Is 3M Stock A Buy In May 2019?

Industrial manufacturer 3M Company (MMM) is one of the notable stock market laggards of 2019, as it has declined 12% year-to-date. It has significantly underperformed the S&P 500 Index, which has gained 14% so far this year.

3M has underperformed the broader market by a wide margin, despite the fact that it has a long history of increasing its dividend. 3M is not only a Dividend Aristocrat—a group of 57 S&P 500 stocks with 25+ years of consecutive dividend growth—it is a Dividend King as well.

The Dividend Kings are an even more exclusive group of just 24 stocks that have increased their dividends for an amazing 50+ years in a row.

The downloadable Dividend Kings Spreadsheet List below contains the following for each stock in the index, among other important investing metrics:

- Payout ratio

- Dividend yield

- Price-to-earnings ratio

3M is off to a poor start to 2019, having recently cut its sales and earnings guidance for the rest of the year. In addition, rising litigation expenses are lingering headwinds that could continue to impact the stock.

At the same time, 3M is a high-quality business with a long history of dividend growth. Its attractive dividend yield of 3.5% and investments in strategic growth areas could provide a quick turnaround for this time-tested dividend growth stock. This could make 3M a stock to buy in May 2019.

Business Overview

3M is a diversified global manufacturer, which sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. 3M is composed of several separate divisions. The Industrial segment produces tapes, abrasives, adhesives, and supply chain management software and solutions, while Safety & Graphics manufactures personal protective gear and security products.

Its Healthcare segment supplies medical and surgical products as well as drug delivery systems. 3M’s Electronic & Energy division produces fibers and circuits with a goal of using renewable energy sources while reducing costs. Lastly, the Consumer division sells office supplies, home improvement products, protective materials, and stationery supplies.

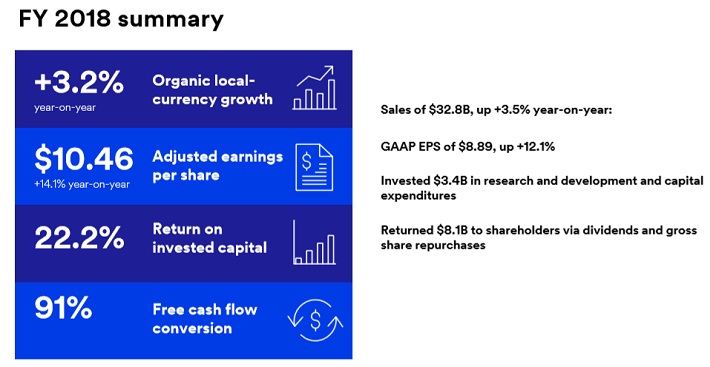

Business conditions remained strong through 2018. 3M posted strong financial results for the fourth quarter, as adjusted earnings-per-share increased 10%, due in part to a solid 3% organic revenue growth rate. For the year, adjusted EPS increased 14% to $10.46. Organic revenue growth increased 3.2%, while share repurchases fueled additional EPS growth. 3M returned $4.9 billion to shareholders in 2018 in the form of share buybacks.

(Click on image to enlarge)

Source: Investor Presentation

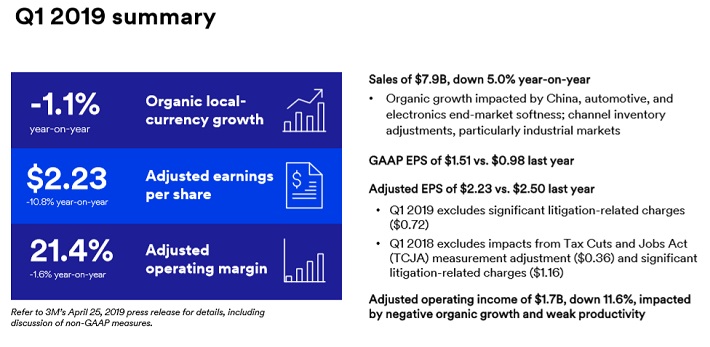

3M performed well last year, but things suddenly changed for the worst to start 2019. 3M released weak first-quarter results and significantly reduced its full-year outlook. Revenue declined 5% to $7.9 billion, which was $162 million below expectations.

On the positive side, Health Care segment sales increased 0.7% for the quarter, and Consumer sales grew 0.9%. But these results were more than offset by declines elsewhere. Safety & Graphics revenue fell 0.1%, Industrial sales dropped 2.8%, and Electronics & Energy sales declined 3%.

(Click on image to enlarge)

Source: Investor Presentation

Making matters worse, 3M’s first-quarter EPS was reduced by $0.72 due to litigation-related charges. The company is involved in a number of legal proceedings, which represent a significant headline risk. 3M incurred a total litigation-related pre-tax charge of $548 million in the first quarter, and its elevated litigation expense is a dark cloud over the stock right now. While it is likely 3M is strong enough to withstand the litigation risk, investors should pay close attention to the company’s future results to make sure the situation does not worsen moving forward.

3M performed poorly in the first quarter, and even more of a concern is the company significantly reduced its full-year guidance. 3M lowered its earnings-per-share guidance to $9.25 to $9.75 for 2019, down from $10.45 to $10.90 previously. At the midpoint of guidance, EPS is likely to decline ~9% in 2019, compared with last year. Organic revenue growth is now expected in a range of down 1% to up 2%, a big drop from previous guidance of 1% to 4% growth.

Due to sluggish performance in the first quarter and a weak full-year forecast, 3M announced a number of restructuring initiatives designed to return the company to growth. Going forward, the Industrial and Safety & Graphics will be combined into a single segment, and Electronics & Energy will be renamed Transportation & Electronics. As part of its restructuring, the company also announced it would cut 2,000 jobs that will help save the company $225 million to $250 million each year. This is one of many steps the company is taking to restore growth in 2020 and beyond.

Growth Prospects

Despite the company’s challenging first-quarter and lowered full-year forecast, the long-term outlook is still positive. 3M has long-term growth catalysts, primarily healthcare and the emerging markets, thanks in large part to its competitive advantages.

Specifically, 3M’s innovation is one of the company’s greatest competitive advantages. The company targets research and development spending equivalent to 6% of sales ($1.8 billion in 2018) in order to create new products to meet consumer demand. R&D is a key component of 3M’s capital allocation.

(Click on image to enlarge)

Source: Investor Presentation

3M’s spending has proven to be very beneficial to the company, as 30% of sales during the last fiscal year were from products that did not exist five years ago. 3M’s commitment to developing innovative products has led to a portfolio of more than 100,000 patents.

This innovation will be put to work across multiple growth areas, and in particular health care. The demographics of the U.S. health care industry are highly supportive of growth, due to the aging population. The Baby Boomers are a huge generational group, totaling over 70 million.

Such a large generation of aging individuals is expected to cause demand for healthcare to grow at a higher rate than GDP over the next decade. According to the Centers for Medicare & Medicaid Services (CMS), U.S. healthcare spending is expected to rise by 5.5% per year, reaching nearly $6 trillion by 2027.

3M is already a major healthcare product manufacturer, with segment sales above $7 billion per year. And, healthcare is expected to lead 3M’s growth in the years ahead.

(Click on image to enlarge)

Source: Investor Presentation

3M will accelerate its expansion in healthcare through two major acquisitions over the past year. First, 3M announced (12/19/18) the acquisition of M*Modal’s technology business, for a total enterprise value of $1 billion.

M*Modal provides cloud-based healthcare technology, as well as conversational Artificial Intelligence (AI)-powered systems. The acquisition helps 3M further build out its Health Information Systems business. M*Modal’s annual revenue is estimated to be approximately $200 million.

Separately, 3M also announced (5/2/19) the $6.7 billion acquisition of Acelity, which amounts to 3M’s biggest takeover ever.

(Click on image to enlarge)

Source: Investor Presentation

Acelity manufactures wound dressings and other specialty surgical products. It will expand 3M’s Medical Solutions business with a high-growth category. Acelity generated $1.5 billion of sales last year, growing at a 10% rate in 2018 with attractive margins.

Excluding certain one-time transaction and integration expenses, 3M expects the deal to be accretive to earnings by $0.25 per share in the first 12 months after closing. 3M paid approximately 11x estimated annual adjusted EBITDA for Acelity, which is a reasonable multiple for a fast-growing, high-margin business.

Another major area of long-term growth for 3M is the emerging markets, such as Latin America, China, and many others. 3M is a global manufacturer, with a large presence outside the United States. The company’s international exposure was not a positive catalyst in the 2019 first quarter, as sales fell across 3M’s international businesses. And the short-term could remain difficult if global economic growth slows or trade tensions worsen.

However, the emerging markets remain a compelling long-term catalyst. Many international regions have high rates of economic growth and large populations, making them highly attractive for global conglomerates like 3M. In 2018, 3M’s organic currency-neutral sales increased 3.8% in Asia-Pacific, and 4.1% in the Latin America & Canada segment. Both geographic segments grew at a faster rate than the U.S. in 2018, and while short-term concerns persist, the long-term outlook remains highly attractive in these markets.

Lastly, share repurchases will help boost 3M’s earnings. Because the company is highly profitable and generates lots of free cash, it can afford to invest heavily in growth, while still returning excess cash to shareholders. 3M does this through share buybacks and dividends. After the Acelity acquisition, 3M revised its full-year share repurchase plan to $1 billion to $1.5 billion. This would represent just over 1% of 3M’s current market capitalization, amounting to a modest but noticeable boost to EPS.

Valuation & Expected Returns

The 3M stock has declined significantly to start 2019, but the good news is the stock has a more reasonable valuation. 3M has gotten measurably cheaper for investors as the share price has moved lower throughout the year. As a result, shares now trade at a price-to-earnings ratio of 17.6x, based on the midpoint of full-year EPS guidance.

In the past 10 years, the stock had an average P/E ratio of 17.2x, which is a reasonable estimate of fair value. Therefore, although 3M stock is still not significantly undervalued, it is no longer overvalued. Of course, the lingering legal issues could continue to erode 3M’s stock valuation. As a result, investors should not assume a high level of stock price appreciation for 3M in the near-term.

That said, 3M still expects long-term earnings growth, which will contribute positively to shareholder returns. 3M had previously guided investors to expect 8% to 11% annual EPS growth through 2023. While litigation risk and operational challenges could mean 3M does not reach its target, we expect 3M to grow EPS by 5% per year over the next five years.

Lastly, 3M’s dividend will add to shareholder returns. The company has a highly impressive dividend history. 3M has paid uninterrupted dividends to shareholders for over 100 years. It has also raised its dividend for the past 61 consecutive years, including a 6% increase in February 2019.

One of the advantages of a declining stock price is that the dividend yield rises. With 3M now trading at ~$167 per share, the annual dividend payout of $5.76 per share represents an attractive dividend yield of 3.5%. At the present time, we continue to view 3M’s dividend as secure. We discuss 3M’s dividend safety in further detail in the video below:

Running length 00:05:02

3M’s dividend growth should continue for the foreseeable future. Even though EPS will be lower this year than the company previously anticipated, 3M remains highly profitable. At the midpoint of revised guidance, 3M’s dividend payout ratio of 61% still represents sufficient coverage, with room for future dividend hikes provided the company’s turnaround is successful.

The various headline risks facing 3M could continue to keep a lid on its valuation multiple. As the stock still holds a P/E multiple in the high teens, the potential for downside remains. This makes 3M a relatively unattractive stock when it comes to valuation.

However, 3M has long been a highly attractive stock for dividend growth investors. 3M’s dividend growth rate could slow next year from previous years, due to the various challenges the company is working through. But with a hefty 3.5% dividend yield and over 60 years of dividend increases, 3M could be an attractive stock for income.

In terms of total returns, 3M has a mixed outlook. We expect virtually no impact from valuation changes over the next five years. Earnings-per-share growth of 5% and the 3.5% dividend yield result in expected total returns of 8.5% per year over the next five years. This is a satisfactory potential rate of return, although we acknowledge the elevated level of headline risk facing 3M. Litigation concerns can be a significant risk, as the potential liability is hard for the company to estimate.

Final Thoughts

Things change rapidly in business, and 3M is a prime example of this. Business conditions were highly positive in recent years, but 3M’s momentum came to a screeching halt to begin in 2019.

If 3M’s various litigation issues amount to only a short-term concern that the company can work past, it is likely that the company will return to EPS growth. Indeed, we believe 3M still has a positive long-term growth outlook.

Short-term headwinds could continue to serve as an anchor on 3M’s valuation, particularly from litigation and its emerging market exposure. At the same time, the emerging markets are an attractive long-term area of growth, as is 3M’s focus on healthcare. Its two major acquisitions could get the company back on track for growth in the years ahead.

For dividend growth investors looking for above-average dividend yields and durable competitive advantages, 3M is a stock to consider buying in May 2019.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more