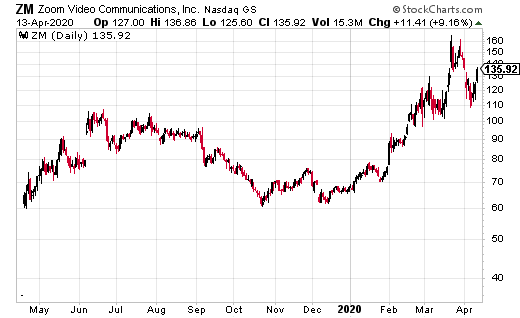

Is It Time To Drop Zoom (ZM)?

The novel coronavirus does not discriminate. A prime minister can get COVID-19 just as easily as a convenience store clerk.

But the impact of the virus on individual stocks has been extremely varied. There have been massive winners, massive losers, and other stocks that are basically trading where they were a few months or even a year ago.

Some of the big winners have included ZM, GIS, CLX among others.

This is an extension of what I’ve been writing about the past several weeks. Some investing trends have caught fire due to COVID-19, while others have gone into a deep freeze.

For example, companies tied to 5G, connectivity, and the ability to work remotely are either prospering or weathering the current storm. Companies that have a business model focused on gathering large numbers of people in small spaces, such as airlines, cruise ships, and sporting or live event venues, are struggling mightily.

As it appears we are turning at least the first corner in the rise in COVID-19 cases, there is a bit of good news. I’d like to focus on some of the companies that will continue to prosper in what will most certainly be a different world when the virus subsides.

These companies had been growing their businesses before the virus struck, and have had lighter fluid poured on their business models as a result of operational changes forced by the virus. I don’t see many of these changes reversing, but instead, they will broaden now that these companies have established a true beachhead in their respective industries.

Zoom (ZM) has come under fire in the past few weeks for a lack of security and some rather inappropriate breaches of its video conferencing system, leading CEO Eric Yuan to apologize for the technology’s shortcomings. This reminds me very much of a little-known company that experienced some growing pains many years ago, America Online.

For those of you too young to remember, America Online was one of the first commercial internet providers, with their iconic “you’ve got mail” tagline. Early on, America Online came under fire for providing lackluster service when too many customers were overwhelming the system. The company adjusted, and its stock went on to a spectacular rise.

I believe Zoom will work through its recent issues as well, and continue to see high demand after COVID-19 is in the rearview mirror. The bigger challenge will be how to monetize much of the free traffic that is currently on their platform, but it is much easier to monetize traffic that is already there than to have to seek out new traffic.

The stock price has moved higher as a result of COVID-19, now trading around or over $120. A PE of 1,300 reflects a young company just turning the corner to profitability, and shouldn’t be given too much weight. In its latest quarter, the company reported a record revenue of $188 million and earnings of $0.07 per share.

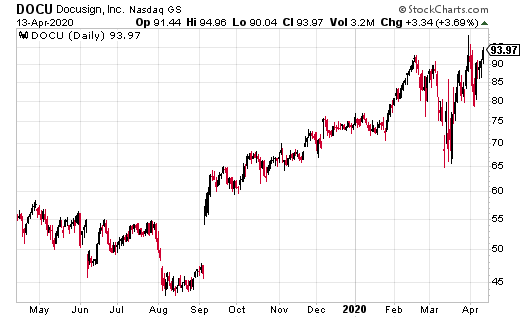

Another company which has weathered the virus storm, and should see a boost to its business model, is Docusign (DOCU). Docusign allows customers to “sign” legally binding documents via the internet, in a safe and secure environment.

But it’s not just a secure “signing” software. Much more is involved in the document writing process, and Docusign understands the complexity of contract formation. The company’s software lets users work through the entire document management process. Think of it as Google docs on steroids.

The company has seen a big uptick in business with COVID-19. Remember all the interactions that used to be mandatory in person, like signing mortgage, brokerage, and banking documents? Docusign can handle all of those tasks remotely.

The stock has not moved substantially on virus fears, trading just under $90, where it was in mid-February. In its latest quarter the company reported a 38% year-over-year revenue increase to $275 million.

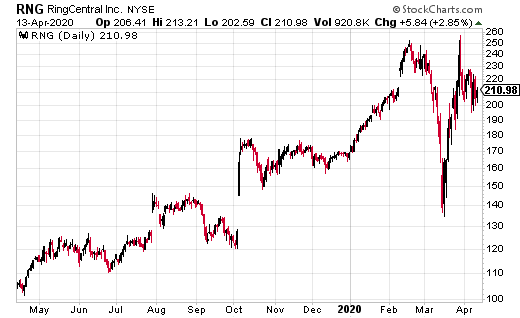

Finally, let’s talk for a minute about RingCentral (RNG). I could list all of the things RingCentral does, but I think it’s easier to envision its many offerings as a job posting.

RingCentral offers what they call “Unified Communications as a Service,” fulfilling the functions of a receptionist, administrative assistant, marketer, and IT department, all rolled up into one. As with both Zoom, and Docusign, they are providing many of the functions necessary to perform business operations, but either doing it remotely or in a distributed fashion.

RingCentral trades at just over $200, and has seen increased volatility in its stock price as a result of the current crisis. Like Docusign, the stock is not substantially higher from where it was trading in February. In its latest quarter, RingCentral revenue increased 34% year-over-year to $253 million. Total revenue for 2019 was also up 34% over 2018 revenue, with the company finishing the year at $903 million.

Disclosure: None.