ITG Reports Third Quarter 2016 Results

NEW YORK, Nov. 09, 2016 (GLOBE NEWSWIRE) -- ITG (NYSE:ITG), a leading independent broker and financial technology provider, today reported results for the quarter ended September 30, 2016.

Third Quarter 2016 Highlights

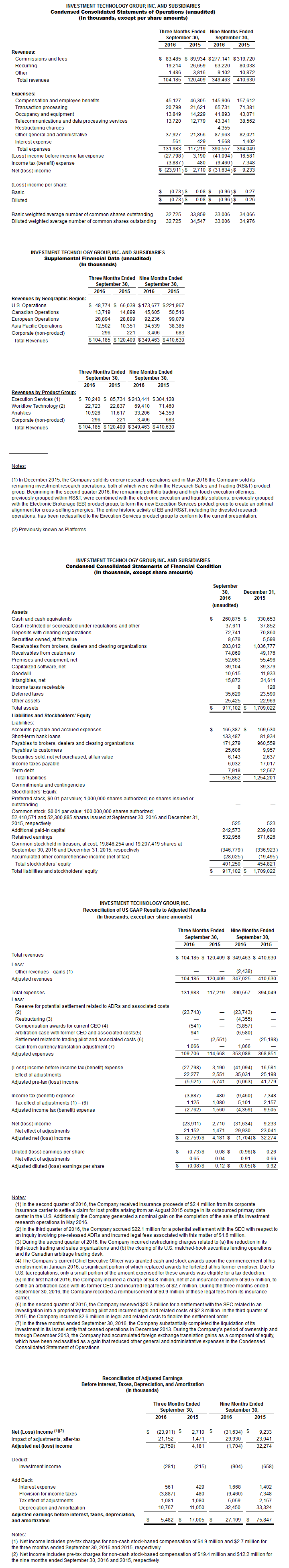

- GAAP net loss of $23.9 million, or $0.73 per share compared to GAAP net income of $2.7 million, or $0.08 per share for the third quarter of 2015.

- GAAP results for the third quarter of 2016 include the establishment of a reserve for the potential settlement of an SEC inquiry into activity involving pre-release American Depositary Receipts (ADRs). The firm discontinued transacting in pre-release ADRs in the fourth quarter of 2014. The settlement reserve of $22.1 million, together with related legal expenses of $1.6 million in the quarter, reduced after-tax earnings by $0.68 per share. A substantial portion of the reserve represents anticipated disgorgement of approximately $15 million in revenue for the period 2011 through the fourth quarter of 2014, as well as pre-judgment interest.The rest relates to an anticipated civil monetary penalty.

GAAP results for the third quarter of 2016 were also impacted by (i) a translation gain that was reclassified from equity to earnings upon the substantial wind-down of the Company’s Israel entity, (ii) proceeds from an insurance claim for the recovery of previously expensed legal fees related to the arbitration settlement with ITG’s former CEO and (iii) the amount expensed for upfront awards granted to ITG’s current CEO. GAAP net income for the third quarter of 2015 includes legal and other fees related to the August 2015 SEC settlement of $2.5 million pre-tax, or $0.04 per share after taxes.

- Adjusted net loss of $2.8 million, or $0.08 per share, compared to adjusted net income of $4.2 million, or $0.12 per share in the third quarter of 2015, in each case excluding the charges and gains listed above.

- Revenues of $104.2 million, compared to revenues of $120.4 million in the third quarter of 2015.

- GAAP expenses of $132.0 million and adjusted expenses of $109.7 million compared to GAAP expenses of $117.2 million and adjusted expenses of $114.7 million in the third quarter of 2015.Adjusted expenses exclude the charges and gains listed above.

- Average daily trading volume in the U.S. of 116 million shares versus 152 million shares in the third quarter of 2015. POSIT® average daily U.S. volume was 45 million shares compared to 67 million shares in the third quarter of 2015. Total average daily U.S. volume traded through POSIT Alert®was 11 million shares, compared to 9 million shares in the third quarter of 2015.

- In Europe, average daily value traded in POSIT was $857 million compared to $1.2 billion in the third quarter of 2015, including the effects of currency translation. Total average daily value traded through POSIT Alert in Europe increased 26% compared to the third quarter of 2015.

- Repurchased 426,000 shares of common stock for a total of $7.2 million under ITG’s authorized share repurchase program. Repurchases since the first quarter of 2010 have totaled $253 million for a total of 16.6 million shares, resulting in a decrease in shares outstanding, net of issuances, of more than 25%.

Commenting on the results, ITG President and Chief Executive Officer, Frank Troise, said, “We remain focused on executing on our strategic operating plan which includes investing in ITG’s global capabilities in liquidity, execution, analytics and workflow solutions. We are determined to address legacy issues, including through our efforts to reach a settlement of the SEC regulatory inquiry concerning pre-release ADRs.”

“While much work lies ahead, with disciplined investment and a commitment to excellence, we will continue to focus our efforts on gaining significant market share. We are assembling a team to deliver world-class client solutions and significant value for our shareholders,” he concluded.

Third Quarter Regional Segment Results

North American revenues were $62.5 million in the third quarter of 2016 compared to revenues of $80.9 million in the third quarter of 2015.

ITG reported a net loss of $4.8 million in North America in the third quarter of 2016, compared to net income of $2.4 million in the third quarter of 2015.

U.S. revenues were $48.8 million, compared to $66.0 million in the third quarter of 2015 including the impact of the research divestitures in December 2015 and May 2016.

Canada revenues were $13.7 million, compared to $14.9 million in the third quarter of 2015, including the impact of currency translation.

Europe and Asia Pacific revenues were $41.4 million in the third quarter of 2016 compared to $39.3 million in the third quarter of 2015, including the impact of currency translation.

ITG reported net income for its Europe and Asia Pacific operations of $4.7 million in the third quarter of 2016 compared to $3.6 million in the third quarter of 2015.

European revenues were $28.9 million in the third quarter of 2016 and $29.0 million in the third quarter of 2015, including the impact of currency translation.

Asia Pacific revenues were $12.5 million, up from $10.3 million in the third quarter of 2015.

Corporate activity reduced GAAP net income by $23.8 million in the third quarter of 2016, including the reserve for a potential resolution of the pre-release ADR matter and related legal fees in the quarter, the translation gain, the recovery of legal fees from insurance and the charges related to upfront awards to ITG’s current CEO.

Corporate activity reduced GAAP net income by $3.3 million in the third quarter of 2015, including the legal and other related fees associated with the August 2015 SEC settlement.

Corporate activity includes investment income and non-operating gains, as well as costs not associated with operating ITG's regional and product group business lines including, costs of being a public company, intangible amortization, interest expense, costs of maintaining a global transfer pricing structure, foreign exchange gains and losses and certain non-operating items.

Year-to-Date Results

For the first nine months of 2016, revenues were $349.5 million and adjusted revenues were $347.0 million. GAAP net loss for the first nine months of 2016 was $31.6 million, or $0.96 per share, and adjusted net loss was $1.7 million, or $0.05 per share.

For the first nine months of 2015, revenues were $410.6 million, GAAP net income was $9.2 million, or $0.26 per share, and adjusted net income was $32.3 million, or $0.92 per share.

Non-GAAP Financial Measures

To supplement our financial information presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”), management uses certain “non-GAAP financial measures” as such term is defined in Regulation G promulgated by the SEC. Generally, a non-GAAP financial measure is a numerical measure of a company’s operating performance, financial position or cash flows that excludes or includes amounts that are included in, or excluded from, the most directly comparable measure calculated and presented in accordance with GAAP. Management believes the presentation of these measures provides investors with greater transparency and supplemental data relating to our financial condition and results of operations, and therefore a more complete understanding of factors affecting our business than GAAP measures alone. In addition, management believes the presentation of these matters is useful to investors for period-to-period comparison of results as the items may reflect certain unique and/or non-operating items such as acquisitions, divestitures, restructuring charges, large write-offs, significant charges associated with litigation or regulatory matters together with related expenses or items outside of management’s control.

Adjusted revenues, adjusted expenses, adjusted pretax (loss) income, adjusted income tax (benefit) expense, adjusted net (loss) income and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), together with related per share amounts, are non-GAAP performance measures that we believe are useful to assist investors in gaining an understanding of the trends and operating results for our core business. These measures should be viewed in addition to, and not in lieu of, results reported under GAAP.

Reconciliations of adjusted revenues, adjusted expenses, adjusted pre-tax (loss) income, adjusted income tax (benefit) expense, adjusted net (loss) income and adjusted EBITDA to revenues, expenses, (loss) income before income tax (benefit) expense, income tax (benefit) expense and net (loss) income and related per share amounts as determined in accordance with GAAP for the three and nine months ended September 30, 2016 and September 30, 2015, respectively, are provided in the accompanying supplemental tables at the end of this release.

Conference Call on 3Q16 Results

An investor conference call to discuss ITG’s results will be held today at 8:00 am ET. Those wishing to listen to the call should dial 1-844-419-9270 (1-213-358-0776 outside the U.S.) and enter conference number 359 7794 at least 15 minutes prior to the start of the call to ensure connection.

The webcast and accompanying slideshow presentation will be available at: investor.itg.com. A replay will be available for one week by dialing 1-855-859-2056 (1-404-537-3406 outside the U.S.) and entering conference number 359 7794. The replay will be accessible approximately two hours after the completion of the conference call.

About ITG

Investment Technology Group (NYSE:ITG) is a global financial technology company that helps leading brokers and asset managers improve returns for investors around the world. We empower traders to reduce the end-to-end cost of implementing investments via technology-enabled liquidity, execution, analytics and workflow solutions. ITG has offices in Asia Pacific, Europe and North America and offers execution services in more than 50 countries. Please visit: www.itg.com for more information.

In addition to historical information, this press release may contain "forward-looking" statements that reflect management’s expectations for the future. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue” and the negative of these terms and other comparable terminology. A variety of important factors could cause results to differ materially from such statements.

Certain of these factors are noted throughout ITG’s 2015 Annual Report on Form 10-K, and its Form 10-Qs (as amended, if applicable) and include, but are not limited to, general economic, business, credit, political and financial market conditions, both internationally and domestically, financial market volatility, fluctuations in market trading volumes, effects of inflation, adverse changes or volatility in interest rates, fluctuations in foreign exchange rates, evolving industry regulations and increased regulatory scrutiny, the ultimate resolution of the Securities and Exchange Commission’s inquiry regarding pre-released American Depositary Receipts (“ADRs”) and any customer or shareholder reaction to the matter or further proceedings or sanctions based on our ADR activity, the outcome of other contingencies such as legal proceedings or governmental or regulatory investigations, the volatility of our stock price, changes in tax policy or accounting rules, the actions of both current and potential new competitors, changes in commission pricing, rapid changes in technology, errors or malfunctions in our systems or technology, cash flows into or redemptions from equity mutual funds, ability to meet liquidity requirements related to the clearing of our customers’ trades, customer trading patterns, the success of our products and service offerings, our ability to continue to innovate and meet the demands of our customers for new or enhanced products, our ability to protect our intellectual property, our ability to execute on strategic initiatives or transactions, our ability to attract and retain talented employees, and our ability to pay dividends or repurchase our common stock in the future.

The forward-looking statements included herein represent ITG’s views as of the date of this release. ITG undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.

ITG Media/Investor Contact: J.T. Farley 1-212-444-6259 corpcomm@itg.com

Disclosure: None.