Is This Rock Bottom For Newell?

Our latest featured stock is a consumer products company that’s struggling to turn around its business. We pulled this highlight from last week’s research of 421 10-K filings.

Analyst Peter Apockotos found several unusual items in the footnotes of Newell Brands’ (NWL) 2018 10-K.

When NWL acquired Jarden Corporation for $15 billion in 2016, we warned investors that the deal would destroy value. It only took two years for our prediction to come true. In 2018, NWL admitted that the acquisition was failing and sold off several of its brands. The company also recorded an $8.3 billion write-down (28% of invested capital).

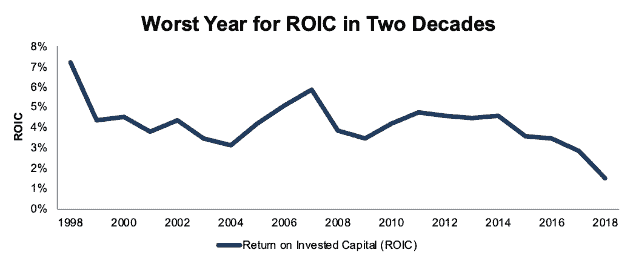

Now that NWL has filed its 10-K (4 days after it was due), our analysis shows that 2018 was NWL’s worst year in regards to return on invested capital (ROIC) in at least 20 years.

Figure 1: ROIC for NWL Since 1998

Sources: New Constructs, LLC and company filings.

NWL’s major write-downs and divestitures made its 10-K unusually complicated. The company required more earnings adjustments than 92% of the companies we cover and more valuation adjustments than 99% of the companies we cover in 2018.

Getting the Truth on Profits

Removing the impact of the $8.3 billion write-down was our biggest earnings adjustment. However, we did find one other significant non-operating expense hidden in the footnotes. On page 97, NWL disclosed that it increased its inventory reserve by $35 million (1% of revenue), a non-cash expense that we adjust for in our calculation of net operating profit after tax (NOPAT).

We noted in our original Danger Zone report that the company had been artificially boosting its reported earnings by lowering its reserves. In a normal year, raising those reserves would have depressed earnings and alarmed investors. However, with everything else going wrong in 2018, the impact of NWL raising its reserves back to a normal level was overshadowed.

After all our adjustments, we see that NWL’s NOPAT fell by just over half in 2018, from ~$1.1 billion to $517 million.

Fully Accounting for Changes to the Balance Sheet

Adding back the $8.3 billion write-down (along with $2.5 billion in previous accumulated write-downs) was our biggest invested capital adjustment. In addition, we found two sources of significant hidden capital buried in the footnotes.

- On page 65, NWL discloses off-balance sheet operating lease commitments with a present value of $724 million (2% of invested capital).

- On page 57, NWL discloses $913 million (3% of invested capital) in accumulated other comprehensive loss.

After all adjustments, we see that NWL’s average invested capital declined by 11% in 2018, from $38.2 billion to $33.9 billion.

The last red flag we found came on page 40, where NWL’s auditor disclosed its opinion that the company failed to maintain effective internal control over financial reporting. This auditor’s opinion means there is a higher chance that NWL’s financials could contain a material misstatement.

We closed our short recommendation on NWL on 11/20/2018 (with the stock down 36% from our original call) due to the company selling off its assets. We still believe these divestitures will be best for the company in the long run, but NWL’s 10-K shows just how far the company has to go to recover from its poor capital allocation. Investors should continue to avoid this stock.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

In total, we made the following adjustments to Newell Brands’ 2018 10-K:

Income Statement: we made $10.7 billion of adjustments, with a net effect of removing $7.4 billion in non-operating expense. We removed $1.6 billion in non-operating income and $9.1 billion in non-operating expense. You can see all the adjustments made to NWL’s income statement here.

Balance Sheet: we made $27.3 billion of adjustments to calculate invested capital with a net increase of $19.5 billion. You can see all the adjustments made to NWL’s balance sheet here.

Valuation: we made $12.1 billion of adjustments with a net effect of decreasing shareholder value by $6 billion.

The Power of the Robo-Analyst

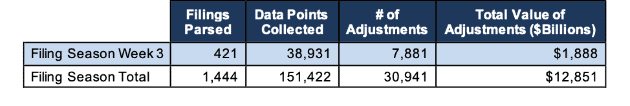

We pulled this highlight from last week’s research of 421 10-K filings, from which our Robo-Analyst technology collected 38,931 data points. Our analyst team used this data to make 7,881 forensic accounting adjustments with a dollar value of $1.9 trillion. The adjustments were applied as follows:

- 3,200 income statement adjustments with a total value of $131 billion

- 3,341 balance sheet adjustments with a total value of $859 billion

- 1,313 valuation adjustments with a total value of $898 billion

Figure 2: Filing Season Diligence for Week of March 4-10

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our research automation technology uses machine learning and natural language processing to automate robust financial modeling.

No Substitute for Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe this research is necessary to uncover the true profitability of a firm and make sound investment decisions. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how the adjustments we make contribute to materially superior models and metrics.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can investors and advisors alike get beyond the noise and get the truth about earnings and valuation.

Disclosure: David Trainer, Peter Apockotos, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.