IPO’s Beating The Market

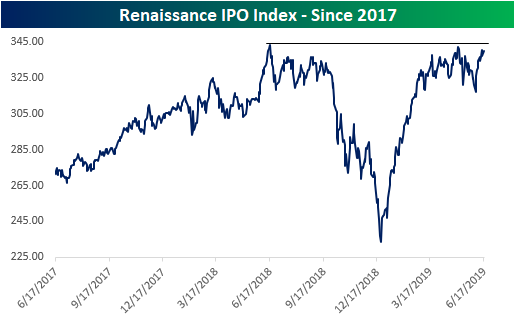

Hot topic stock, Beyond Meat (BYND), has risen over 260% from its IPO just over a month ago. While other recent IPOs have not necessarily matched this rapid appreciation, newly listed companies have for the most part been doing pretty well. The Renaissance IPO Index, which holds the past couple of years largest IPOs, is evidence of this as it has been rapidly moving off of this year’s lower low in the past couple of weeks. On the back of the success of stocks like BYND and Zoom Video (ZM), which both sit handily above their IPO prices, the index is nearing its highs from earlier this year and last.

(Click on image to enlarge)

Given investors flight into these newly listed companies, IPOs have been increasingly outperforming the S&P 500. The chart below shows the relative strength of the IPO index versus the S&P 500 over the last ten years, and in it, we have also noted points where there were notable companies to hit the market. Periods, where the line is rising, indicate that the IPO index is outperforming the S&P 500 and vice versa. Over the past ten years, IPOs have cycled through outperformance and underperformance. In the second half of 2013 through late 2015, as well as most of 2017 into late last year, IPOs outperformed. The times between saw underperformance.

One interesting point to note about the chart is that notable and long-awaited IPOs don’t necessarily cause new interest in IPOs or mark any sort of top. For example, Facebook’s (FB) IPO in 2012 came during a period of underperformance and was followed by further underperformance. In 2013, Twitter (TWTR) IPO’d and that IPO was followed by a period of outperformance. In March 2017, Snap (SNAP) had a rough IPO, but the broader IPO market did well. Finally, while Uber (UBER) and Lyft (LYFT) were two widely watched and anticipated IPOs, it has been less eagerly anticipated names like BYND and ZM that have garnered the most investor interest.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much ...

more