IPO Lockup Expiration For Laureate Education Could School Investors

Laureate Education (Nasdaq: LAUR) - Sell or Short Recommendation Price Target- $16.50.

Event Overview

July 31, 2017 concludes the 180-day lockup period on Laureate Education Inc. (LAUR).

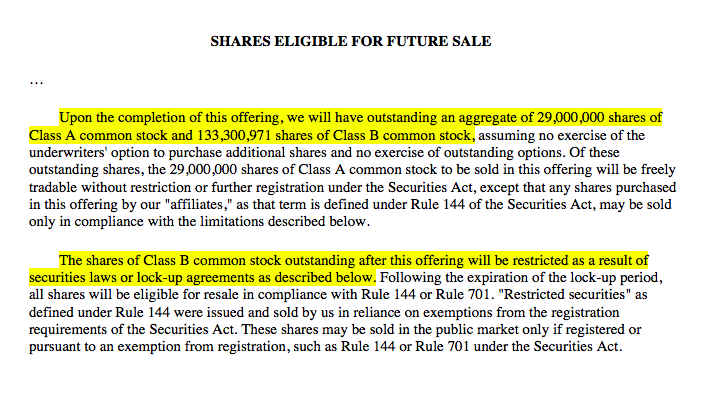

When the lockup period ends for LAUR on 7.31, its pre-IPO shareholders, directors and executives will have the chance to sell 133M shares, previously restricted from trading since the IPO.

(S-1/A)

The potential for a sudden increase in stock available in the open market may cause a significant decrease in the price of Laureate Education shares; just 29M shares of Class A stock are currently trading.

Our firm’s research has shown significant price declines surrounding many IPO lockup expirations, particularly for firms like LAUR with such a large percentage of shares restricted.

We suggest selling or shorting LAUR shares ahead of the event to take full advantage of impending declines. Savvy investors, anticipating the event, often sell early, as well, exacerbating existing price pressure.

Business Overview: Provider of Higher Education Services

Laureate Education, along with its subsidiaries, provides higher education services and programs to students through its universities and additional institutions. The company operates through four segments: Europe, Asia, Middle East and Africa (AMEA), Latin America (LatAM), and Global Products and Services (GPS). For example, Europe and AMEA segments offer professionally oriented undergraduate and graduate degree programs; LatAm is comprised of campus-based institutions that offer undergraduate and graduate degrees. LAUR also provides online and hybrid programs and courses.

Laureate is the largest global network of higher education institutions that grant degrees. Currently, the company has over one million students enrolled in their 71 institutions across 25 countries on over 200 campuses.

The company was formerly known as Sylvan Learning Systems, Inc. and changed its name to Laureate Education, Inc. in May 2004. The company was founded in 1989 and is headquartered in Baltimore, Maryland. Laureate Education, Inc. is a subsidiary of Wengen Alberta, Limited Partnership.

Q1 2017 Results

On May 11, 2017, Laureate Education reported first quarter 2017 financial results with the following highlights, compared to first quarter 2016:

- New enrollments increased 4%; total enrollments grew 2%, up 3% (excluding asset dispositions).

- Revenue decreased 6% to $855.9 million (although up 3% on an organic constant currency basis).

- Net loss for the quarter was $120.4 million, compared to a net loss of $102.4 million in the first quarter of 2016.

Management Team

Douglas Becker founded Laureate Education, and he has served as Chairman and CEO since 2000. Mr. Becker has led the company since 1991. He also co-founded Sterling Partners and Health Management Corporation. He was Vice Chairman and Secretary of CLN, Inc., also known as Caliber learning network. Mr. Becker serves on the Board of numerous cultural, educational, and civic organizations including: Washington College, Greater Baltimore Alliance, Baltimore Museum of Art, Baltimore Reads and as Chairman of the Baltimore-based Port Discovery Museum.

Mr. Eilif Serck-Hanssen has served as President and Chief Administrative Officer since March 28, 2017. He served as EVP since July 2008 until his current promotion. His previous experience comes from senior positions at XOJET Inc, Eos Airlines, US Airways Group, Northwest Airlines, and PepsiCo. Mr. Serck-Hanssen earned his M.B.A. in finance at the University of Chicago Booth School of Business, a B.A. in management science from the University of Kent at Canterbury (United Kingdom), and a B.S. in civil engineering from the Bergen University College (Norway). He is an Associate Chartered Accountant (ACA) and a member of the Institute of Chartered Accountants in England and Wales.

Competition: New Oriental Technology and Education Group, TAL Education Group, Kroton Educacional

While Laureate Education considers itself to be the largest worldwide network of higher learning institutions, it faces competition in local markets from both public and private institutions. According to Morningstar, its largest peers are New Oriental Technology and Education Group (EDU), TAL Education Group (TAL), and Kroton Educacional. LAUR is priced at an attractive 7.0 P/E ratio, compared with the industry average of 83.9.

Strong Early Market Performance

Laureate Education’s IPO priced at $14 per share, below its expected price range of $17 to $20. The stock closed on the first day of trading at $13.25. Since then, the stock hit a low of $12.50 on March 3, but it has recovered and now trades at $17.57 (close 7.17).

(Click on image to enlarge)

Conclusion: Short LAUR Shares Now Prior to 7.31

In addition to major shareholder Wengen Alberta, LP, 25 individuals also owned shares pre-IPO. If even a few of these 26 insiders choose to sell, they could overwhelm LAUR's share price; just 17% of shares are currently trading.

Given LAUR's strong IPO and early market performance, we believe insiders could be ready to take profits and see an enormous opportunity to short LAUR shares ahead of the event.

Disclosure: I am/we are short LAUR.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more