Is Sprint Stock About To Get A Boost?

While 2019 wasn’t exactly a banner year for mergers and acquisitions, there is a potential giant merger in the telecom sector coming up this year. Of course, I’m talking about the proposed merger between Sprint (S) and T-Mobile (TMUS).

A combined S and TMUS entity would have a market cap of around $100 billion and sales of $85 billion. It would also create a third company to rival the stranglehold of AT&T (T) and Verizon (VZ). In particular, Sprint needs this merger to stay relevant.

On the other hand, having just three companies competing in one of the largest industries in the country would create an oligopoly. That’s something both customers and some government officials hope to avoid. To get around this issue, S and TMUS are supposed to sell off certain assets to Dish Network (DISH), so the company can become the fourth major player in the space.

The federal government has approved the merger, and now it’s up to the various state governments. All the state attorney generals have filed a lawsuit to stop the merger, although some have recently settled.

Getting back to Sprint, the company desperately needs this deal as it has continued to lose market share versus the other three major players. A deal with TMUS is likely the best hope for S shareholders.

It does seem like S stock is going to get a boost in the coming weeks – possibly due to an update on the proposed merger. The signal is coming from the options market, where a trader recently put on a large block of covered calls.

As a reminder, a covered call is when the stock is purchased while selling calls at the same time (generally at a higher strike). Depending on the trade, there is typically the ability to make money on stock appreciation while also generating yield from the call sale. Overall, a covered call is a bullish trade since the shares are purchased.

In this case, with the stock at $4.85, the trader bought 1 million shares while simultaneously selling 10,000 February 21st 6 calls for $0.39. The call sale represents a yield of 8% in just about 5 weeks’ time. It also provides a cushion in the stock purchase down to $4.46.

Meanwhile, because the 6 calls were sold, the share price can appreciate to $6 before the gains are capped. That $1.15 of potential upside means the position can earn almost 24% in stock appreciation on top of the 8% yield.

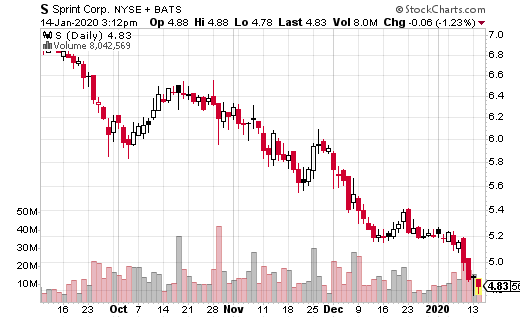

While you can see that Sprint share has had a very tough run of late, this is exactly the sort of trade you should be making if you are bullish on a merger with TMUS. There’s a limit on how far S can fall while the merger is on the table (that is, it’s not going to zero).

Meanwhile, even if the merger doesn’t get approved prior to February expiration, the trade generates a whopping 8% yield in 5 weeks. And, if the stock does jump because of news, an additional 24% gains can be captured. Best of all, this is an easy (and inexpensive) trade to make in your own account if you feel the merger is going to happen.