Is Verizon Stock A Buy In July 2019?

Verizon Communications (VZ) is the second-largest telecommunications company in the United States. Only AT&T (T) is larger in the sector.

As a mega-cap stock with a market capitalization above $200 billion, Verizon is also a member of the Dow Jones Industrial Average.

Verizon has increased its dividend for 14 consecutive years. This qualifies Verizon as a member of the Dividend Achievers, a group of stocks that have increased their dividends for at least 10 consecutive years. You can see all 264 Dividend Achievers here.

Verizon also offers a 4%+ dividend, which should make the stock very attractive to income investors. Verizon is a very consistent company that offers a solid total annual return potential over the next five years.

Business Overview & Recent Events

Verizon was created when Bell Atlantic Corp and GTE Corp merged together in June of 2000. The company’s network covered almost 300 million people and 98% of the U.S.

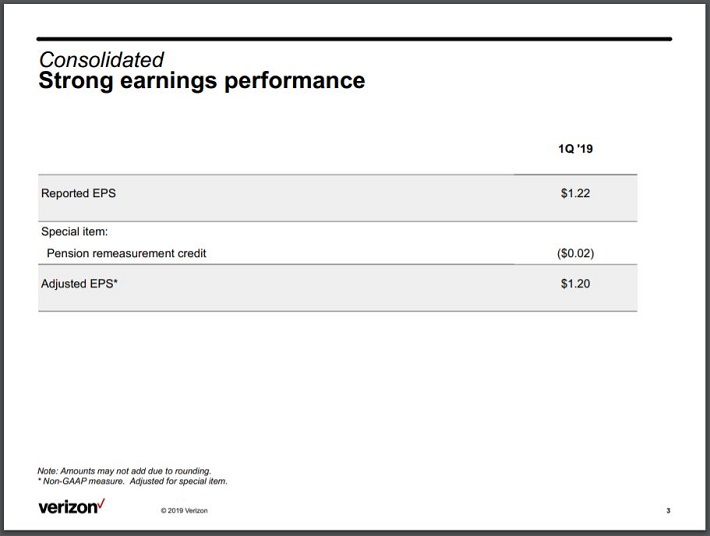

Verizon trades with a market capitalization of $239 billion and produced $131 billion in sales last year. Verizon reported financial results for the first quarter on April 23rd, 2019:

(Click on image to enlarge)

Source: Earnings Slides

Verizon’s adjusted earnings-per-share totaled $1.20 for the first quarter. This was $0.04 above estimates and a 2.6% improvement from the previous year. Revenue increased 1.1% to $32 billion. This was in-line with what analysts had excepted.

The company’s wireless business, which accounts for more than 70% of all revenues, grew nearly 4% to $22.7 billion. Verizon added 61K retail postpaid net additions in the first quarter. The company also added 174K postpaid smartphone net add.

Higher priced plans improved service revenues by 4.4%. Postpaid churn was just 0.84%. Although this was slightly higher than the previous quarter, this remains one of the lowest rates in the industry.

Offsetting gains in wireless was a 3.9% decline in the wireline business. Fios gained a net 52K Fios connections, but lost a net 53K Fios video subscribers.

Based on first quarter results, Verizon now anticipates earnings-per-share to grow at a low-single-digit rate from last year, which is down slightly from previous guidance. We estimate that the company can earn $4.80 per share in 2019, which would be a 2% increase from the previous year.

Growth Prospects

Verizon produced another solid quarter, growing both the top and bottom line. We feel that the company offers several catalysts for growth going forward as well.

Unlike competitor AT&T, which has purchased DirecTV and Time Warner in recent years, Verizon has mostly stayed away from adding media companies to its existing business.

Verizon at its core is a telecommunications company and it is just starting to roll out 5G.

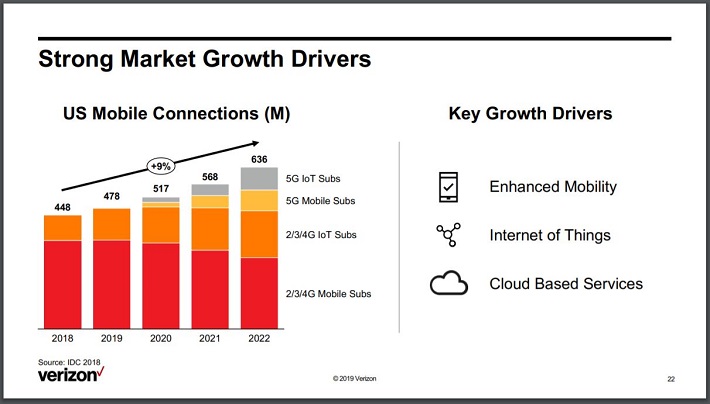

(Click on image to enlarge)

Source: Investor Meeting

The company expects 5G mobile connections to increase at an annual rate of 9% through 2022. Getting ahead of other telecom companies in 5G will only increase Verizon’s competitive advantage in this area.

Verizon will be rolling out 5G service in at least 30 cities in the U.S. in 2019, with 20 cities receiving the company’s Ultra-Wideband 5G service. These cities include Boston, Dallas, and Washington D.C. It was announced at the end of June that Denver and Providence will be the next two cities to receive 5G Ultra Wideband service.

In addition, Verizon is in a position to profit from the popularity of Internet of Things technology. While the company doesn’t directly manufacturer products such as voice assistants and connected speakers and home devices, it will provide the connections and networks needed to run this equipment. This should provide a revenue source from an industry that is still in its infancy.

Dividend Analysis

Despite its relatively short growth streak, Verizon is one of the more well-known dividend-paying stocks in the market. With a 4.2% yield, the stock has one of the highest yields in the Dow Jones Industrial Average.

The stock offers a high yield, but dividend growth is very low. Verizon has increased its dividend:

- By a CAGR of 1.2% over the past three years

- By a CAGR of 1.9% over the past five years

- By a CAGR of 2.4% over the past 10 years

The company has followed a pattern of increasing its dividend $0.0125 per quarter for the past several years. This continued with the most recent increase, which was paid on November 1st, 2018.

We expect that this type of dividend growth will be similar going forward. Although dividend growth is muted, we do feel that the dividend is well covered on a variety of metrics.

In the first quarter of 2019, Verizon generated adjusted earnings-per-share of $1.20. For context, Verizon currently pays a quarterly dividend of $0.60 per share, which implies a payout ratio of 51% in the most recent quarter.

Looking out over a longer time horizon, our conclusion is the same. Verizon generated $4.71 of adjusted earnings-per-share in 2018. The company distributed $2.37 of common share dividends during the same time period for a dividend payout ratio of 50% in the full fiscal year.

Free cash flow is often the preferred measurement of dividend safety.

Verizon generated $7.1 billion of cash flow from operating activities in the first quarter of 2019 and spent $4.3 billion on capital expenditures during the same time period for free cash flow of approximately $2.8 billion. The company paid out $2.5 billion of common share dividends during the same time period for a free cash flow dividend payout ratio of 89%.

Looking out over a longer time horizon, the company’s payout ratio is much lower. Verizon produced $34.34 billion of cash flow from operating activities in fiscal 2018 and spent $16.66 billion on capital expenditures for free cash flow of approximately $17.7 billion. The company distributed $9.8 billion of common share dividends during the same time period for a free cash flow dividend payout ratio of 55%.

It appears that Verizon’s dividend is safe when using either earnings-per-share or the longer term view of free cash flow. We do not anticipate the company cutting its dividend as it is well-covered by both metrics.

The following video further discusses our view of Verizon’s dividend safety:

Running length 00:05:39

Valuation & Expected Returns

Verizon’s earnings-per-share compounded at a rate of 5% over the last decade. Due to lowered guidance for the current year, we forecast that the company will see earnings grow at a rate of 4% annually through 2024.

Shares of Verizon ended the most recent trading session near $58. Using our expected earnings-per-share guidance of $4.80 for 2019, the stock has a current price-to-earnings ratio of 12.1.

Over the last 10 years, Verizon stock has traded with an average price-to-earnings ratio of 14. If shares were to reach this multiple by 2024, then valuation would add 3% to annual returns over this period of time.

Total annual returns for Verizon would consist of the following:

- 4% earnings-per-share growth

- 4.2% dividend yield

- 3% multiple expansion

Combined, we expect that Verizon’s stock will return 11.2% annually through 2024.

Final Thoughts

Verizon is one of the top companies in the telecommunications sector. While it has avoided becoming a content provider, it does lead the rest of the sector in 5G deployment.

The company also enjoys a high rate of loyalty among its customers as evidenced by a very low churn rate.

Investors may be interested in Verizon at first due to its generous yield, while the company also offers a solid growth rate. The stock also has a very low price-to-earnings ratio, making it highly likely that it will enjoy some valuation expansion in the future.

Due to these factors, Verizon receives a buy recommendation from Sure Dividend.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more