Is It Time For Fitbit Investors To Panic?

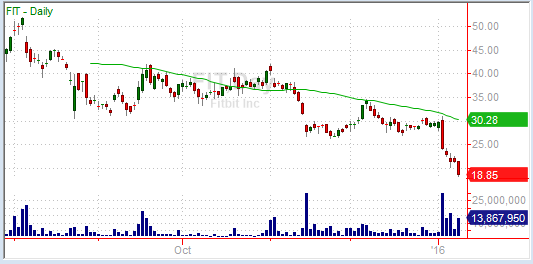

Fitbit Inc. (NYSE:FIT) celebrated the New Year with a brutal selloff. The stock closed 2015 at $29.59, and on Monday, shares of FIT closed at $18.85. This represents a 36.3% decline.

To be sure, some of the decline was due to the broad market weakness. Fitbit is known as a "high beta" stock, meaning that it typically rises and falls faster than the market. So when the broad market is weak, high beta stocks typically experience even larger losses.

(Source: TradeStation)

But while the broad market played some part, the biggest influence on Fitbit's performance this year was investor reaction to Fitbit's newest product. Last week, the company unveiled the "Fitbit Blaze" at the Consumer Electronic Show in Las Vegas.

The blaze is a watch-like fitness tracker that closely resembles the Apple Watch. Investors hit the panic button after the announcement, as it appeared that Fitbit had entered a head-to-head competition against Apple Inc. (NASDAQ:AAPL).

On Monday, the weakness was enough to cause Fitbit to close below its IPO price of $20. This is a significant price point simply because it's the first time investors who participated in the offering have been left with a loss on their hands.

While the decline for Fitbit is disappointing, this is not the time to panic. Today, I want to look at the company's prospects and explain why at this price, Fitbit represents a valuable investment, and not a speculative "also-ran" in the consumer technology field.

Does Fitbit Really Need To Compete With the Apple Watch?

Much of the market chatter surrounding the decline in FIT has been focused on whether the "Fitbit Blaze" can compete with the Apple Watch. But while the two items may look similar at first blush, the functionality of the Blaze and the Apple Watch leave the two devices in very different categories and not likely to compete head-to-head against each other.

(Source: Fitbit and Apple websites)

Similar to Fitbit's other products, the Blaze is truly a fitness tracking device. It just has more functionality built in than previous Fitbit products. So if the product had a design that didn't resemble the shape of the Apple Watch, we might not even be having this discussion in the first place.

Since investors are focused on the resemblance, however, let's look at some of the most important comparisons between the Blaze and the Apple Watch.

- The Blaze has a 5-day battery life versus about a 24-hour life for Apple

- The Blaze does not allow third-party apps, but the Apple Watch does

- The Blaze can alert you to texts but cannot respond like the Apple Watch

Obviously, there are plenty of other differences, but these are the differences that are discussed the most and are having the biggest impact on Fitbit's stock price.

With this quick comparison, it's clear that Blaze is not designed to be a smart watch in the way Apple has branded its watch. Instead, Blaze is designed to be a fitness tracker with some additional conveniences and functionality built in.

And that brings us to a final important difference between Fitbit's Blaze and the Apple Watch: The price.

The Blaze is currently retailing at $199.95. This is a 43% discount to thecheapest Apple Watch which is priced at $349. There also are sport models priced at $399 and the true full version of the Apple Watch actually starts at $549.

Another thing to keep in mind with the Apple Watch is that buyers must own an iPhone (an iPhone model 5 or better) in order to use the Apple Watch. The Blaze, on the other hand, does not need an interface with any particular smartphone and can be updated with a computer or a wide variety of smartphones.

So while Apple investors probably don't have to worry about the Fitbit Blaze cutting into potential Apple Watch sales, investors are probably being too conservative when comparing the Blaze directly to the Apple Watch.

If consumers are able to treat the new Blaze as its own product - a juiced-up fitness band with additional functionality - Fitbit investors may soon be pleasantly surprised with the company's sales growth. (Continue Reading…)

Disclosure: None.