Is AMD Going To Continue To Surge?

Despite a global pandemic and worldwide civil unrest, stocks have mostly gone up. The exuberance of investors is impressive, if perhaps misplaced. It certainly remains to be seen if the gains can hold up when the expected second wave of COVID-19 hits in the fall.

Despite the large move in stocks (the Nasdaq just hit all-time highs), investors should still proceed with caution. The market may have mostly recovered, but let’s not forget the recovery was due to a 30% drop in major equity indexes in March. That’s enough to keep the average investor awake night.

Whether you believe stocks are going to continue marching higher or experience a severe bout of mean reversion, using options can be crucial to your trading strategies. Options provide leverage to take advantage of upside (or downside) moves. Plus, they can offer risk protection, although of course just how much protection depends on the strategy.

For instance, a covered call on a stock or exchange traded fund (ETF) will provide some measure of upside appreciation potential, while also supplying income. This income can be viewed as a form of downside protection (lower cost basis) or simply a means of cash flow.

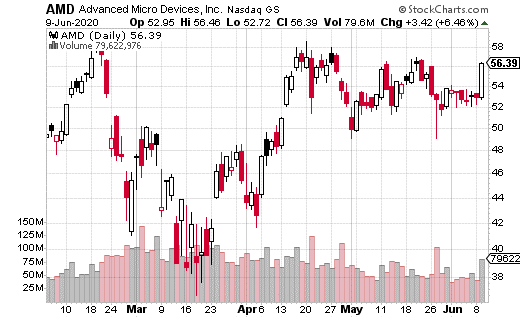

Take Advanced Micro Devices (AMD), for example. The stock recently shot up following news of a big deal with rival NVIDIA (NVDA), supplying processors to a NVIDIA platform. As you can see below, the stock shot higher, back to the top of a recent range between roughly $52 and $56.

A savvy investor, looking to take advantage of the move higher, sold 1,500 short-term covered calls versus 150,000 shares of Advanced Micro Devices at $55.30. The covered call, which expires on June 19, caps the stock’s upside at $60. Given the recent behavior of the share price, it seems unlikely the stock will travel far above $60 by expiration.

What’s more, the calls were sold for $0.68, providing a 1.2% yield on the trade. That may not seem like a huge yield until you realize that it’s just a 10-day trade. Annualized, that yield would be over 43%. Plus, the trade provides an additional upside potential of $4.70 in share appreciation.

All told, the trade could earn 9.7% if Advanced Micro Devices is at $60 or above at expiration. In other words, this particular trade is taking advantage of market conditions to create upside potential and yield over a short timeframe. Only with options is this sort of scenario possible.

Moreover, options strategies can easily be adjusted to meet your personal risk/reward goals. It’s the flexibility of options that make them such powerful tools for investors and traders.

In the Advanced Micro Devices example, the trader could sell a call closer to the current price of the stock to boost yield at the expense of upside potential. Or, an investor could add a cheap short-term put with part of the call sale proceeds to protect downside exposure.