Is Now A Good Time To Buy Amgen?

Amgen (AMGN) is a market leader in biotechnology-based human therapeutics, with historical expertise in renal disease and cancer supportive care products. The company is facing growing competitive pressure from biosimilars in recent years, but management is doing a sound job of diversifying its revenue base. In fact, management considers that biosimilars could be an opportunity as much as a risk for Amgen in the years ahead.

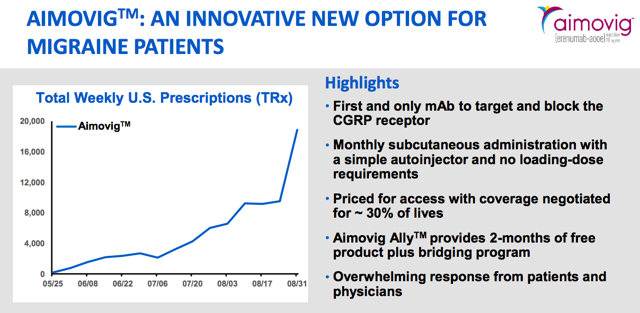

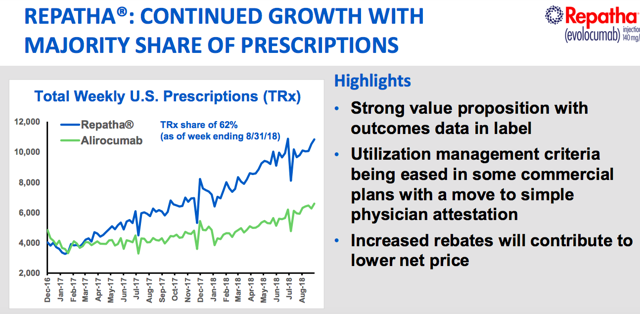

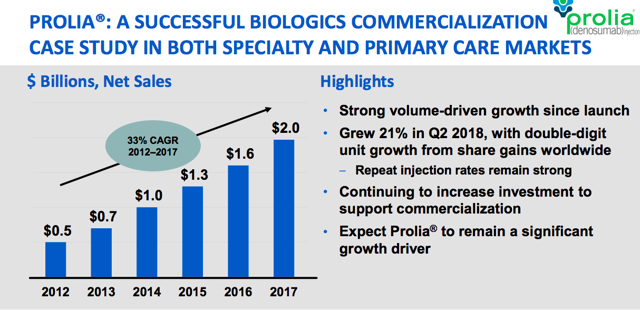

Among the company’s most promising new products, names such as Aimovig for migraine treatments, Repatha for cardiovascular disease, and Prolia for osteoporosis look particularly strong.

Source: Amgen.

Source: Amgen

Source: Amgen

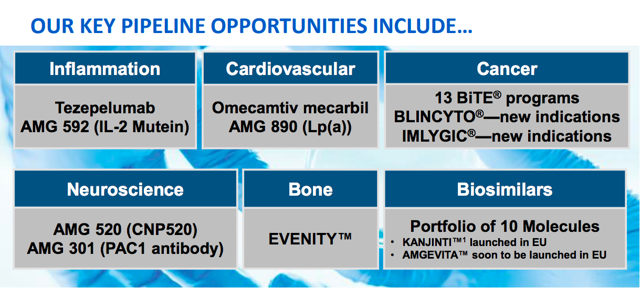

Amgen has a promising pipeline with multiple products in big markets such as oncology, cardiovascular health, bone health, and neuroscience. While it’s hard to tell how any of these products in particular may work in the future, it’s good to know that the company is betting on a wide variety of alternatives with attractive potential.

Source: Amgen.

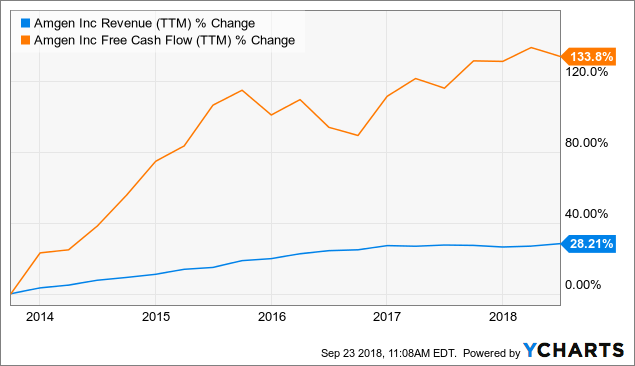

Being a mature player in the sector, Amgen is facing increasing pressure from biosimilar competitors, and this is hurting revenue growth. But revenue is still moving in the right direction, and the business produces abundant cash flow. In fact, cash flow growth has substantially outpaced revenue growth over the past five years.

AMGN Revenue (NYSE:TTM) data by YCharts

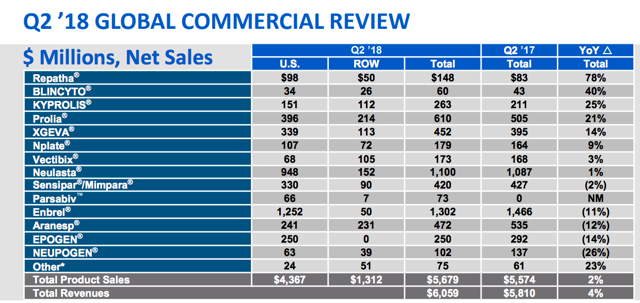

Looking at the company's revenue sources, Amgen is quite diversified, and growing revenue from the company's younger products is more than compensating for the decline in revenue from products such as Embrel.

These high-growth products should account for a larger share of total revenue over time, and this will most likely have positive implications in terms of overall company-level revenue growth in the years ahead.

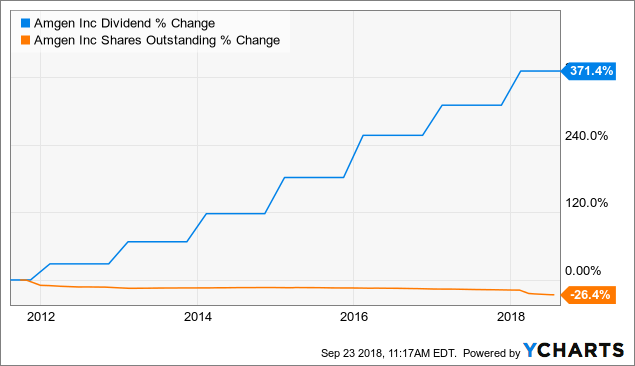

Strong cash flow generation has allowed Amgen to reward shareholders with generous dividends and buybacks over the years. Since 2011 the company has increased its dividend by more than 370%, while also reducing the number of shares outstanding by over 26% in such period.

AMGN Dividend data by YCharts

Reasonable Valuation

Wall Street analysts are on average estimating that Amgen will produce $14.52 in earnings per share during 2019. Under this assumption, the stock is trading at a forward price to earnings ratio around 14.1. By comparison, the average company in the S&P 500 index is currently trading at a forward price to earnings ratio in the neighborhood of 16.2.

The table below compares key valuation ratios such as price to earnings, forward price to earnings, price to sales, and price to free cash flow for Amgen versus other big industry players like Novo Nordisk (NVO), Biogen (BIIB), and Celgene (CELG).

| Ticker | P/E | Fwd P/E | P/S | P/FCF |

| AMGN | 17.06 | 14.1 | 5.79 | 18.77 |

| NVO | 19.05 | 18.54 | 5.41 | 40.46 |

| BIIB | 17.57 | 12.58 | 5.44 | 15.02 |

| CELG | 16.63 | 8.28 | 4.45 | 18.66 |

Both in comparison to the market as a whole and by industry standards, Amgen stock is priced at fairly reasonable valuation levels.

Strong Earnings Momentum

Stock prices don't just reflect current fundamentals, but expectations about those fundamentals can be even more important. When a company is delivering better than expected earnings and expectations about future earnings are increasing, this generally means that the stock price is increasing too.

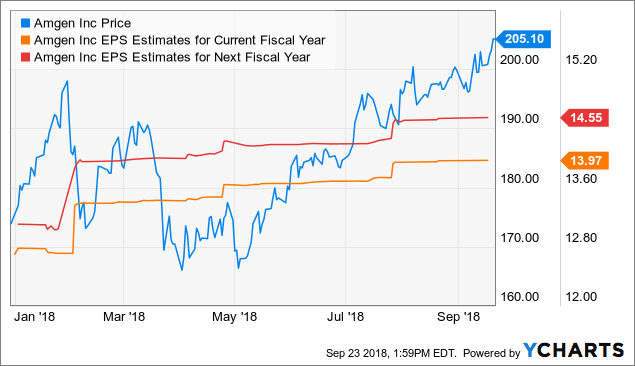

Amgen delivered better than expected numbers last quarter, in a sign of confidence, management also raised revenue and sales guidance for the full year. In this context, Wall Street analysts are increasing their earnings expectations for Amgen in both the current year and next fiscal year.

AMGN data by YCharts

As long as the trend remains in place, increasing earnings expectations could be strong return driver for Amgen stock going forward.

Vigorous Relative Strength

Money has an opportunity cost, when you buy a stock with mediocre returns, that capital is not available for investing in companies with superior potential. Besides, winners tend to keep on winning in the stock market, so you want to invest in stocks that are not only doing well but also doing better than other alternatives.

Amgen stock is outperforming both SPDR S&P 500 (SPY) and iShares Nasdaq Biotechnology (IBB) on a year to date basis. In comparison to both the broad market and the biotech sector, Amgen stock is displaying vigorous relative strength.

AMGN data by YCharts

Putting It All Together

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to the factors analyzed in this article for Amgen: financial quality, valuation, earnings momentum, and relative strength.

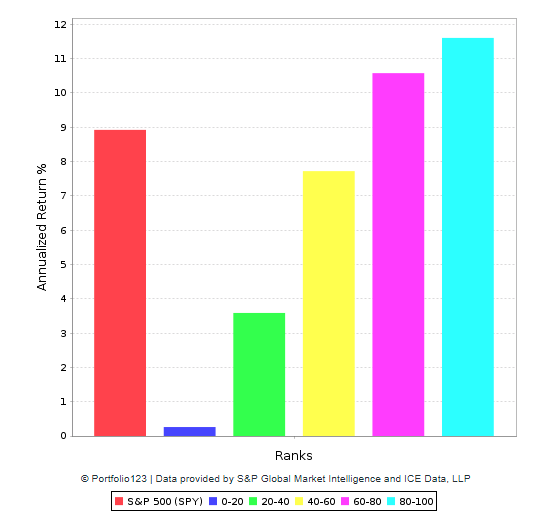

The chart below divides the investable universe in 5 buckets based on their PowerFactors ranking, and it compares their historical performance versus the SPDR S&P 500. There is a clear and direct relationship between PowerFactors rankings and historical performance, this is to be expected when the quantitative system is robust and consistent. Also, companies with elevated quantitative rankings have substantially outperformed the market over the long term.

Data from S&P Global via Portfolio123

Amgen stock has a PowerFactors ranking of 99.25, and the company gets remarkably high scores across the four variables considered: quality, value, fundamental momentum, and relative strength. From a quantitative perspective, the numbers bode well for investors in Amgen going forward.

Past performance does not guarantee future returns, of course. A quantitative system is always based on past data and current expectations about future performance. If Amgen fails to deliver in accordance to those expectations, then the stock will most likely deliver disappointing returns going forward.

Investors may want to keep a close eye on the company's current and potential new products, and how they compare versus the offerings from the competition. Besides, regulatory risk and the always evolving pricing environment are always key variables to watch when investing in biotech stocks.

The quantitative system alone does not tell you the whole story, it's important to understand the business behind the numbers in order to truly understand the main risks and return drivers in Amgen stock.

That being acknowledged, making investment decisions based on quantified data is certainly a much sounder approach than relying entirely on emotions and subjectivity when picking stocks. If the statistical evidence is any valid guide, Amgen looks well positioned for attractive performance over the middle term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more