Oracle On The Fundamental Side

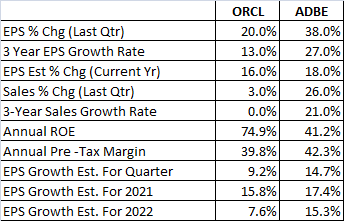

If we look at some of the key metrics for these two firms, Adobe has outperformed Oracle in most categories. The table below shows the earnings growth rates, the sales growth rates, the profitability measurements, and the expected earnings growth rates for each company.

As you can see, Adobe’s figures are better in every category but one, Oracle’s return on equity is better than Adobe’s. Most of these stats are backward-looking as opposed to forward-looking and that might explain why Oracle’s stock has been able to outperform Adobe over the past year. But when we look at the forecast for the upcoming report, for 2021, and for 2022, Adobe is still expected to see greater earnings growth than Oracle. What this tells me is that the expectations for Adobe were/are greater than the expectations for Oracle.

If we look at a comparison of the two stocks on Tickeron’s AI platform, we see that Oracle does rank as a “strong buy” while Adobe is rated as a “buy”. Oracle gets positive marks in five different fundamental categories and from two technical indicators. It doesn’t get any negative marks on the fundamentals or from the technical indicators.

Adobe gets positive marks in three fundamental categories, but it also gets negative marks in three. Three technical indicators are pointing to a bullish move for Adobe, but two are bearish.

If we break down the fundamental indicators for each stock, we see why Oracle is rated higher than Adobe. The scores breakdown such that a rating in the 1-33 range are positive, 34-66 are neutral, and 67 or higher are negative. Oracle not only has positive marks in five categories, but they are all scores lower than 20, so really strong scores in five different areas.

Adobe gets positive marks in its Profit vs. Risk Rating, SMR Rating, and Price Growth Rating. Unfortunately, it gets negative marks for its Outlook Rating, Valuation Rating, and P/E Growth Rating. The SMR Rating is the only one in the single digits while Oracle has three single-digit readings.

One Sentiment Indicator Stands Out From All the Rest

In addition to the charts and the fundamental indicators, I looked at three sentiment indicators for both Adobe and Oracle, the analysts’ ratings, short interest ratios, and the put/call ratios. For the most part, the readings on the indicators were similar and close to average, except for the analysts’ ratings.

Analysts are far more bullish on Adobe than they are Oracle. There are 27 analysts covering Adobe with 22 “buy” ratings and five “hold” ratings. This means the buy percentage is 81.5% and that is above the average range which falls between 65% and 75%. On the other hand, Oracle has 28 analysts covering it with seven “buy” ratings, 18 “hold” ratings, and three “sell” ratings. This puts its buy percentage at 25%, considerably below average—especially when you consider the company’s fundamental indicators.

I mentioned earlier that expectations for Adobe must have been higher than they were for Oracle and that could help explain how the stock performances have been so different in the last six months or so. Given the outlooks from analysts, the expectations are considerably higher for Adobe.

As for the other sentiment indicators, Adobe’s short-interest ratio is 2.6, and Oracle’s is 2.2. Both of those figures are slightly below average, but not alarmingly low. The average short interest ratio is in the 3.0 area. The low readings rule out the chances of a short-covering rally and that’s about it.

The put/call ratios are slightly different with Adobe’s coming in at 1.17 and Oracle’s ratio at 0.833. The average range for put/call ratios is between 0.90 and 1.10. What the readings tell us is that option traders are slightly more pessimistic on Adobe than the average stock and they are slightly more bullish on Oracle. Once again, the readings are only marginally outside the average range, but they aren’t at alarming levels.

Based on all of the data across all three analysis styles, The strong buy rating for Oracle and the buy rating for Adobe make sense. Oracle’s overall fundamental ratings are better, but Adobe’s growth has been better and it’s expected to remain that way for the next few years. The technical analysis shows that Oracle has more upward momentum than Adobe, but it’s overbought at this time. Adobe isn’t overbought, but it does face some resistance in the $525 area. The fact that the sentiment toward Oracle shows a sense of pessimism from analysts adds to the bullish case for it being a little stronger than that of Adobe.