Is It Too Late To Buy Salesforce Stock?

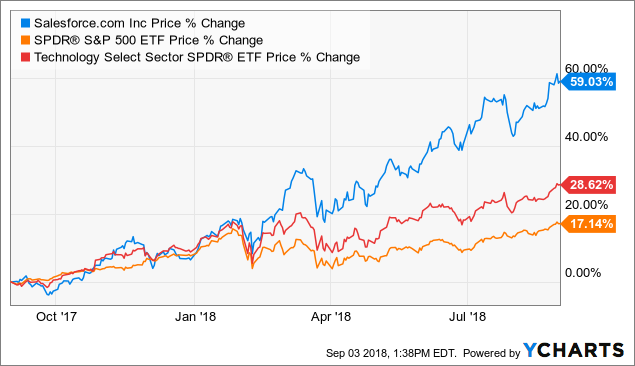

Salesforce (NYSE:CRM) has gained nearly 60% in the past year alone, and its performance is even more impressive on a longer time frame. Over the past decade, investors in Salesforce have gained a stratospheric 1,010%, versus a far more modest cumulative gain of 127% for the S&P 500 index in the same period.

CRM data by YCharts

With the stock delivering such massive returns and trading near historical highs, investors may understandably feel reluctant to buy Salesforce stock at current prices. From a contrarian perspective, the time to pull the trigger is when the stock is substantially down and trading near its lows of the year, not when it is reaching record high price levels.

On the other hand, past price performance and valuation can be remarkably different things, and only because a stock has risen steeply, that does not mean it’s necessarily overvalued. Importantly, valuation needs to be interpreted in its due context. Companies with superior growth obviously deserve an above-average valuation, and Salesforce is an exceptional growth stock.

There is no infallible formula to pick winning stocks, but statistical data shows that quantitative indicators such as financial quality, valuation, momentum and relative strength tend to generate above-average returns for investors in the long term. Let's take a look at Salesforce from a quantitative perspective in order to find out what the numbers are saying about the stock and its potential returns going forward.

Financial Quality

Salesforce is a market leader in software-as-a-service. The company offers a deep ecosystem of services across different verticals that are critically important to customers. Brand recognition, the ubiquity of products and access to data provide solid sources of competitive strength for the business.

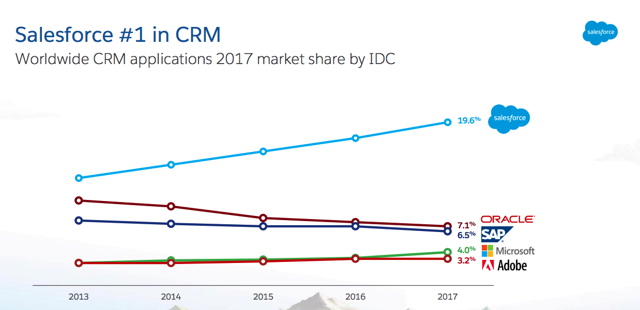

Salesforce competes against strong players such as Microsoft (Nasdaq:MSFT), Oracle (NYSE:ORCL) and SAP AG (NYSE:SAP), but it has outperformed the competition and consolidated its leadership position in the industry over the past several years.

Source: Salesforce

The enterprise software industry is going through a major shift over the past several years, since many corporations of all sizes are moving toward the cloud and subscription-based services for all kinds of applications.

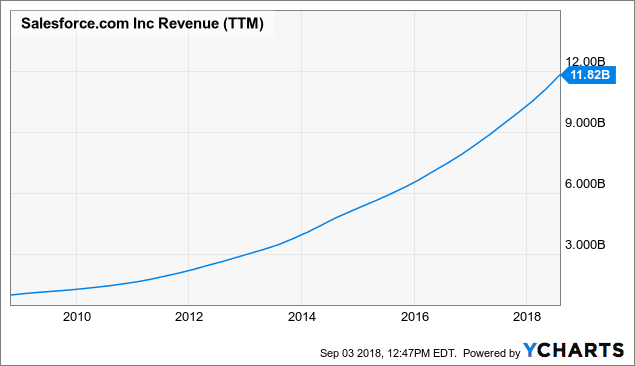

Salesforce is a major driving force behind this trend and also one of the main beneficiaries from it. Back in 2009, the company was making $1.08 billion in revenue, and Wall Street analysts are currently expecting Salesforce to make $13.17 billion in sales in the current fiscal year.

CRM Revenue (TTM) data by YCharts

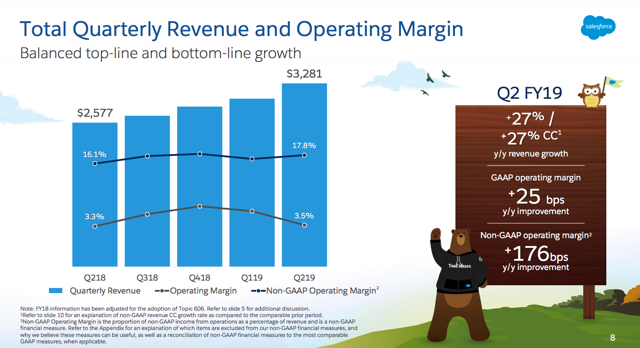

Financial performance for the most recent quarter confirms that the business keeps firing on all cylinders as of the period ended July 2018. Revenue for the quarter rose 27% year over year, and revenue under contract grew 36% to $21 billion. In a sign of confidence, Salesforce also raised its guidance for the full year.

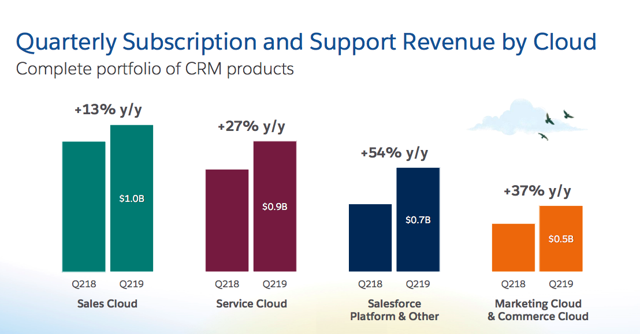

Importantly, Salesforce is benefiting from vigorous growth across its different business segments, and this is a major positive when it comes to evaluating the company and its ability to sustain performance over the years ahead.

Source: Salesforce

Profitability is somewhat of a mixed picture, though. The company is aggressively investing for growth, and stock-based compensation is taking a considerable toll on GAAP profit margins. On the other hand, non-GAAP margins are much more attractive, and profit margins are moving in the right direction.

Source: Salesforce

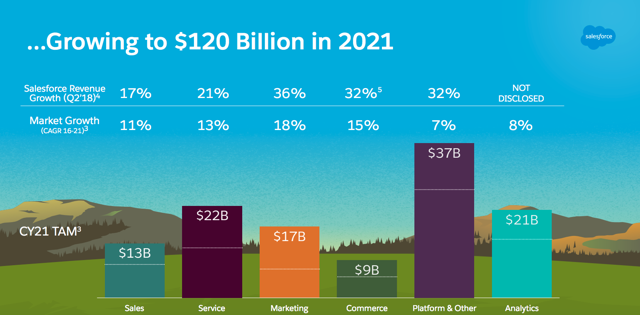

Moving forward, Salesforce has a lot of room for growth in the years ahead. Management estimates that the total addressable market opportunity for the company is currently worth $72 billion, and the size of such market opportunity is expected to increase to over $120 billion by 2021.

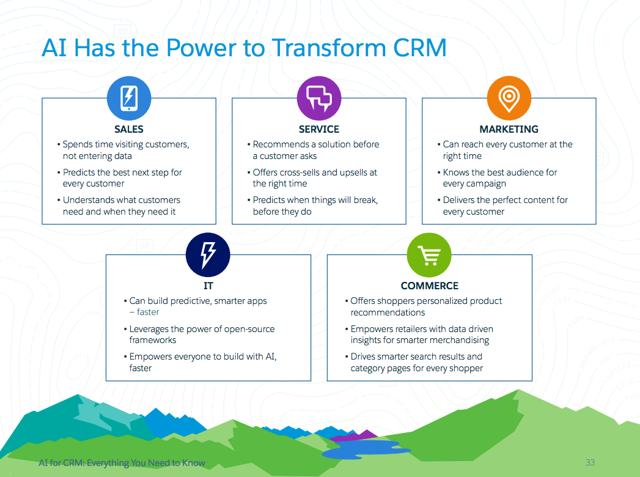

The company is focusing on artificial intelligence as a key growth engine with its Einstein Artificial Intelligence service. According to a report from IDC, artificial intelligence technologies associated with CRM activities will generate $1.1 trillion in global business revenue from the beginning of 2017 to the end of 2021, and Salesforce is building a wide portfolio of AI solutions in multiple services and applications.

Source: Salesforce

Valuation

The table below shows key valuation ratios and financial statistics for Salesforce versus other industry players such as Oracle (ORCL), SAP (SAP), Adobe (ADBE), Intuit (INTU), Workday (WDAY), Red Hat (RHT), Splunk (SPLK), ANSYS, Inc. (ANSS) and Shopify (SHOP).

Data in the table includes forward P/E, price-to-sales, price-to-operating cash flow and expected earnings per share growth in the coming five years. Salesforce is expected to remain a growth leader in the sector over the years ahead, and valuation is not too excessive if the company delivers in accordance with expectations.

| Ticker | Fwd P/E | P/S | P/CFO | EPS Next 5Y |

| CRM | 55.91 | 9.61 | 15.87 | 28.09% |

| ORCL | 13.43 | 4.89 | 2.89 | 8.33% |

| SAP | 20.98 | 5.45 | 26.23 | 8.43% |

| ADBE | 34.23 | 16.18 | 20.75 | 23.83% |

| INTU | 30.07 | 9.37 | 28.88 | 16.75% |

| WDAY | 93.6 | 14.56 | 9.87 | 14.50% |

| RHT | 37.26 | 8.58 | 12.5 | 16.92% |

| SPLK | 82.52 | 12.78 | 19.49 | 34.56% |

| ANSS | 34.08 | 13.41 | 22.47 | 6.60% |

| SHOP | 245.65 | 18.09 | 9.34 | NA |

The market is expecting vigorous growth for Salesforce. From current price levels, the stock is clearly vulnerable to the downside if financial performance disappoints. However, it's important to note Salesforce stock does not look overpriced when considering industry valuation standards and the company's growth potential in the long term.

Impressive Momentum

Stock prices don't just reflect current fundamentals, but expectations about those fundamentals can be even more important. When a company is delivering better-than-expected earnings and expectations about future earnings are increasing, this generally means that the stock price is increasing too.

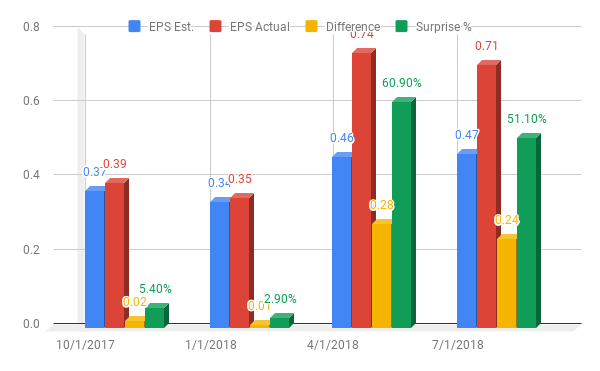

Salesforce has delivered earnings numbers considerably above expectations in the past four quarters in a row. The chart below shows the expected earnings number, the actual reported number and the difference between the two, both in absolute terms and in percentages.

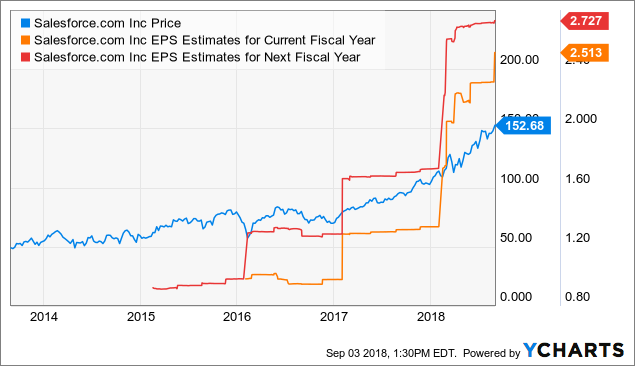

Wall Street analysts have substantially increased their earnings expectations for Salesforce in the current fiscal year and next fiscal year over time. Like it usually happens, rising earnings expectations are a powerful upside fuel for the stock price.

CRM data by YCharts

Outstanding Relative Strength

Money has an opportunity cost. When you buy a stock with mediocre returns, that capital is not available for investing in companies with superior potential. Besides, winners tend to keep on winning in the stock market, so you want to invest in stocks that are not only doing well but also doing better than other alternatives.

Salesforce stock has substantially outperformed both the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) and the Technology Select Sector SPDR ETF (NYSEARCA:XLK) over the past year. In comparison to both the broad market in general and the sector in particular, Salesforce is displaying impressive relative strength.

CRM data by YCharts

Putting It All Together

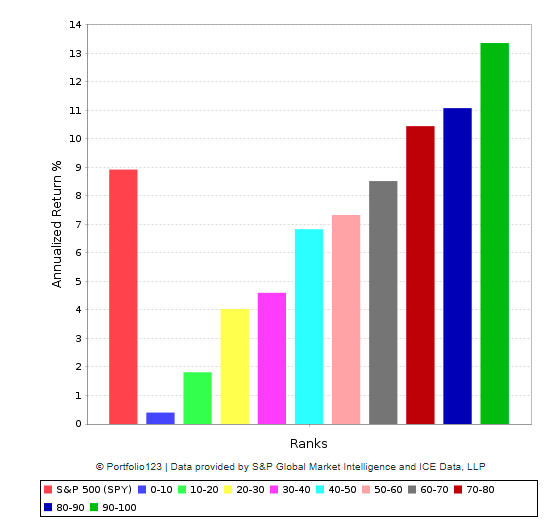

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to the factors analyzed in this article for Salesforce: financial quality, valuation, fundamental momentum and relative strength.

The system has produced solid performance over the long term. The chart below shows the annualized returns for companies in different PowerFactors ranking buckets since January of 1999 in comparison to the SPDR S&P 500.

There is clearly a direct relationship between the PowerFactors ranking and annualized returns, meaning that companies with higher rankings tend to produce superior returns and vice versa. In addition, stocks with relatively high quantitative rankings tend to materially outperform the market over the years.

Data from S&P Global via Portfolio123

Salesforce is among the best 10% of stocks in the market based on the quantitative algorithm. The company has a PowerFactors ranking of 98.12, and it enjoys strong metrics across the four factors considered: financial quality, valuation, fundamental momentum and relative strength.

Historical performance does not guarantee future returns, and performance numbers for quantitative systems should always be interpreted with caution, since the future is always a matter of possibilities and probabilities as opposed to certainties.

Because of its own nature, a quantitative system is always backward-looking. This means that a system can tell you that a specific group of companies with certain quantitative attributes has a good chance of delivering market-beating returns over long periods of time, but it does not tell you much about a particular stock.

In the case of Salesforce, it operates in a high-growth industry prone to technological disruption. It's important for investors to monitor the competitive landscape in order to make sure that the company remains strategically well-positioned for growth in the years ahead. This is particularly relevant since the stock is priced for aggressive growth expectations. If growth slows down more abruptly than expected, compressing valuation ratios could deliver a considerable blow to investors in Salesforce.

The quantitative system alone does not tell you the whole story - it's important to understand the business behind the numbers in order to truly understand the main risks and return drivers in Salesforce stock. That being acknowledged, making investment decisions based on quantified data is certainly a sounder approach than relying entirely on emotions and subjectivities when picking stocks. If the statistical evidence is any valid guide, Salesforce is well-positioned for attractive performance over the middle term.

Disclosure: I am/we are long CRM, WDAY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more

Its not too late. There's still money to be made with $CRM.