Is Costco Stock Worth Buying Now Before Earnings?

Photo by Grant Beirute on Unsplash

Costco Wholesale (COST) is set to report its second quarter fiscal 2022 financial results on Thursday, March 3. The membership-based big box retailer has withstood supply chain setbacks to thrive during the pandemic and Costco’s growth outlook remains impressive.

The Basics

Costco is somewhat unique in the retail world, with its most direct competitor being Walmart-owned Sam’s Club. The company offers people and businesses various levels of annual memberships, where they pay fees in order to shop at its massive warehouse-style stores known for large quantities and low prices. Costco’s standard membership or ‘cardholder’ fees start at $60 annually.

Costco is a one-stop-shop for many customers and it’s able to keep its prices very low and competitive because of its membership fees. Consumers can buy everything from fresh fruit to diamond engagement rings. Costco has expanded its same-day delivery service to “most” metropolitan areas through its Instacart partnership, while offering two-day delivery for non-perishable food and many other non-grocery items nationwide.

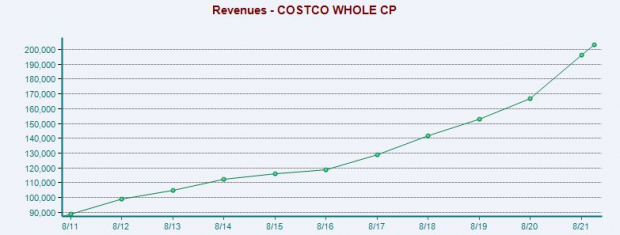

(Click on image to enlarge)

Image Source: Zacks Investment Research

Costco posted a strong fiscal 2021 (period ended August 29), with revenue up 17.5% for its best top-line growth in the last 20 years. This came on top of 8.9% average revenue growth between FY17 and FY20. Most recently, it posted 16.5% revenue expansion in Q1 FY22 (period ended November 21), as pandemic-based buying habits continued.

Costco has benefitted from increased home-focused spending and its membership fees have helped it try to avoid passing on all of its various rising costs to its customers. Zacks estimates call for its Q2 FY22 revenue to climb 14% to help lift its adjusted earnings by 25%.

Overall, Costco’s adjusted FY22 earnings are projected to climb 14%, with FY23 projected to jump another 10% higher. The retail giant’s revenue is expected to jump roughly 12% and 8%, respectively. Despite the supply chain bottlenecks, Costco’s earnings outlook has improved slightly since its last report. And COST has topped our EPS estimates by an average of 15% in the trailing three quarters.

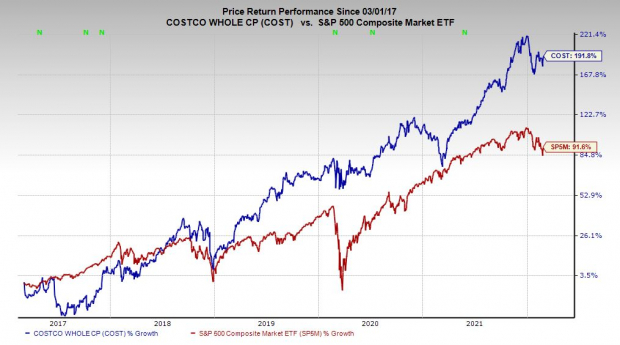

(Click on image to enlarge)

Image Source: Zacks Investment Research

Other Fundamentals

Costco said it closed the first quarter of 2022 with total paid households of 62.5 million, up 800K from Q4. Meanwhile, its total cardholders climbed 1.5 million during the quarter to 113.1 million. COST executives noted on its earnings call that ‘Executive’ members (who pay $120 annually for more perks) accounted for 42% of members and a little over 70% of sales.

COST shares have climbed 140% in the last three years and 191% in the past five. More recently, Costco stock is up 68% in the past 24 months vs. its Retail-Discount industry’s 43%. This run includes a 56% climb in the last year to double its peers and blow away the S&P 500’s 13%.

Costco stock got caught up in the market downturn so far this year and it closed regular trading hours Monday roughly 9% below its records at $519.25 a per share. Along with its outperformance of the market and its industry, comes a somewhat stretched valuation, with COST trading at 38.9X forward 12-month earnings, up from 34.5X two years ago and 31.5X this time last year. This also marks a premium compared to its industry’s 23.2X and Walmart’s 20X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Wall Street has been willing to pay up for Costco stock for years and 11 of the 19 brokerage recommendations Zacks has are “Strong Buys,” with three more “Buys,” and nothing below a “Hold.” And its dividend yields 0.61% at the moment.

Costco lands a Zacks Rank #3 (Hold) right now, alongside an “A” grade for Growth and a “B” for Momentum in our Style Scores system. Some investors might decide they want to buy the relatively unique retail stock at a discount before its earnings.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more