Is The Nasdaq 100 The New Dotcom Bubble?

Another day, another surge by the Nasdaq 100 without the rest of the indices joining the party. You know the few stocks; Apple, Amazon, Netflix, Microsoft, Nvidia, Facebook, Google, and a few more. The Dow Industrials, S&P 500, S&P 400, and Russell 2000 are not behaving well.

This is not 1999 and the Dotcom Bubble, but this is still dangerous behavior that can lead to consequences tomorrow, next month, or next year. Remember, markets can stay irrational longer than investors can stay solvent.

I did go out on a limb on Yahoo Finance the other day and forecast the Nasdaq 100’s outperformance, to put it mildly, was going to end this quarter. That means by September 30. I will stick with that until the market makes me look foolish, which it certainly has done more than a few times in my 32-year career. Here is the link to the segment.

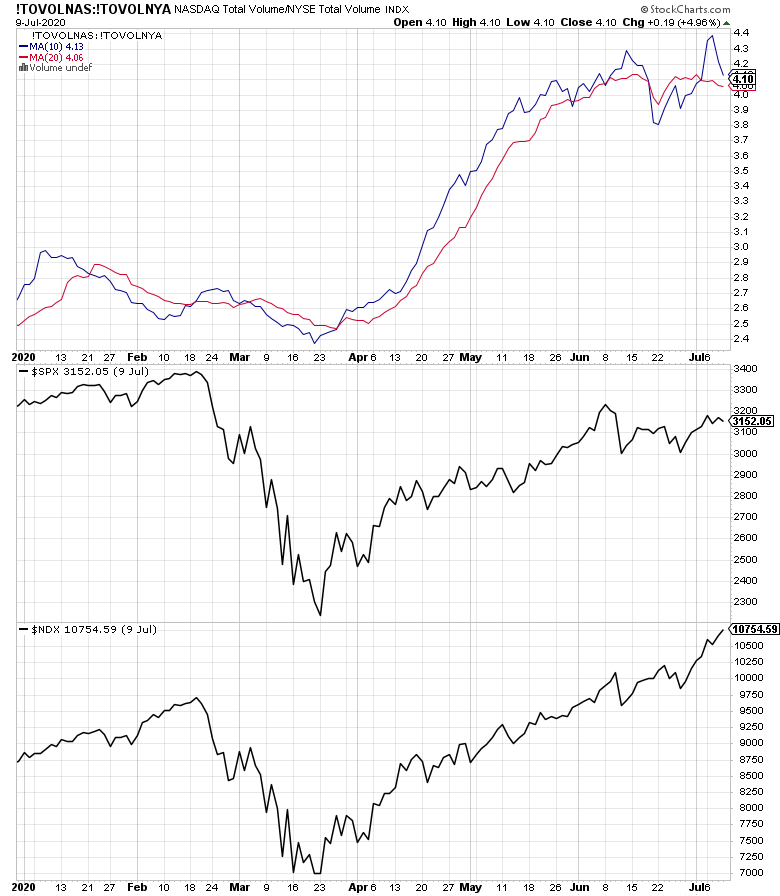

There are a few ways to articulate the massive imbalance, one being the volume (shares traded) pouring into the Nasdaq versus the NYSE. Below in the top chart, you can see the 10-day (blue) and 20-day (red) average volume of Nasdaq versus the NYSE. In short, you do not need a PhD to see that all the excitement is and has been in the tech sector. The charts of the S&P 500 and Nasdaq 100 are below.

As I mentioned above, this is not the Dotcom Bubble. It’s not even a bubble. I know that may sound crazy, but true investing bubbles are generational at best. Yes, we have Robinhood’s free trading platform today and that may resemble the new online platforms of the late 1990's, but it’s not pervasive like the Dotcom Bubble, where even my grandparents with their municipal bonds and Mobil stocks wanted a piece of the casino-like action.

I vividly remember the Dotcom era when companies had no earnings at all. Some even had no revenue. I will never forget being told that even though I was a “young fellow," I didn’t get the new age of investing where companies were being valued by eyeballs over earnings. In other words, how many people on your website.

Traders were buying stocks in the morning, checking in on them at lunch and selling them by the close for insane profits. While I refused to engage client money in this nonsense, I will admit to buying one single Dotcom stock for myself. At Home was the name, and it ended up being $0 very quickly. I think I bought it high and sold it low, very low.

A few friends even offered to manage my firm’s money because they now knew much more than I did. Except for one very sharp, conservative, and humble couple from DC who sold 100% of their public and private holdings in early 2000, the rest lost not only their profits, but their principal as well. Bulls and bears make money. Pigs get slaughtered.

2020 is not 1999-2000, not by a long shot. But that doesn’t mean the current behavior is constructive or positive. It’s not. Sooner or later there will be consequences and punishment.